Increased Demand for Real-Time Data

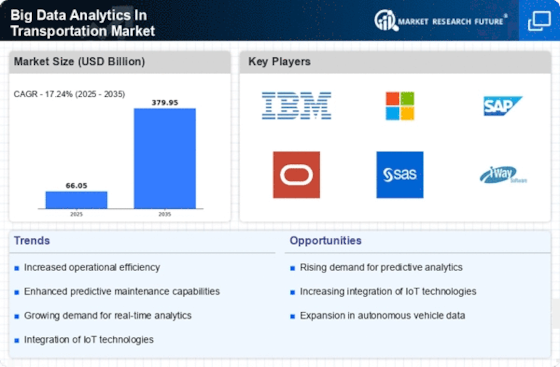

The demand for real-time data analytics in the transportation sector appears to be escalating, driven by the need for timely decision-making. Companies are increasingly leveraging Big Data Analytics in Transportation Market to enhance operational efficiency and improve customer satisfaction. According to recent estimates, the market for real-time analytics is projected to grow at a compound annual growth rate of over 25% in the coming years. This growth is likely fueled by advancements in data processing technologies and the proliferation of connected devices, which generate vast amounts of data. As organizations seek to optimize routes, reduce delays, and enhance safety measures, the integration of real-time analytics becomes essential. Consequently, the Big Data Analytics in Transportation Market is poised to benefit significantly from this trend, as stakeholders recognize the value of immediate insights.

Focus on Cost Reduction and Efficiency

The relentless pursuit of cost reduction and operational efficiency is a driving force behind the adoption of Big Data Analytics in the Transportation Market. Companies are increasingly recognizing that data-driven insights can lead to substantial savings in fuel consumption, maintenance costs, and labor expenses. Recent studies indicate that organizations utilizing analytics can achieve up to a 15% reduction in operational costs. This trend is particularly evident in logistics and freight transportation, where optimizing routes and improving load management can yield significant financial benefits. As competition intensifies, the pressure to enhance efficiency will likely propel further investment in analytics solutions. Consequently, the Big Data Analytics in Transportation Market stands to gain as businesses seek to leverage data to streamline operations and improve their bottom line.

Government Initiatives and Regulations

Government initiatives aimed at improving transportation infrastructure and safety are likely to play a crucial role in shaping the Big Data Analytics in Transportation Market. Various governments are investing heavily in smart transportation systems, which utilize data analytics to enhance traffic management and reduce congestion. For instance, funding for smart city projects has seen a significant increase, with billions allocated to develop data-driven solutions. These initiatives not only promote the adoption of Big Data Analytics but also encourage collaboration between public and private sectors. As regulations evolve to support data sharing and interoperability, the market for analytics solutions is expected to expand. This regulatory environment may create a fertile ground for innovation, thereby driving the growth of the Big Data Analytics in Transportation Market.

Rising Adoption of Autonomous Vehicles

The transportation industry is witnessing a notable shift towards autonomous vehicles, which may significantly influence the Big Data Analytics in Transportation Market. As these vehicles generate extensive data regarding traffic patterns, road conditions, and user behavior, the need for sophisticated analytics tools becomes paramount. It is estimated that the autonomous vehicle market could reach a valuation of over 500 billion dollars by 2030, indicating a substantial opportunity for analytics providers. The integration of Big Data Analytics allows for the processing of this data, enabling predictive maintenance, route optimization, and enhanced safety features. This trend suggests that as the adoption of autonomous vehicles accelerates, the demand for advanced analytics solutions will likely follow suit, further propelling the growth of the Big Data Analytics in Transportation Market.

Emergence of Smart Transportation Systems

The emergence of smart transportation systems is transforming the landscape of the Big Data Analytics in Transportation Market. These systems leverage advanced technologies such as artificial intelligence and machine learning to analyze vast datasets generated by vehicles, infrastructure, and users. The market for smart transportation solutions is projected to grow significantly, with estimates suggesting a valuation exceeding 200 billion dollars by 2025. This growth is indicative of the increasing recognition of the benefits that data-driven decision-making can provide. By utilizing Big Data Analytics, transportation agencies can optimize traffic flow, enhance public transit services, and improve overall safety. As cities continue to evolve into smart environments, the demand for analytics solutions tailored to transportation needs is likely to surge, further solidifying the role of Big Data Analytics in the Transportation Market.