Rising Environmental Awareness

The increasing awareness of environmental issues among consumers and industries is significantly influencing the Rotating Machines for Biofuels Market. As public concern regarding climate change and pollution grows, there is a corresponding shift towards sustainable energy solutions, including biofuels. This heightened awareness is prompting businesses to invest in rotating machines that facilitate the production of cleaner fuels. Consequently, the market is poised for expansion, with projections suggesting a steady increase in demand as more stakeholders recognize the importance of sustainable practices in energy production.

Growing Demand for Renewable Energy

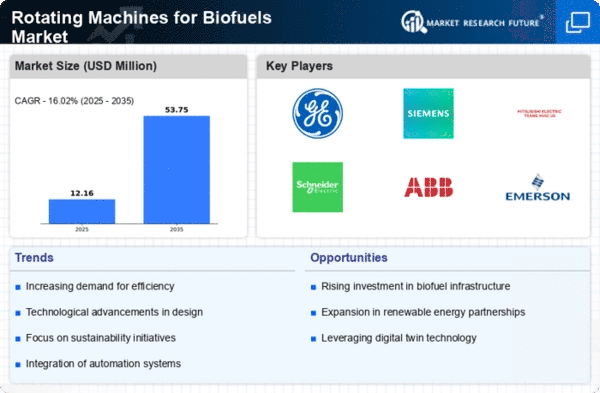

The Global Rotating Machines for Biofuels Market is experiencing a surge in demand driven by the increasing global emphasis on renewable energy sources. Governments worldwide are implementing policies to reduce carbon emissions, which has led to a heightened interest in biofuels as a sustainable alternative. For instance, the market is projected to reach 12.5 USD Billion in 2024, reflecting a robust shift towards cleaner energy solutions. This trend is likely to continue as countries strive to meet their renewable energy targets, thereby enhancing the adoption of rotating machines designed for biofuel production.

Integration of Biofuels in Transportation

The integration of biofuels into the transportation sector is emerging as a key driver for the Rotating Machines for Biofuels Industry. With many countries mandating the use of biofuels in vehicles, the demand for efficient production technologies is escalating. This trend is likely to propel the market forward, as manufacturers seek to enhance their production capabilities to meet regulatory requirements. The anticipated growth in biofuel consumption within transportation is expected to contribute to the overall market value, reinforcing the need for advanced rotating machines.

Supportive Government Policies and Incentives

Government policies and incentives are crucial drivers in the Rotating Machines for Biofuels Market. Many countries are offering subsidies and tax breaks to encourage the adoption of biofuels and related technologies. These initiatives not only promote the use of renewable energy but also stimulate investment in the development of rotating machines tailored for biofuel production. As a result, the market is anticipated to witness a compound annual growth rate of 6.5% from 2025 to 2035, indicating a favorable environment for manufacturers and investors alike.

Technological Advancements in Rotating Machines

Technological innovations play a pivotal role in the Rotating Machines for Biofuels Market. Recent advancements in machine efficiency and performance have led to the development of more effective biofuel production systems. Enhanced designs and materials have improved the durability and output of these machines, making them more appealing to manufacturers. As a result, the market is expected to grow significantly, with projections indicating a value of 25 USD Billion by 2035. This growth is likely fueled by ongoing research and development efforts aimed at optimizing rotating machines for biofuel applications.