Top Industry Leaders in the Bioactive Ingredients Market

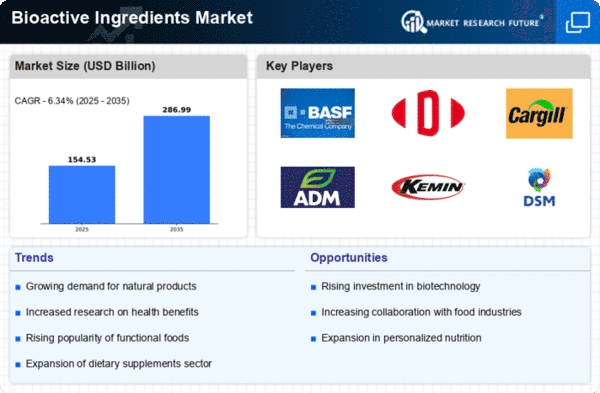

The Bioactive Ingredients market, a pivotal segment within the food and pharmaceutical industries, has experienced substantial growth due to increasing consumer awareness of the health benefits associated with bioactive compounds. This analysis delves into the competitive landscape, outlining key players, their strategies, factors influencing market share, emerging companies, industry news, current investment trends, and a notable development in 2023.

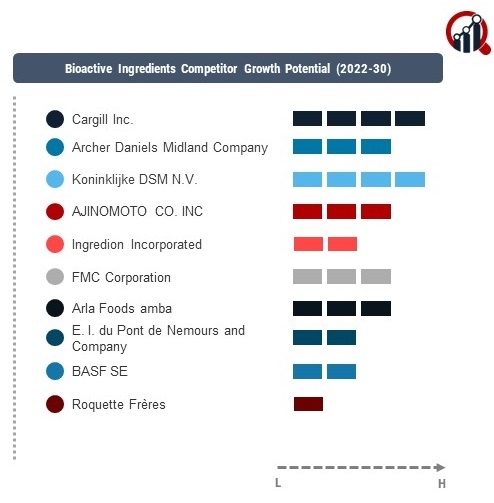

Key Players:

Cargill Inc. (US)

Archer Daniels Midland Company (US)

Koninklijke DSM N.V. (Netherlands)

AJINOMOTO CO. INC (Japan)

Ingredion Incorporated (US)

FMC Corporation (US)

Arla Foods amba (Denmark)

BASF SE (Germany)

Roquette Frères (France)

Mazza Innovation Ltd (Canada)

Sabinsa Corporation (US)

Nuritas (Ireland)

Vytrus Biotech (Spain)

Kuehnle AgroSystems (US)

Strategies Adopted:

The Bioactive Ingredients market employ various strategies to fortify their competitive positions. Strategies include partnerships, acquisitions, research and development investments, and a focus on sustainability. For example, DuPont de Nemours has strategically expanded its bioactive ingredient portfolio through acquisitions of specialized companies, enhancing its capabilities to cater to diverse consumer demands for functional and health-oriented products.

Market Share Analysis:

The Bioactive Ingredients market involves evaluating factors contributing to competitive advantages. Key considerations include the quality and purity of bioactive ingredients, research capabilities, compliance with regulatory standards, and responsiveness to evolving consumer preferences. Companies successfully navigating these factors are better positioned to capture and expand their market share. Additionally, factors such as brand reputation, global distribution networks, and strategic collaborations play a pivotal role in market differentiation.

News & Emerging Companies:

The Bioactive Ingredients market has witnessed the emergence of new and innovative companies responding to the growing demand for functional and health-promoting ingredients. In 2023, companies like BioHealth Solutions entered the market, focusing on novel bioactive compounds derived from natural sources. These emerging players contribute to market diversity, fostering innovation and challenging established market dynamics.

Industry Trends:

The Bioactive Ingredients market revolve around sustainable sourcing, research and development, and technological advancements. Key players are investing in sustainable and traceable supply chains to address growing consumer concerns about environmental impact and support ethical sourcing practices. Investments in research and development underscore the industry's commitment to introducing new bioactive ingredients with enhanced functionalities and health benefits.

Current investment trends highlight the importance of adapting to changing consumer preferences and advancing technologies. Companies are investing in advanced extraction and production methods, such as nanotechnology, to enhance the bioavailability and efficacy of bioactive ingredients. Additionally, investments in digital marketing and e-commerce reflect the industry's acknowledgment of the growing influence of online channels in consumer education and purchasing decisions.

Competitive Scenario:

The Bioactive Ingredients market is characterized by a focus on research, innovation, and sustainability. Companies differentiate themselves through product quality, technological advancements, and their ability to address evolving consumer health and wellness preferences. The market is influenced by factors such as regulatory compliance, sustainable practices, and the ability to adapt to emerging scientific research supporting the health benefits of bioactive ingredients.

Recent Development

The Bioactive Ingredients market in 2023 was Cargill's strategic partnership with a leading biotech company to explore innovative bioactive compounds with potential applications in functional foods and dietary supplements. This collaboration aimed to leverage Cargill's expertise in ingredient manufacturing and the biotech company's research capabilities to identify and commercialize novel bioactive ingredients. The partnership showcased the industry's recognition of the importance of collaborative efforts to drive innovation and bring cutting-edge bioactive products to market.

Cargill's strategic partnership exemplified the broader trend of established companies actively seeking collaborations to harness complementary expertise and accelerate innovation in the bioactive ingredients space. This move positioned Cargill as a frontrunner in exploring and commercializing the next generation of bioactive compounds, highlighting the industry's commitment to staying at the forefront of scientific advancements and addressing evolving consumer demands for functional and health-enhancing ingredients.