Research Methodology on Biosimilars Market

Introduction

The advancement in biotechnology and the increasing number of applications of biologics and biosimilars in therapeutics and diagnostics has created a need to understand the factors driving the global biosimilars market. Biosimilars are drug products similar to the originator biologic product but not an exact copy of it, developed and manufactured using recombinant DNA technology for commercial use in the marketplace. The Market Research Future (MRFR) report studies this market in detail with a focus on several factors such as market growth drivers, challenges, regional markets, and competitive landscape.

Research Objectives

The objectives of this comprehensive research are to:

- Analyze the global biosimilars market to understand the current market situation and the growth potential in the future.

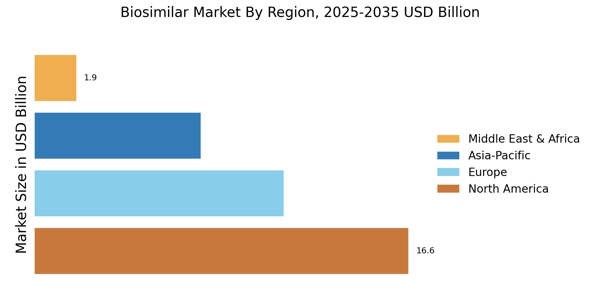

- Analyse the regional markets for biosimilars, including North America, Europe, South America, Asia-Pacific (APAC) and the Middle East & Africa to identify the opportunities in each region.

- Evaluate the key factors driving and restraining global biosimilars market growth.

- Determine the technological advancements, developments and trends in the global biosimilars market.

- Evaluate the change in customer preferences and the capacity of the industry to cope with them.

- Study the competitive landscape and assess the strategies adopted by the leading players in the biosimilars market.

Research Methodology

Research design and approach

The study is based on the analysis of both secondary and primary data sources. Secondary data related to the biosimilars market is collected from various published sources, such as annual reports, news articles and press releases, patent applications, and recognised sources from industry publications. Primary data is collected through interviews with experts and leading industry professionals, as well as through surveys for customer and consumer treatment data about biosimilars. Additionally, data is also collected through interviews and surveys with clinicians, regulatory bodies, resellers, and distributors. The research team also conducts detailed analyses of collected data to conclude.

Primary Research

Primary research methods are used to uncover the pieces of information that cannot be determined through secondary data. Primary research involves interviewing clinical experts, medical and market researchers, key industry opinion leaders, and regulatory bodies, and holds immense importance in the market study. Through primary research, the team strives to understand and accurately reflect and assess the state of the biosimilars market.

Secondary Research

Secondary sources, such as Annual Reports, Medical Journals, and Economic Forecasts, are referred to analyse the industry trends and to enable a comprehensive understanding of the biosimilars market. All of these sources are constantly monitored to help verify, update, and extrapolate data, to offer accurate and up-to-date market intelligence. The team also features industry experts, who constantly monitor and analyze the pharmaceuticals industry in various regions.

Market Segmentation

The market of biosimilars is segmented based on type into monoclonal antibodies and other biosimilars (recombinant proteins, hormones, interferons, and insulin). Other biosimilars are further segmented into epoetin alfa, filgrastim, granulocyte growth factor, and interferon among others. Based on therapeutic areas, the market is segmented into oncology, immunology, a blood disorder, cardiovascular, endocrinology and other therapeutic areas. Based on end users, the market is segmented into hospitals, speciality clinics, retail pharmacies and online pharmacies.

Data Triangulation

Data triangulation is used to validate the results of data collection and the uncertainty associated with each estimate. Different combinations of data from multiple sources are used to develop and verify the market estimates. Also, the weighted average of the original sizes and the expected growth from the same sources are used to corroborate the market estimations.

Conclusion

This comprehensive research methodology provides systematic and thorough information about the current biosimilar market and the forces shaping it. It covers all the major facets of the global biosimilars market and helps to create an in-depth understanding of the market. The research reveals that the biosimilars market is expected to grow at a steady pace during the forecast period of 2024-2032. Factors such as increasing research & development activities, regulatory changes, technological advancements etc. are expected to drive the biosimilars market growth in the coming years.