Enhanced Operational Efficiency

The Big Data Analytics In Manufacturing Market is witnessing a surge in demand for enhanced operational efficiency. Manufacturers are increasingly leveraging big data analytics to optimize production processes, reduce waste, and improve resource allocation. By analyzing vast amounts of data from various sources, including machinery and supply chains, companies can identify inefficiencies and implement corrective measures. This trend is supported by a report indicating that organizations utilizing big data analytics can achieve up to a 20% reduction in operational costs. As manufacturers strive for leaner operations, the integration of big data analytics becomes essential for maintaining competitiveness in a rapidly evolving market.

Growing Demand for Customization

The growing demand for customization in the Big Data Analytics In Manufacturing Market is reshaping production strategies. Consumers are increasingly seeking personalized products, prompting manufacturers to adopt flexible production systems. Big data analytics facilitates this shift by enabling manufacturers to analyze consumer preferences and trends, allowing for tailored offerings. Reports indicate that companies that utilize big data analytics for customization can increase customer satisfaction by up to 25%. This trend not only enhances customer loyalty but also drives revenue growth, as manufacturers can respond more effectively to individual consumer needs.

Integration of Advanced Technologies

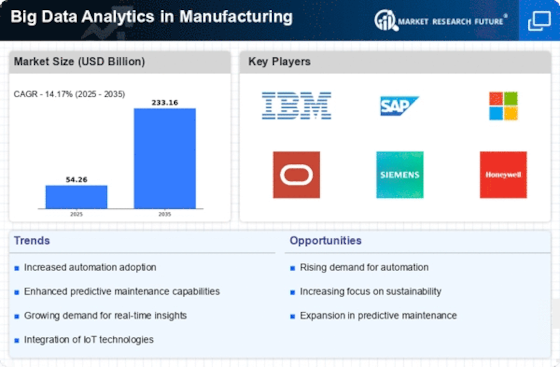

The integration of advanced technologies is a pivotal driver in the Big Data Analytics In Manufacturing Market. Technologies such as artificial intelligence, machine learning, and the Internet of Things are increasingly being combined with big data analytics to create smarter manufacturing environments. This convergence allows for predictive maintenance, quality control, and enhanced supply chain management. For instance, predictive analytics can reduce equipment downtime by up to 50%, significantly impacting productivity. As manufacturers adopt these advanced technologies, the demand for big data analytics solutions is expected to rise, further transforming the landscape of the manufacturing sector.

Improved Decision-Making Capabilities

In the Big Data Analytics In Manufacturing Market, improved decision-making capabilities are emerging as a critical driver. The ability to analyze real-time data allows manufacturers to make informed decisions swiftly, thereby enhancing responsiveness to market changes. Data-driven insights enable companies to forecast demand accurately, manage inventory effectively, and streamline production schedules. A study suggests that organizations employing big data analytics can improve their decision-making speed by up to 30%. This capability not only fosters agility but also positions manufacturers to capitalize on emerging opportunities, ultimately driving growth and innovation within the industry.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are becoming increasingly important in the Big Data Analytics In Manufacturing Market. As regulations surrounding data privacy and security tighten, manufacturers are compelled to adopt robust analytics solutions to ensure compliance. Big data analytics aids in identifying potential risks and ensuring adherence to industry standards. A significant portion of manufacturers, approximately 60%, report that implementing big data analytics has improved their compliance efforts. This focus on regulatory adherence not only mitigates risks but also enhances the overall reputation of manufacturers in the marketplace.