Market Growth Projections

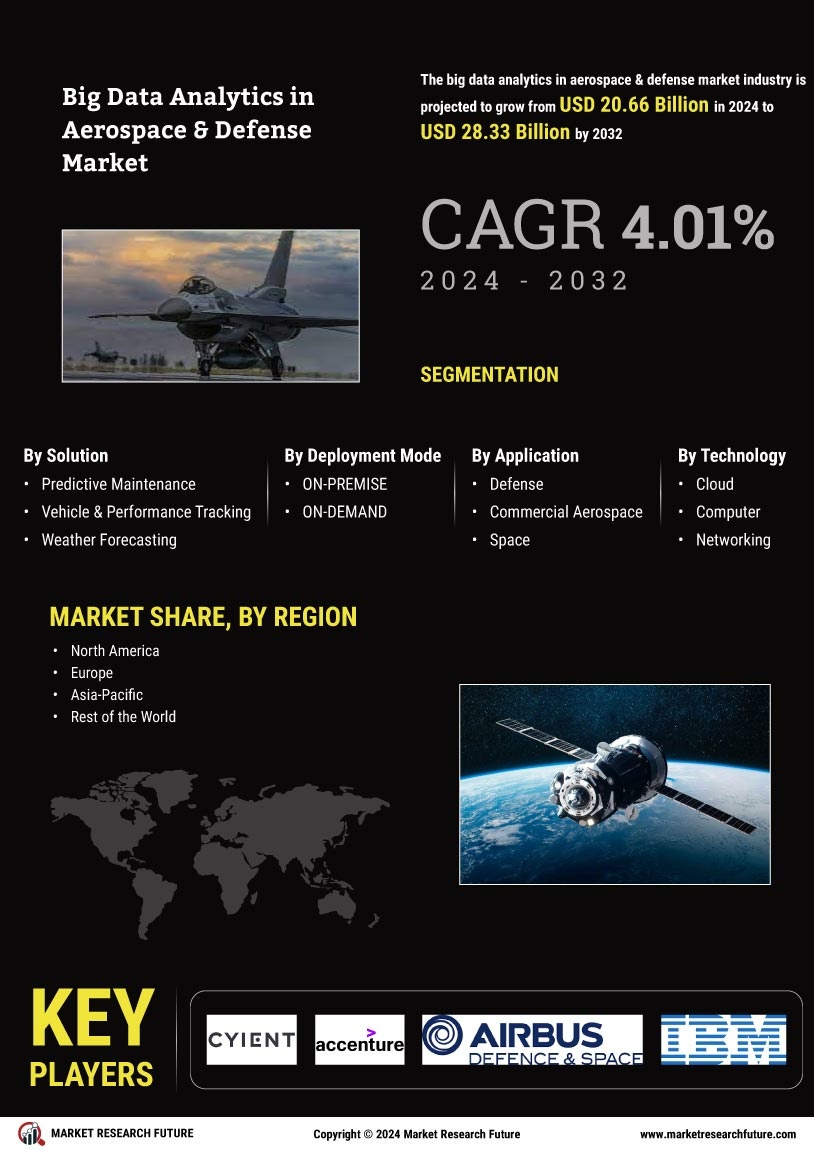

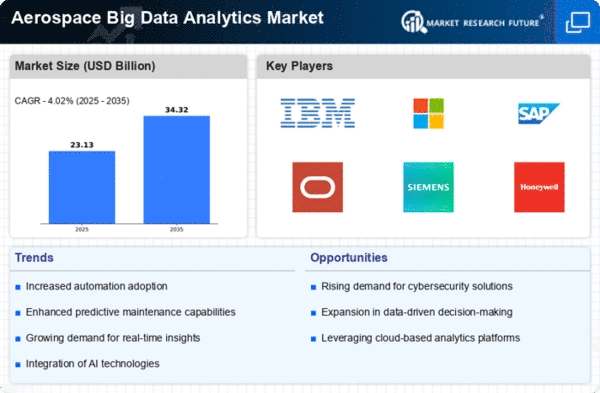

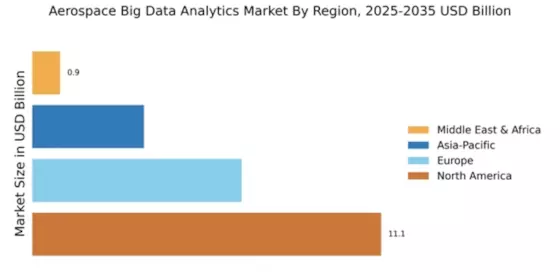

The Global Big Data Analytics in Aerospace and Defense Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 19.8 USD Billion in 2024, with a robust growth trajectory leading to an estimated 29.5 USD Billion by 2035. This growth is underpinned by a CAGR of 3.7% from 2025 to 2035, reflecting the increasing adoption of data analytics solutions across the aerospace and defense sectors. The expansion of this market is indicative of the broader trend towards data-driven decision-making and the integration of advanced technologies in defense operations.

Focus on Operational Efficiency

A strong focus on operational efficiency is a key driver in the Global Big Data Analytics in Aerospace and Defense Industry. Organizations are increasingly recognizing the importance of optimizing their operations to reduce costs and improve performance. Big data analytics provides insights that can streamline processes, enhance resource allocation, and improve overall productivity. For example, analytics can identify inefficiencies in supply chains, leading to better inventory management and reduced operational costs. As organizations strive for greater efficiency, the demand for big data analytics solutions is expected to rise, further propelling market growth.

Integration of IoT and Big Data

The integration of Internet of Things (IoT) technologies with big data analytics is transforming the Global Big Data Analytics in Aerospace and Defense Industry. IoT devices generate vast amounts of data from various sources, including aircraft sensors and defense systems. This data, when analyzed, provides actionable insights that can enhance operational efficiency and safety. For example, real-time monitoring of aircraft systems can lead to proactive maintenance, reducing costs and improving safety. The synergy between IoT and big data analytics is expected to drive market growth, as organizations seek to harness the potential of connected devices.

Regulatory Compliance and Security

Regulatory compliance and security concerns are pivotal drivers in the Global Big Data Analytics in Aerospace and Defense Industry. Governments and defense organizations are mandated to adhere to stringent regulations regarding data management and security. Big data analytics solutions help organizations ensure compliance by providing tools for data governance, risk management, and security analytics. For instance, analytics can identify vulnerabilities in defense systems, enabling timely interventions. As the market evolves, the emphasis on compliance and security will likely propel the adoption of big data analytics solutions, ensuring that organizations can meet regulatory requirements effectively.

Increasing Demand for Advanced Analytics

The Global Big Data Analytics in Aerospace and Defense Industry experiences a notable surge in demand for advanced analytics solutions. This demand is driven by the need for enhanced decision-making capabilities and operational efficiency. Organizations are increasingly leveraging data analytics to optimize maintenance schedules, improve supply chain management, and enhance mission planning. For instance, predictive analytics can reduce aircraft downtime, thereby improving fleet availability. As a result, the market is projected to reach 19.8 USD Billion in 2024, reflecting a growing recognition of the value of data-driven insights in aerospace and defense operations.

Growing Investment in Defense Technologies

The Global Big Data Analytics in Aerospace and Defense Industry is witnessing a surge in investment in advanced defense technologies. Governments worldwide are allocating substantial budgets to enhance their defense capabilities, which includes the adoption of big data analytics. This investment is driven by the need for improved situational awareness, threat detection, and operational effectiveness. The market is projected to grow at a CAGR of 3.7% from 2025 to 2035, reaching 29.5 USD Billion by 2035. Such investments are likely to foster innovation in analytics solutions, enabling defense organizations to leverage data for strategic advantages.