Top Industry Leaders in the Biometric Banking Market

Competitive landscape of the biometric banking market

The competitive landscape of the biometric banking market is highly dynamic and fragmented, with a growing number of players vying for a share of this lucrative market. Market leaders are focusing on innovation and acquiring emerging companies to maintain their competitive edge.

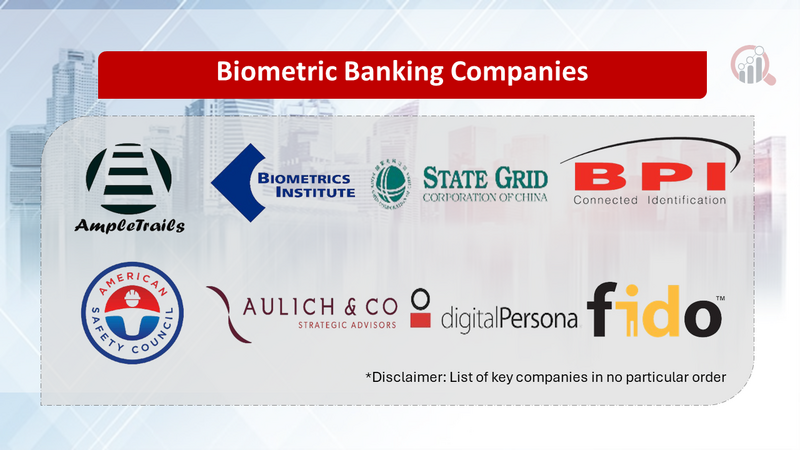

Key Players in the Biometric Banking Market

- Techshino Technology

- Ample trails, Inc

- Biometrics Institute

- State Grid Corporation of China

- BPI Connected Identification

- American Safety Council, Inc

- Aulich & Co

- Digital Persona

- FIDO Alliance member

- Diebold & Co

- Omaha Based First Data Co

- Chase & Co

- Authentik Solutions

- Visa Co

- Biolink Solutions

- Innoventry Corporation

- Auraya Systems Pty Ltd

- Baztech Inc

- Axon Wireless International

- Charles Schwab And Co

Strategies Adopted by Biometric Banking Market Players

Biometric banking market players are employing a variety of strategies to gain a competitive advantage. Some of the key strategies being used include:

- Innovation: Companies are investing heavily in the development of new and innovative biometric technologies, such as facial recognition and voice biometrics.

- Acquisition: Companies are acquiring emerging companies with promising biometric technologies to expand their product portfolios and gain access to new markets.

- Partnerships: Companies are forming partnerships with banks and other financial institutions to develop and deploy biometric solutions.

- Marketing and sales: Companies are investing in marketing and sales activities to raise awareness of their biometric solutions and generate new business.

Factors for Market Share Analysis in the Biometric Banking Market

Several factors are important for understanding the market share of biometric banking market players. These factors include:

- Technology: The type of biometric technology offered by a company is a key factor in determining its market share. Companies that offer the most advanced and secure biometric technologies are likely to have a larger share of the market.

- Geographic reach: Companies with a strong presence in key global markets, such as North America, Europe, and Asia, are likely to have a larger share of the market.

- Customer base: Companies with a large and loyal customer base are likely to have a larger share of the market.

- Revenue: Companies with high revenue are likely to have a larger share of the market.

New and Emerging Companies in the Biometric Banking Market

The biometric banking market is also seeing a growing number of new and emerging companies. These companies are often bringing innovative new technologies to the market and are challenging the dominance of the established players.

Some of the key new and emerging companies in the biometric banking market include:

- Idemia

- HID Global Corporation

- Sodexo

- Crossmatch Technologies, Inc.

- Precise Biometrics AB

Current Company Investment Trends in the Biometric Banking Market

Biometric banking market players are investing heavily in research and development (R&D) to develop new and innovative biometric technologies. They are also investing in acquisitions and partnerships to expand their product portfolios and gain access to new markets.

R&D investment is focused on areas such as:

- Improving the accuracy and speed of biometric technologies

- Developing new biometric modalities, such as vein recognition

- Enhancing the security of biometric solutions

Acquisitions and partnerships are being used to:

- Gain access to new technologies

- Expand into new markets

- Strengthen customer relationships

Latest news and updates on the biometric banking market:

- In January 2023, Mastercard announced that it would be partnering with NEC Corporation to offer biometric authentication services to its customers.

- In March 2023, Wells Fargo became the first major US bank to offer facial recognition authentication services to its customers.

- In April 2023, Deloitte released a report that found that biometric authentication is becoming increasingly popular among banks.

- In May 2023, the Federal Reserve Bank of Boston released a report that found that biometric authentication could help to reduce fraud in the banking industry.