Biological Treatment Technologies Market Summary

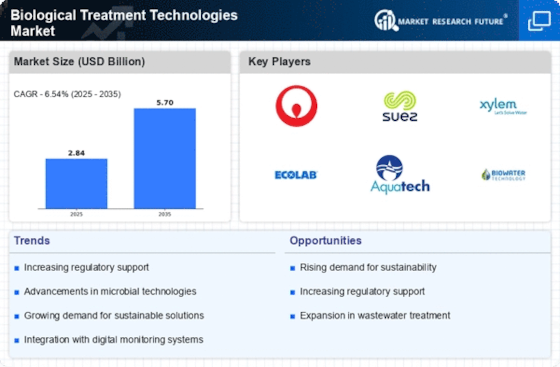

As per Market Research Future analysis, the Biological Treatment Technologies Market was estimated at 2.838 USD Billion in 2024. The Biological Treatment Technologies industry is projected to grow from 3.023 USD Billion in 2025 to 5.696 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.54% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Biological Treatment Technologies Market is experiencing robust growth driven by technological advancements and increasing environmental awareness.

- The market is witnessing a notable integration of advanced technologies to enhance treatment efficiency and effectiveness.

- There is a growing emphasis on the circular economy, promoting sustainable waste management practices across various sectors.

- Collaboration and partnerships among key stakeholders are becoming increasingly prevalent to drive innovation and market expansion.

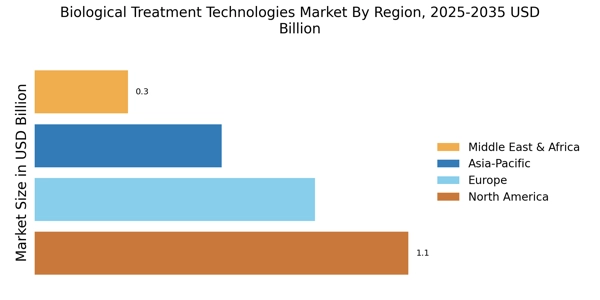

- Rising environmental regulations and growing awareness of sustainable practices are major drivers propelling the market, particularly in the North American and Asia-Pacific regions, with anaerobic treatment leading the largest segment and vermicomposting emerging as the fastest-growing segment.

Market Size & Forecast

| 2024 Market Size | 2.838 (USD Billion) |

| 2035 Market Size | 5.696 (USD Billion) |

| CAGR (2025 - 2035) | 6.54% |