Growing Awareness and Education

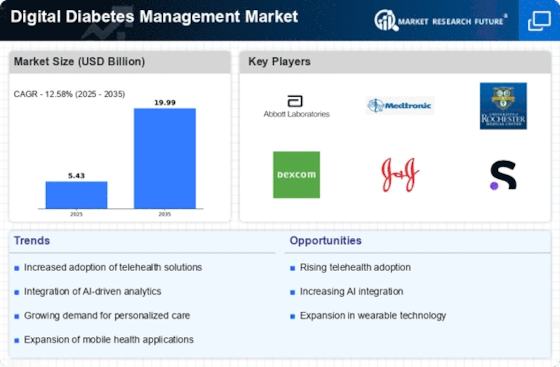

There is a notable increase in awareness and education regarding diabetes management, which serves as a catalyst for the Digital Diabetes Management Market. Health organizations and advocacy groups are actively promoting the importance of self-management and education for individuals living with diabetes. This heightened awareness encourages patients to seek digital solutions that can aid in their management journey. As a result, the market for digital diabetes tools is expanding, with a projected growth rate of over 20% annually. Educational initiatives that emphasize the benefits of digital management tools are likely to further propel the adoption of these technologies, thereby enhancing the overall effectiveness of diabetes care.

Increasing Prevalence of Diabetes

The rising incidence of diabetes worldwide is a primary driver for the Digital Diabetes Management Market. According to recent statistics, the number of individuals diagnosed with diabetes is projected to reach 700 million by 2045. This alarming trend necessitates innovative management solutions, leading to a surge in demand for digital tools that assist in monitoring and controlling blood glucose levels. As healthcare systems grapple with the growing burden of diabetes, the Digital Diabetes Management Market is likely to expand significantly, offering various applications and devices that empower patients to take charge of their health. The increasing prevalence of diabetes not only highlights the need for effective management solutions but also presents opportunities for technology developers to create tailored products that cater to diverse patient needs.

Supportive Government Initiatives

Government initiatives aimed at improving diabetes care and management are playing a pivotal role in shaping the Digital Diabetes Management Market. Various countries are implementing policies that promote the use of digital health technologies to enhance patient outcomes. For instance, funding for research and development of digital tools is increasing, alongside initiatives that encourage healthcare providers to adopt these technologies. Such supportive measures are likely to foster innovation within the Digital Diabetes Management Market, leading to the development of new applications and devices that meet the evolving needs of patients. As governments continue to prioritize diabetes management, the market is expected to experience robust growth, driven by these initiatives.

Technological Advancements in Healthcare

Technological innovations are transforming the landscape of healthcare, particularly in the Digital Diabetes Management Market. The advent of artificial intelligence, machine learning, and data analytics has enabled the development of sophisticated applications that provide personalized insights for diabetes management. For instance, predictive analytics can forecast blood sugar fluctuations, allowing patients to make informed decisions about their diet and medication. Furthermore, the integration of cloud computing facilitates seamless data sharing between patients and healthcare providers, enhancing collaborative care. As these technologies continue to evolve, they are expected to drive growth in the Digital Diabetes Management Market, making diabetes management more efficient and effective for patients and healthcare professionals alike.

Rising Demand for Remote Patient Monitoring

The demand for remote patient monitoring solutions is escalating, significantly impacting the Digital Diabetes Management Market. Patients increasingly prefer to manage their health from the comfort of their homes, leading to a surge in telehealth services and remote monitoring technologies. This trend is particularly relevant for diabetes management, where continuous monitoring of blood glucose levels is crucial. The market for remote monitoring devices is expected to grow substantially, driven by the need for real-time data and personalized care. As healthcare providers recognize the benefits of remote monitoring in improving patient outcomes, the Digital Diabetes Management Market is poised for considerable growth, offering innovative solutions that cater to this demand.