Global Biofuels Market Overview

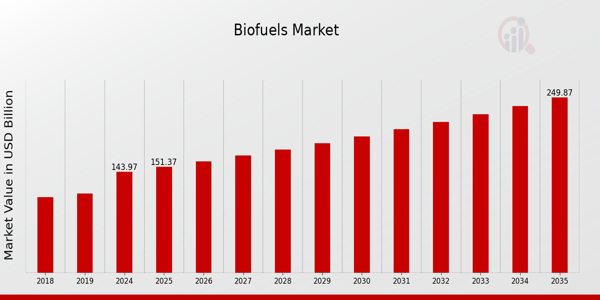

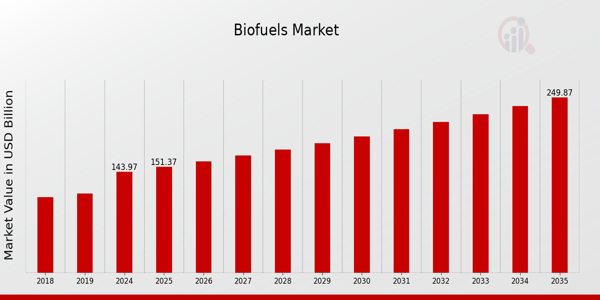

As per MRFR analysis, the Biofuels Market Size was estimated at 136.92 (USD Billion) in 2023. The Biofuels Market Industry is expected to grow from 143.97 (USD Billion) in 2024 to 250 (USD Billion) by 2035. The Biofuels Market CAGR (growth rate) is expected to be around 5.15% during the forecast period (2025 - 2035).

Key Biofuels Market Trends Highlighted

The Biofuels Market is shaped by several pivotal trends that reflect the ongoing shift towards sustainable energy solutions. A key market driver is the increasing demand for renewable energy sources as governments worldwide seek to reduce greenhouse gas emissions and combat climate change. Various nations have established policies that encourage the use of biofuels as a cleaner alternative to traditional fossil fuels. This regulatory support plays a critical role in promoting biofuels for transport and heating applications, aligning with global climate goals. Opportunities in the biofuels sector are expanding, particularly in regions where agricultural production can be integrated with energy needs.

Exploring the improvement and optimization of the technological processes involved in the production of second and third-generation biofuels, which utilize non-food biomass and waste materials, indicates possible further developments. Such advancements increase the efficiency of fuel and lessen the concern of competition with food resources, thus addressing one of the major issues regarding biofuels. It has recently been observed that there is a significant increase in the adoption of advanced biofuels, algal biofuels, and crop residue biofuels. These processes are being adopted due to their ability to deliver cleaner and greener energy. Moreover, the interest in models of the circular economy that consider waste as a resource for biofuel production is on the rise.

Overall, the Biofuels Market is poised for growth, driven by a confluence of government policies, technological innovation, and an increasing focus on sustainable practices. These factors are likely to propel the adoption of biofuels, making them a significant component of the global energy landscape in the coming years.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Biofuels Market Drivers

Increasing Demand for Renewable Energy Sources

The shift towards sustainable and renewable energy sources is driving the Biofuels Market Industry. Global energy demands are projected to rise significantly, with the International Energy Agency reporting that renewable energy share in the total energy mix is expected to surpass 30% by 2025, representing a notable increase from previous years. This trend aligns with various country-specific commitments to reduce carbon emissions, such as the European Union's pledge to increase the use of renewable sources to at least 32% of total energy consumption by 2030.

Furthermore, initiatives by organizations like the United Nations Environment Programme to promote sustainable agriculture and reduce greenhouse gas emissions are stimulating governmental and industrial efforts to transition to biofuels, supporting the industry's expansion. This combination of regulatory support and rising consumer preference for cleaner energy sources is expected to propel the Biofuels Market Industry forward.

Advancements in Biofuel Technologies

Technological advancements in biofuel production methods are significantly influencing the growth of the Biofuels Market Industry. Innovations such as second and third-generation biofuel production, which utilize non-food biomass and waste materials, can enhance fuel yield and reduce reliance on agricultural feedstocks. The U.S. Department of Energy estimates that utilizing waste materials can increase biofuel production capacity by approximately 50% while also addressing waste management issues.

Companies like POET and Novozymes have been at the forefront of this technological evolution, focusing on enzyme development and advanced fermentation processes to improve efficiency. Such advancements not only reduce production costs but also create a more sustainable biofuel supply chain, reinforcing the market's growth potential.

Government Policies and Incentives

Government policies and incentives play a crucial role in driving the Biofuels Market Industry. Many governments across the globe have enacted regulations aimed at increasing the use of biofuels to reduce dependence on fossil fuels and lower carbon emissions. For instance, countries like Brazil have implemented the National Biofuels Policy, which mandates the incorporation of biofuels in the transportation sector. According to the Brazilian Ministry of Mines and Energy, this policy has led to a substantial increase in biofuel consumption, resulting in a more than 20% rise in ethanol production within five years.

Similarly, the Renewable Fuel Standard in the United States continues to promote biofuel use, with the Environmental Protection Agency projecting that renewable fuel volume obligations will require approximately 16 billion gallons of biofuel by 2022. Such supportive policies not only enhance market confidence but also stimulate investment in the Biofuels Market Industry.

Biofuels Market Segment Insights:

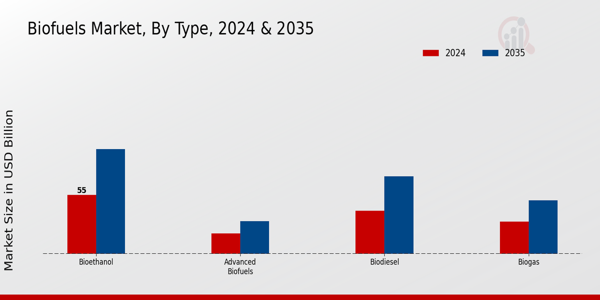

Biofuels Market Type Insights

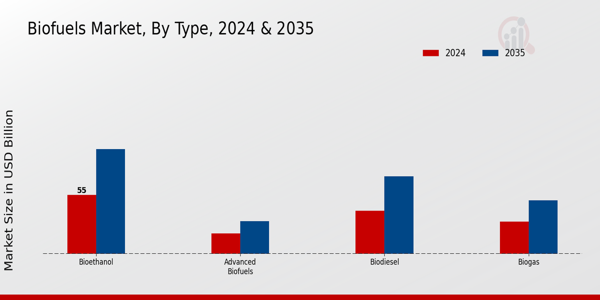

The Biofuels Market is experiencing significant growth, driven by an increasing demand for renewable energy sources, environmental sustainability, and energy security. In 2024, the Biofuels Market reached a valuation of 143.97 USD Billion, reflective of the major shifts towards cleaner energy options. The market is categorically segmented into four main types: Bioethanol, Biodiesel, Biogas, and Advanced Biofuels, each exhibiting notable market dynamics. Bioethanol is a prominent segment, which was valued at 45.0 USD Billion in 2024 and is projected to grow to 80.0 USD Billion by 2035, thus manifesting a significant growth trajectory that is attributed to its uses in transport fuels as well as its ability to reduce greenhouse gas emissions.

Biodiesel, which was valued at 35.0 USD Billion in 2024 and an anticipated rise to 60.0 USD Billion in 2035, remains a pivotal alternative to traditional diesel, with its ability to integrate seamlessly into existing engines offering a convincing case for its increased adoption within the transport sector. Biogas, which was valued at 25.0 USD Billion in 2024 and is expected to expand to 45.0 USD Billion by 2035, stands out due to its dual role as an energy source and an effective waste management solution, driving interest in rural and urban energy projects globally.

The Advanced Biofuels segment, which was valued at 38.97 USD Billion in 2024 and is forecasted to reach 65.0 USD Billion by 2035, plays a crucial role in bridging conventional biofuels and new technologies, harnessing innovation to develop cleaner fuels that can potentially replace fossil fuels, driven by advancements in Research and Development. This diversification within the Biofuels Market segmentation reflects a growing recognition of the significant potential that biofuels hold in addressing not only energy-related challenges but also critical environmental issues worldwide.

Global initiatives and policies aimed at promoting renewable energy sources are projected to further catalyze growth as national governments increasingly set mandates to reduce carbon emissions and shift away from fossil fuels. This strategic focus on renewable energy solutions will continue to enhance the importance of each type of biofuel, solidifying their role as key components of a sustainable energy landscape on a global scale.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Biofuels Market Feedstock Insights

The Biofuels Market, which was valued at 143.97 billion USD in 2024, plays a significant role in the transition to renewable energy, and its Feedstock segment is pivotal for this growth. This segment of the market encompasses various types, including Food Crops, Non-Food Crops, Waste Materials, and Algae, each contributing uniquely to the overall biofuels landscape. Food Crops, typically used for ethanol production, are crucial due to their widespread availability and established cultivation practices. Non-Food Crops are gaining traction as they provide sustainable alternatives without competing directly with the food supply.

Waste Materials, representing an innovative approach, help in resource recycling and reducing overall environmental impact, while Algae, known for their high oil content and rapid growth rates, present promising opportunities for future fuel production. As consumers and industries shift towards more sustainable practices, the feedstock sources will play a vital role in shaping the Biofuels Market revenue and its overall segmentation by providing diverse routes for biofuel production and meeting regulatory and environmental demands. The continued growth in this market is driven by advancements in technology and increasing investments in Research and Development, illustrating the dynamic nature of the Biofuels Market industry.

Biofuels Market Application Insights

The Biofuels Market was valued at 143.97 USD Billion in 2024, reflecting the increasing reliance on biofuels across various applications. The applications within this market include Transportation, Power Generation, Heating, and Industrial, each playing a pivotal role in advancing sustainable energy solutions. Transportation is expected to drive major growth due to the rising demand for greener fuel alternatives, contributing to a shift in the automotive industry towards biofuels. Power Generation also holds prominence, offering renewable energy sources that help reduce carbon emissions and enhance energy security.

Heating applications are gaining attention as energy prices fluctuate and consumers seek more sustainable heating options, further bolstering the market. The Industrial application segment promotes the use of biofuels in manufacturing processes, presenting opportunities for enhanced energy efficiency and reduced environmental footprints. Overall, these segments collectively highlight favorable market trends, with the increasing emphasis on sustainability and regulatory support amplifying the potential of the Biofuels Market. The market is positioned to adapt to challenges like production costs and supply chain complexities while capitalizing on opportunities to innovate and expand in the evolving energy landscape.

Biofuels Market End Use Insights

The Biofuels Market, which was valued at 143.97 USD Billion in 2024, showcases significant potential within its End Use categories. The Automotive sector is pivotal as it increasingly integrates biofuels to comply with stringent emissions standards, reflecting the market's growing contribution to sustainable transportation. The Aviation segment is also evolving, with biofuels being recognized for reducing carbon footprints and making air travel more environmentally friendly. In the Marine sector, the use of biofuels is expanding as industries shift towards cleaner alternatives to comply with international regulations aimed at reducing marine emissions.

The Residential segment is gaining traction as consumers seek renewable energy sources for heating and electricity, highlighting a shift towards sustainability in daily living. Overall, the Biofuels Market segmentation illustrates robust growth opportunities driven by the demand for cleaner energy solutions across various sectors, reinforcing the need for innovative technologies and policies supporting biofuel adoption. This trend aligns with global efforts to reduce reliance on fossil fuels and mitigate climate change impacts, making the Biofuels Market industry a crucial player in the development of sustainable energy systems.

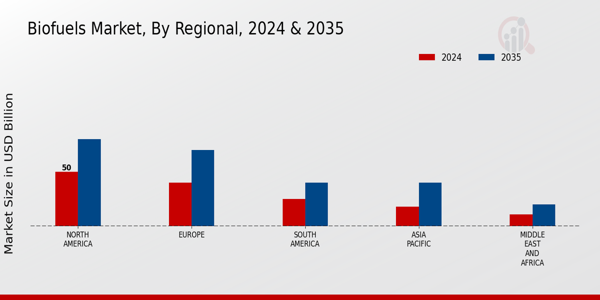

Biofuels Market Regional Insights

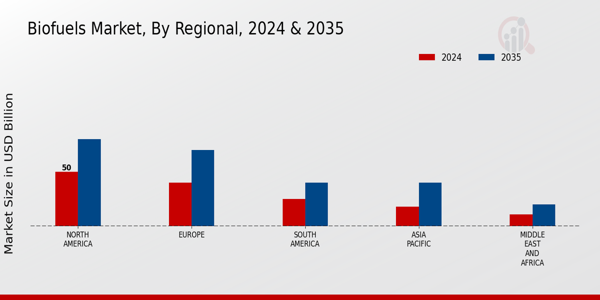

The Biofuels Market is experiencing significant growth, which was valued at 143.97 USD Billion in 2024. Regionally, North America led with a valuation of 40.0 USD Billion, projected to rise to 70.0 USD Billion by 2035, largely due to robust government policies supporting renewable energy initiatives and advancements in biofuel technologies, which dominate this region. Europe followed closely, valued at 35.0 USD Billion in 2024 and anticipated to grow to 60.0 USD Billion by 2035, reflecting increasing investments in sustainable energy to meet environmental targets.

The Asia-Pacific (APAC) region, which was valued at 35.0 USD Billion in 2024 and is set to expand to 70.0 USD Billion by 2035, showcases emerging economies' commitment to biofuels as they prioritize energy independence and sustainable development. South America, which was valued at 25.0 USD Billion in 2024, is expected to increase to 30.0 USD Billion by 2035, benefiting from its rich agricultural resources that enable biofuel production. Meanwhile, the Middle East and Africa (MEA) held a smaller market valuation of 8.97 USD Billion in 2024 but is expected to elevate to 20.0 USD Billion by 2035, indicating potential growth driven by investments in renewable energy projects.

Overall, the regional distribution of the Biofuels Market showcases varying levels of maturity and opportunities for growth across different geographies.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Biofuels Market Key Players and Competitive Insights:

The Biofuels Market is characterized by a complex interplay of various stakeholders vying for competitive advantage amidst a backdrop of evolving regulations, technological advancements, and shifts in consumer preferences towards sustainable energy sources. As the demand for cleaner energy alternatives rises, companies in the biofuels sector are increasingly focusing on enhancing production efficiency, expanding their product portfolios, and forging strategic partnerships to consolidate their market positions.

The competitive landscape is shaped by factors such as feedstock availability, infrastructure development, government policies promoting renewable energy utilization, and the race to innovate within biofuel technologies. Additionally, sustainability practices and environmental considerations are influencing corporate strategies, making it essential for market players to align with global sustainability goals while maintaining profitability and market relevance.

Lime Energy has carved a niche in the Biofuels Market through its commitment to delivering sustainable energy solutions. The company demonstrates strengths in effectively leveraging advanced technologies to produce innovative biofuel solutions that cater to both environmental and economic needs. Lime Energy is recognized for its comprehensive approach, integrating renewable energy production with robust energy efficiency solutions, which positions it favorably against competitors. The strategic focus on partnerships and collaborations has enhanced its market presence, as the company works closely with various stakeholders to foster sustainable energy developments. Its adaptability in responding to changing regulations and market demands further reinforces its competitive edge, enabling Lime Energy to maintain a strong foothold in the global biofuels sector.

Archers Daniel Midland, a prominent player in the Biofuels Market, is well-regarded for its diversified portfolio of biofuel-related products and its vast production capabilities. The company specializes in producing biodiesel and ethanol, leveraging its extensive distribution networks to optimize market outreach. With a strong emphasis on innovation, Archers Daniel Midland continuously invests in research and development to enhance its biofuel offerings, ensuring that they meet the rigorous standards and demand for sustainability.

The company has solidified its market presence through strategic mergers and acquisitions, allowing it to expand its operational capacity and integrate new technologies. Its strengths lie in its established relationships with suppliers and its ability to scale production efficiently, securing a competitive position in the global biofuels landscape. Archers Daniel Midland's commitment to sustainability and energy diversification further underscores its role as a key player in shaping the future of the biofuels market on a global scale.

Key Companies in the Biofuels Market Include:

- Valero Energy Corporation

Biofuels Market Industry Developments

The Biofuels Market has been witnessing significant developments recently. For instance, in November 2023, Renewable Energy Group announced its plans to expand its biodiesel production capacity in the United States to meet the growing demand for renewable fuels. Meanwhile, in October 2023, Lime Energy launched a new initiative aimed at increasing the adoption of biogas technology among small and medium-sized enterprises. In terms of mergers and acquisitions, in September 2023, Valero Energy Corporation acquired a major ethanol plant from a competitor, boosting its market presence significantly.

Growth in market valuation has been notable, with Green Plains Inc. reporting a considerable increase in revenue, driven by surging demand for renewable diesel. The global push toward cleaner energy sources has been further supported by policy initiatives promoting biofuels as alternatives to fossil fuels. Over the past two to three years, companies like Cargill Incorporated and Bunge Limited have been strategically investing in biofuel technologies aimed at enhancing sustainability and efficiency in production practices. The increasing investments and strategic expansions demonstrate an upward trajectory in the Biofuels Market, driven by both regulatory support and rising consumer awareness.

In July 2023, Equilon Enterprises LLC, a subsidiary of Shell Plc, and Green Plains Inc. established a technological collaboration to implement Shell Fiber Conversion Technology (SFCT) in conjunction with Fluid Quip Technologies’ precision separation and processing technology. The strategic partnership is anticipated to enhance the value of Green Plains Inc.’s biorefinery platform significantly.

In July 2023, Petrobras announced the initiation of performance testing for a B24 bio bunker fuel blend. The fuel blend is utilized for powering a vessel at the Rio Grande (RS) Terminal, under charter by Transpetro, with a total capacity of 573,000 liters of fuel to be loaded onto the ship.

In July 2023, Gevo, Inc. established a Master Services Agreement (MSA) with a subsidiary of McDermott International, Ltd. This agreement is intended to facilitate front-end engineering and early planning services for the development of multiple sustainable aviation fuel facilities by Gevo in North America.

Biofuels Market Segmentation Insights

Biofuels Market Type Outlook

Biofuels Market Feedstock Outlook

Biofuels Market Application Outlook

Biofuels Market End Use Outlook

Biofuels Market Regional Outlook

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

136.92 (USD Billion)

|

|

Market Size 2024

|

143.97 (USD Billion)

|

|

Market Size 2035

|

250.0 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

5.15% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Lime Energy, Archers Daniel Midland, Renewable Energy Group, Valero Energy Corporation, Pacific Biodiesel, Bunge Limited, Infinita Renovables, Green Plains Inc., World Energy Holdings, ADM, Algenol Biotech, Cargill Incorporated, POET LLC, Bioprocess Algae, Neste Corporation

|

|

Segments Covered

|

Type, Feedstock, Application, End Use, Regional

|

|

Key Market Opportunities

|

Rising government mandates, Advancements in production technologies, Increasing biofuel adoption in transportation, Growing demand for sustainable energy, Expanding use in the aviation sector

|

|

Key Market Dynamics

|

Government policies and incentives, Rising demand for renewable energy, Technological advancements in production, Fluctuating oil prices, Environmental sustainability concerns

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Bio Fuels Market Highlights:

Frequently Asked Questions (FAQ) :

The Biofuels Market is expected to be valued at 250.0 USD Billion by 2035.

The projected CAGR for the Biofuels Market from 2025 to 2035 is 5.15%.

North America is expected to have the highest market value, projected at 70.0 USD Billion by 2035.

The market size for Bioethanol in 2024 is valued at 45.0 USD Billion.

Key players in the Biofuels Market include Lime Energy, Archers Daniel Midland, and Renewable Energy Group, among others.

The expected market value of Biodiesel is projected to be 60.0 USD Billion by 2035.

The Biogas market is expected to grow from 25.0 USD Billion in 2024 to 45.0 USD Billion by 2035.

The anticipated market size for Advanced Biofuels by 2035 is 65.0 USD Billion.

South America is projected to have a market value of 30.0 USD Billion by 2035.

The estimated market value for the MEA region by 2024 is 8.97 USD Billion.