Growing Renewable Energy Sector

The growing renewable energy sector is a significant driver for the Battery Electrolyte Market. As the world shifts towards cleaner energy sources, the demand for energy storage solutions has surged. Battery systems are essential for storing energy generated from renewable sources such as solar and wind. In 2025, the energy storage market is projected to reach USD 20 billion, with a substantial portion attributed to battery electrolytes. This trend underscores the necessity for efficient and durable electrolytes that can support the increasing capacity and performance requirements of energy storage systems. The Battery Electrolyte Market is thus positioned to benefit from the expansion of renewable energy initiatives, as these systems require advanced battery technologies to ensure reliability and efficiency.

Rising Demand for Electric Vehicles

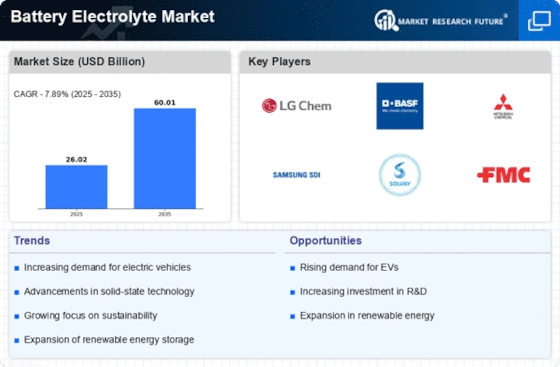

The increasing demand for electric vehicles (EVs) is a primary driver of the Battery Electrolyte Market. As consumers and manufacturers alike prioritize sustainability and reduced carbon footprints, the shift towards EVs has accelerated. In 2025, the number of electric vehicles on the road is projected to surpass 30 million units, significantly boosting the need for efficient battery systems. This surge in EV adoption necessitates advanced battery electrolytes that enhance performance and longevity. Consequently, manufacturers are investing in research and development to create electrolytes that can withstand higher voltages and temperatures, thereby improving overall battery efficiency. The Battery Electrolyte Market is thus poised for substantial growth as it aligns with the automotive sector's transition towards electrification.

Regulatory Support for Clean Energy Initiatives

Regulatory support for clean energy initiatives is fostering growth in the Battery Electrolyte Market. Governments worldwide are implementing policies and incentives to promote the adoption of electric vehicles and renewable energy solutions. For example, tax credits and subsidies for EV purchases are encouraging consumers to transition to electric mobility. Additionally, regulations mandating reductions in greenhouse gas emissions are driving manufacturers to invest in cleaner technologies, including advanced battery systems. This supportive regulatory environment is expected to propel the Battery Electrolyte Market forward, as companies seek to comply with new standards and capitalize on emerging opportunities in the clean energy landscape.

Technological Advancements in Battery Chemistry

Technological advancements in battery chemistry are reshaping the Battery Electrolyte Market. Innovations such as lithium-sulfur and solid-state batteries are gaining traction due to their potential to offer higher energy densities and improved safety profiles. For instance, solid-state batteries, which utilize solid electrolytes instead of liquid ones, are expected to enhance battery performance significantly. The market for solid-state batteries is anticipated to reach USD 1.5 billion by 2026, indicating a robust growth trajectory. These advancements not only promise to extend battery life but also reduce the risk of leakage and thermal runaway, which are critical concerns in battery safety. As a result, the Battery Electrolyte Market is likely to witness increased investments in research and development to harness these emerging technologies.

Increased Investment in Energy Storage Solutions

Increased investment in energy storage solutions is a crucial driver of the Battery Electrolyte Market. As industries and consumers recognize the importance of energy storage for grid stability and efficiency, funding for battery technologies has surged. In 2025, investments in energy storage are projected to exceed USD 10 billion, reflecting a growing commitment to enhancing energy infrastructure. This influx of capital is likely to accelerate the development of innovative battery electrolytes that can meet the demands of various applications, from residential energy storage to large-scale grid solutions. The Battery Electrolyte Market stands to gain significantly from this trend, as advancements in energy storage technologies necessitate the development of high-performance electrolytes.