Benelux Smart Transformers Market Summary

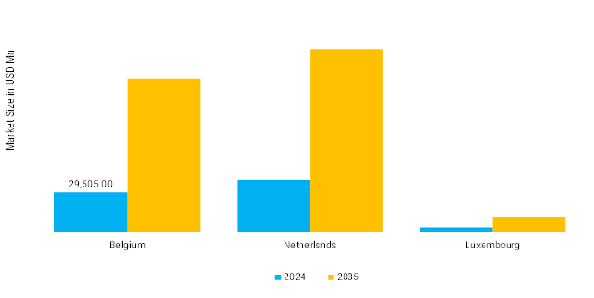

As per Market Research Future analysis, the Benelux Smart Transformers Market Size was estimated at USD 71,655.0 Million in 2024. The Benelux Smart Transformers industry is projected to grow from USD 71,745.2 Million in 2025 to 72,654.4 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 12.6% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Benelux Smart Transformers Market is experiencing robust growth driven by Rising incidence of the Benelux smart transformers segment, as it is typically aggregated into European or Western European analyses.

- The Benelux region, particularly the Netherlands with its offshore wind leadership and Belgium's growing solar capacity, is driving demand for smart transformers to manage variable renewable inputs, stabilize voltage, and optimize power flow in increasingly decentralized grids.

- Grid Modernization and Digitalization have heavy investments in smart grid infrastructure, including IoT-enabled monitoring and real-time analytics, are replacing aging assets.

- Rising Demand from EV Charging Infrastructure rapid expansion of electric vehicle networks across Benelux requires smart transformers for efficient load management, peak shaving, and high-capacity charging support, aligning with regional electrification goals.

- Focus on Energy Efficiency and Regulatory Compliance strict EU energy-efficiency regulations and eco-design standards are pushing adoption of advanced smart transformers with features like predictive maintenance, reduced losses, and biodegradable materials to meet decarbonization targets.

- Enhanced Grid Resilience and Interconnectivity increasing cross-border interconnections and emphasis on bidirectional power flows are boosting smart transformer deployment for better outage prevention, flexibility, and integration with neighbouring European grids.

Market Size & Forecast

| 2024 Market Size | 71,655.0 (USD Million) |

| 2035 Market Size | 72,654.4 (USD Million) |

| CAGR (2025 - 2035) | 12.6% |

Major Players

THERMO Fisher Scientific Inc, Qiagen, Merck KGAA, Sartorius Ag, F. Hoffmann-La Roche Ltd., and Agilent Technologies Inc.