Health and Wellness Trends

The beverage dispenser Market is significantly influenced by the rising health and wellness trends among consumers. As individuals become more health-conscious, there is a growing preference for beverages that align with healthier lifestyles. This shift has led to an increased demand for dispensers that offer fresh juices, flavored waters, and low-calorie options. Market data suggests that the health-focused beverage segment is expected to grow by approximately 6% over the next five years. Consequently, beverage dispensers that cater to this demand are likely to thrive, as they provide an efficient means for consumers to access healthier drink choices, thereby driving growth in the Beverage Dispenser Market.

Technological Advancements

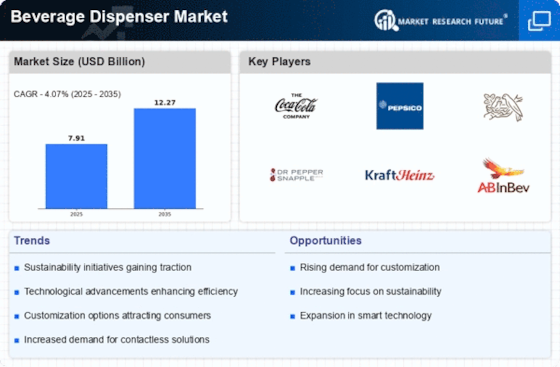

Technological advancements play a pivotal role in shaping the Beverage Dispenser Market. The integration of smart technology into beverage dispensers enhances user experience and operational efficiency. Features such as touchless dispensing, mobile app connectivity, and real-time inventory tracking are becoming increasingly prevalent. These innovations not only improve hygiene standards but also streamline the ordering process, appealing to tech-savvy consumers. Market analysis indicates that the smart beverage dispenser segment is anticipated to witness a compound annual growth rate of 8% over the next few years. This technological evolution is likely to attract new customers and retain existing ones, thereby propelling the Beverage Dispenser Market forward.

Rising Demand for Convenience

The Beverage Dispenser Market experiences a notable surge in demand for convenience-driven solutions. As consumers increasingly seek quick and easy access to beverages, the popularity of beverage dispensers in various settings, such as restaurants, cafes, and events, continues to grow. This trend is supported by data indicating that the foodservice sector is projected to expand, with an estimated growth rate of 4.5% annually. Beverage dispensers offer a streamlined service model, allowing establishments to serve multiple drink options efficiently. This convenience not only enhances customer satisfaction but also optimizes operational efficiency, making it a compelling driver for the Beverage Dispenser Market.

Expansion of Foodservice Outlets

The expansion of foodservice outlets is a critical driver for the Beverage Dispenser Market. As new restaurants, cafes, and food trucks emerge, the demand for efficient beverage dispensing solutions rises correspondingly. This trend is supported by data showing that the number of foodservice establishments has increased by approximately 3% annually. Beverage dispensers are essential in these settings, providing a cost-effective and space-efficient way to serve a variety of drinks. The proliferation of foodservice outlets not only creates opportunities for beverage dispenser manufacturers but also enhances competition, leading to innovation and improved product offerings within the Beverage Dispenser Market.

Sustainability and Eco-Friendly Practices

Sustainability and eco-friendly practices are increasingly influencing the Beverage Dispenser Market. As consumers become more environmentally conscious, there is a growing demand for dispensers that minimize waste and promote sustainable practices. This includes the use of recyclable materials and the reduction of single-use plastics. Market data indicates that the eco-friendly beverage segment is projected to grow by 5% annually, reflecting a shift in consumer preferences. Beverage dispensers that align with these sustainability goals not only attract environmentally aware customers but also enhance brand reputation. This alignment with eco-friendly practices is likely to be a significant driver for growth in the Beverage Dispenser Market.