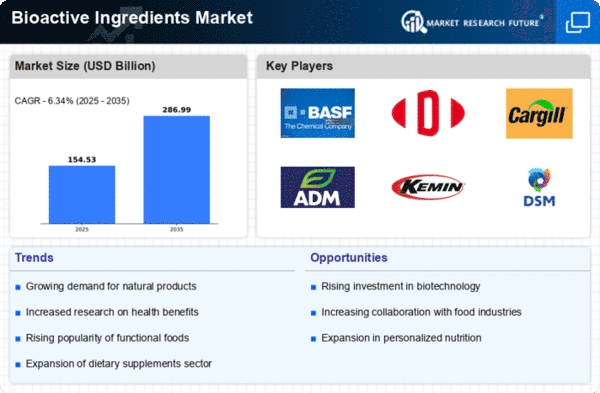

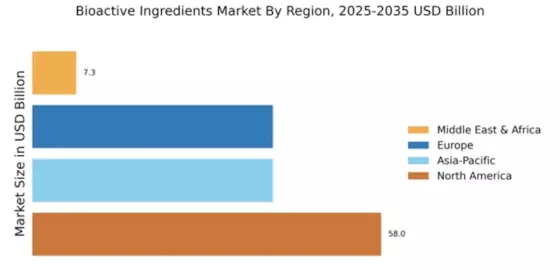

North America : Market Leader in Bioactive Ingredients

North America is poised to maintain its leadership in the bioactive ingredients market, holding a significant share of 58.0% as of 2024. The region's growth is driven by increasing consumer demand for natural and organic products, alongside stringent regulations promoting health and safety standards. The rise in health-conscious consumers and the growing trend of functional foods are key demand drivers, supported by government initiatives encouraging innovation in bioactive ingredients. The competitive landscape in North America is robust, featuring major players such as BASF SE, DuPont de Nemours Inc, and Cargill Inc. The U.S. stands out as the leading country, with a strong focus on research and development in bioactive compounds. The presence of established companies and a favorable regulatory environment further enhance market dynamics, fostering innovation and collaboration among industry stakeholders.

Europe : Emerging Market with Growth Potential

Europe's bioactive ingredients market is experiencing significant growth, with a market size of €40.0 billion. The region benefits from a strong regulatory framework that encourages the use of bioactive compounds in food and pharmaceuticals. Increasing health awareness among consumers and a shift towards preventive healthcare are driving demand. Additionally, the European Union's focus on sustainability and natural ingredients is catalyzing market expansion, making it a key player in the global landscape. Leading countries in this region include Germany, France, and the Netherlands, where companies like Royal DSM N.V. and Symrise AG are prominent. The competitive landscape is characterized by innovation and collaboration among key players, focusing on developing new bioactive products. The presence of a well-established supply chain and research institutions further supports the growth of the bioactive ingredients market in Europe.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region is emerging as a significant player in the bioactive ingredients market, with a market size of $40.0 billion. The growth is fueled by rising disposable incomes, urbanization, and a growing awareness of health and wellness among consumers. Additionally, government initiatives promoting the use of natural ingredients in food and beverages are acting as catalysts for market expansion. The region's diverse dietary preferences also contribute to the increasing demand for bioactive ingredients. Countries like China, India, and Japan are leading the charge in this market, with a competitive landscape featuring both local and international players. Companies such as Kemin Industries Inc and Ginkgo BioWorks Inc are making strides in innovation and product development. The presence of a large consumer base and increasing investments in research and development further enhance the region's market potential, positioning it for substantial growth in the coming years.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region, with a market size of $7.32 billion, is gradually emerging in the bioactive ingredients sector. The growth is driven by increasing health awareness and a shift towards natural products among consumers. However, the market faces challenges such as regulatory hurdles and limited access to advanced technologies. Despite these challenges, the region is witnessing a growing interest in functional foods and dietary supplements, which are expected to drive demand for bioactive ingredients. Leading countries in this region include South Africa and the UAE, where local companies are beginning to invest in bioactive ingredient production. The competitive landscape is still developing, with opportunities for international players to enter the market. As the region continues to evolve, the presence of key players and increasing consumer interest in health products will likely shape the future of the bioactive ingredients market.