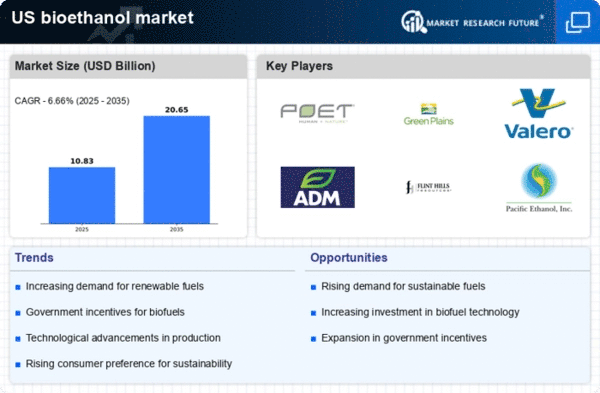

The bioethanol market exhibits a dynamic competitive landscape characterized by a blend of innovation, sustainability initiatives, and strategic partnerships. Key players such as POET LLC (US), Green Plains Inc. (US), and Valero Energy Corporation (US) are at the forefront, each adopting distinct operational focuses. POET LLC (US) emphasizes technological advancements in biofuel production, aiming to enhance efficiency and reduce environmental impact. Green Plains Inc. (US) is actively pursuing vertical integration, optimizing its supply chain to bolster resilience and reduce costs. Valero Energy Corporation (US), on the other hand, is diversifying its portfolio by investing in renewable diesel alongside bioethanol, indicating a strategic pivot towards broader renewable energy solutions. Collectively, these strategies contribute to a competitive environment that is increasingly focused on sustainability and technological innovation.The business tactics employed by these companies reflect a concerted effort to localize manufacturing and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share while also collaborating on sustainability initiatives. This fragmentation allows for a variety of approaches to bioethanol production, fostering innovation and competition among key players. The collective influence of these companies shapes market dynamics, as they navigate regulatory landscapes and consumer preferences for greener energy solutions.

In October POET LLC (US) announced a partnership with a leading agricultural technology firm to develop advanced fermentation processes aimed at increasing bioethanol yield. This strategic move underscores POET's commitment to innovation and positions the company to capitalize on emerging technologies that enhance production efficiency. Such collaborations may not only improve operational performance but also align with the growing demand for sustainable energy sources.

In September Green Plains Inc. (US) unveiled plans to expand its bioethanol production capacity by 20% through the construction of a new facility in Nebraska. This expansion reflects Green Plains' strategy to meet increasing market demand while reinforcing its position as a leader in the bioethanol sector. The investment is likely to enhance the company's competitive edge by improving economies of scale and reducing production costs.

In August Valero Energy Corporation (US) completed the acquisition of a bioethanol plant in Texas, further diversifying its renewable energy portfolio. This acquisition is strategically significant as it allows Valero to integrate bioethanol production with its existing operations, potentially leading to synergies that enhance overall efficiency. The move indicates Valero's commitment to expanding its footprint in the renewable energy market, aligning with broader industry trends towards sustainability.

As of November current competitive trends in the bioethanol market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence in production processes. Strategic alliances among companies are shaping the landscape, fostering innovation and collaboration. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices. This shift suggests that companies that prioritize innovation and adaptability will be better positioned to thrive in an evolving market.