Rising Demand in Medical Applications

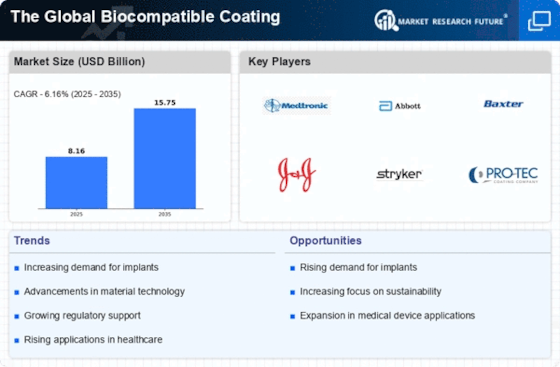

The increasing prevalence of chronic diseases and the aging population are driving the demand for advanced medical devices, which in turn propels The Global Biocompatible Coating Industry. Biocompatible coatings are essential for ensuring the safety and efficacy of implants and devices, as they minimize the risk of adverse reactions. According to recent data, the medical segment is projected to account for a substantial share of the market, with a compound annual growth rate (CAGR) of over 10% through the next few years. This growth is attributed to the rising need for surgical implants, drug delivery systems, and diagnostic devices, all of which require biocompatible coatings to enhance performance and patient outcomes. As healthcare continues to evolve, the demand for innovative biocompatible solutions is likely to expand further.

Regulatory Support and Standardization

Regulatory frameworks and standardization efforts are playing a pivotal role in shaping The Global Biocompatible Coating Industry. Governments and international organizations are establishing guidelines and standards to ensure the safety and efficacy of biocompatible materials used in medical devices and other applications. This regulatory support is essential for fostering consumer confidence and facilitating market entry for new products. Recent developments indicate that compliance with these regulations can enhance a company's reputation and marketability, potentially leading to increased sales. Furthermore, as the industry matures, the establishment of standardized testing methods and quality assurance protocols is likely to streamline the approval process for new coatings, thereby accelerating innovation and market growth. The alignment of regulatory practices with industry needs is crucial for the sustainable development of the biocompatible coatings sector.

Sustainability and Environmental Considerations

There is a growing emphasis on sustainability within The Global Biocompatible Coating Industry, as manufacturers seek to develop eco-friendly materials and processes. The shift towards sustainable practices is driven by regulatory pressures and consumer preferences for environmentally responsible products. Biocompatible coatings derived from natural sources or biodegradable materials are gaining traction, as they align with the global movement towards reducing environmental impact. Market data suggests that the segment of sustainable coatings is expected to grow significantly, potentially reaching a market share of 25% by 2030. This trend not only addresses environmental concerns but also enhances the marketability of products, as consumers increasingly favor brands that prioritize sustainability. Consequently, companies that invest in green technologies may find themselves at a competitive advantage in the biocompatible coatings sector.

Technological Advancements in Coating Techniques

Innovations in coating technologies are transforming The Global Biocompatible Coating Industry, enabling the development of more effective and versatile coatings. Techniques such as plasma spraying, sol-gel processes, and electrospinning are being employed to enhance the properties of biocompatible coatings, including adhesion, durability, and biocompatibility. These advancements are crucial for meeting the stringent requirements of various applications, particularly in the medical field. Market analysis indicates that the adoption of advanced coating techniques is likely to drive growth, with a projected increase in market size by approximately 15% over the next five years. As research and development continue to progress, the introduction of novel materials and methods will further expand the potential applications of biocompatible coatings, thereby solidifying their role in modern healthcare solutions.

Increasing Investment in Research and Development

The Global Biocompatible Coating Industry is witnessing a surge in investment directed towards research and development initiatives. This influx of funding is primarily aimed at discovering new materials and enhancing existing coating technologies to meet the evolving needs of various industries, particularly healthcare. As companies strive to innovate and differentiate their products, R&D efforts are becoming increasingly critical. Recent statistics indicate that R&D spending in the biocompatible coatings sector is expected to grow by 20% annually, reflecting the industry's commitment to advancing technology and improving product performance. This focus on innovation not only fosters the development of superior coatings but also positions companies to capitalize on emerging market opportunities, thereby driving overall market growth.