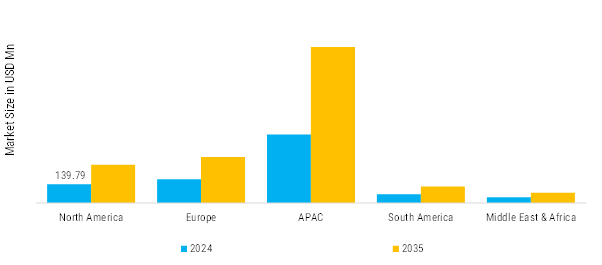

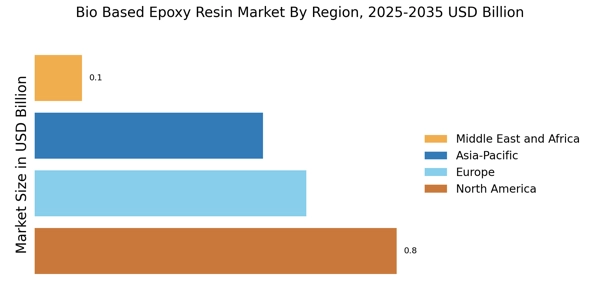

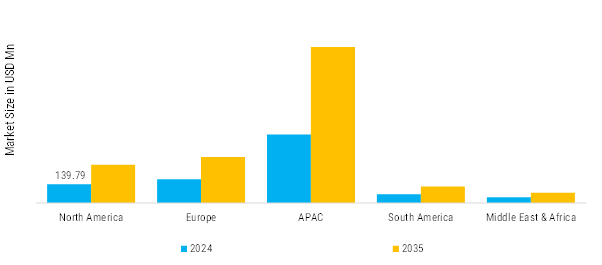

North America: Mature Market with Stable Demand

North America is one of the key markets for bio‑based epoxy resins, driven by strong sustainability mandates, robust industrial R&D, and increasing demand across automotive, construction, and electronics sectors. The U.S. and Canada are actively promoting renewable materials through government programs and industry commitments to reduce carbon emissions, which encourages formulators to replace petroleum‑derived epoxies with bio‑based alternatives. There is significant adoption of plant‑derived feedstocks such as soybean, glycerol, and corn derivatives, which support a thriving supply chain for bio‑based resins and reduce reliance on fossil‑based inputs. The construction sector continues to be a major consumer, with bio‑based coatings and adhesives specified for green building projects. Automotive manufacturers are increasingly using lightweight bio‑composite parts to meet emissions reduction targets and improve fuel economy, while electronics OEMs are adopting low‑VOC bio‑epoxies for coatings and encapsulants. Overall, North America is transitioning from conventional petrochemical resins toward higher bio‑content materials, supported by strong funding for innovation and sustainability standards.

Europe: Regulation-Driven Market with Strong Sustainability Adoption

Europe holds a substantial share of the bio‑based epoxy resin market, with adoption strongly propelled by stringent environmental regulations, circular economic initiatives, and a high level of consumer awareness around sustainability. Regulatory frameworks such as the European Green Deal and low‑VOC mandates push manufacturers in automotive, construction, aerospace, and wind energy sectors to integrate bio‑based resins in place of traditional petroleum‑based epoxies. European companies have increasingly invested in next‑generation feedstocks such as plant oils and high‑bio‑content monomers, and the region is known for advanced collaborative R&D between industry, government, and academia. Germany, France, and the Netherlands are among the leaders in bio‑epoxy adoption, especially for lightweight composites and eco‑friendly coatings. Europe’s strong chemical sector and supportive policy environment make this region both a conventional and innovative leader in bio‑based epoxy materials, often adopting renewable feedstock faster and at larger scales compared with global peers.

Asia-Pacific: Largest & Fastest-Growing Region

Asia Pacific is a rapidly expanding and high‑potential region for bio‑based epoxy resins, driven by widespread industrialization, expanding manufacturing bases, and supportive government policies. Countries like China, India, Japan, and South Korea lead growth as demand from automotive, electronics, and construction sectors surges. Rapid EV production and infrastructure development projects are key demand drivers for lightweight composites and sustainable coatings, fostering significant uptake of plant‑based feedstocks particularly palm, castor, soybean, and other vegetable oils. Government incentives promoting renewable materials and environmental standards further accelerate adoption, with numerous local producers entering the market to meet regional and global demand. Asia Pacific also benefits from abundant agricultural feedstock supplies, which helps reduce costs and supports large‑scale production of bio‑based resins. Marine composites and wind energy applications are additional growth fronts as the region transitions toward greener industrial practices. Overall, Asia Pacific is both the fastest‑growing and increasingly influential region in the bio‑based epoxy resin landscape.

South America: Emerging Market with Moderate Growth Potential

South America is an emerging market for bio‑based epoxy resins, with growth supported by abundant agricultural resources and increasing interest in sustainable industrial materials. The region’s feedstock strength lies in its rich agricultural base particularly in soybean, palm, and other vegetable oil production which provides cost‑effective raw materials for bio‑epoxy resin synthesis. Although demand is not as large as in North America, Europe, or Asia Pacific, infrastructure development and growing industrialization are driving adoption in construction and industrial maintenance applications. Bio‑based resins are beginning to gain traction in automotive and consumer goods sectors, particularly where sustainability credentials add market value. However, adoption remains constrained by limited local production capacity and the need for greater processing infrastructure. Many manufacturers in the region rely on imports of plant‑oil‑based bio‑epoxy resins, although partnerships with global suppliers are expanding. Continued investment in bio‑economy initiatives and renewable material programs is expected to accelerate future growth in South America.

Middle East & Africa: Nascent Market with Gradual Uptake

The The Middle East & Africa (MEA) region currently holds a smaller share of the global bio‑based epoxy resin market but is showing noteworthy growth momentum. Infrastructure and megaprojects in countries such as the UAE, Saudi Arabia, and South Africa are increasingly specifying low‑VOC and renewable materials, contributing to rising demand for bio‑based coatings and composites. Growth is supported by expanding manufacturing capacities and foreign direct investment in sustainable chemical industries, as well as increasing availability of agricultural feedstocks such as castor oil for bio‑resin production. Despite limited local production compared with more mature regions, imports of plant‑based bio‑epoxy resins are growing, and regional R&D efforts are beginning to focus on product performance improvement. Renewable energy projects including wind and solar infrastructure further enhance demand for durable, sustainable resin systems. As sustainability agendas strengthen, the MEA region is expected to be a gaining traction market, particularly if regulatory and economic diversification strategies continue to push for renewable and low‑carbon materials.