Growing Consumer Electronics Market

The consumer electronics sector is a significant driver of the Lithium-ion Battery Electrolyte Solvent Market. With the proliferation of smartphones, laptops, and wearable devices, the demand for efficient and compact lithium-ion batteries continues to rise. In 2025, the consumer electronics market is projected to witness substantial growth, with millions of devices requiring advanced battery solutions. This trend emphasizes the need for high-quality electrolyte solvents that can enhance battery performance and safety. As manufacturers seek to meet consumer expectations for longer battery life and faster charging times, the Lithium-ion Battery Electrolyte Solvent Market is likely to experience increased demand for innovative electrolyte formulations.

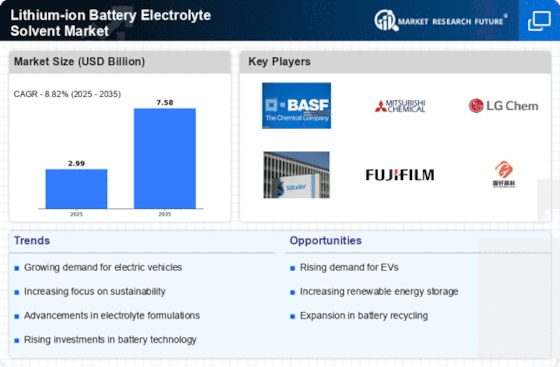

Rising Demand for Electric Vehicles

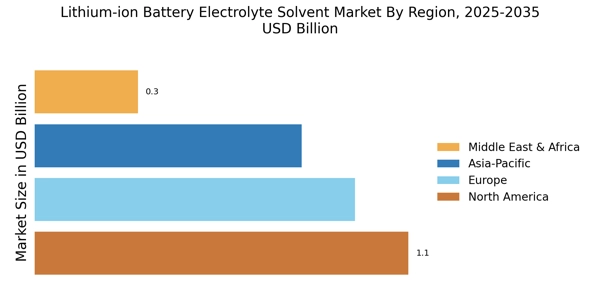

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium-ion Battery Electrolyte Solvent Market. As consumers and manufacturers shift towards sustainable transportation solutions, the demand for high-performance lithium-ion batteries surges. In 2025, the EV market is projected to grow significantly, with estimates suggesting that over 30 million units could be sold worldwide. This growth directly correlates with the need for advanced electrolyte solvents that enhance battery efficiency and longevity. Consequently, manufacturers are investing in research and development to create innovative electrolyte formulations that meet the evolving requirements of the automotive sector. The Lithium-ion Battery Electrolyte Solvent Market is thus positioned to benefit from this trend, as the demand for reliable and efficient battery components continues to rise.

Technological Innovations in Battery Chemistry

Technological advancements in battery chemistry are significantly influencing the Lithium-ion Battery Electrolyte Solvent Market. Innovations such as the development of solid-state batteries and new electrolyte formulations are enhancing battery safety, energy density, and charging speed. In 2025, the market for solid-state batteries is anticipated to expand, driven by their potential to outperform traditional lithium-ion batteries. These advancements necessitate the formulation of specialized electrolyte solvents that can accommodate new battery architectures. As manufacturers strive to improve battery performance, the demand for cutting-edge electrolyte solutions is likely to increase, positioning the Lithium-ion Battery Electrolyte Solvent Market at the forefront of this technological evolution.

Expansion of Renewable Energy Storage Solutions

The transition towards renewable energy sources, such as solar and wind, necessitates efficient energy storage solutions, thereby driving the Lithium-ion Battery Electrolyte Solvent Market. As energy generation becomes more decentralized, the need for reliable storage systems to manage supply and demand fluctuations increases. Lithium-ion batteries are favored for their high energy density and efficiency, making them ideal for storing renewable energy. In 2025, the market for energy storage systems is expected to reach substantial figures, with lithium-ion batteries accounting for a significant share. This trend indicates a growing reliance on advanced electrolyte solvents that can enhance battery performance and lifespan, further propelling the Lithium-ion Battery Electrolyte Solvent Market forward.

Regulatory Support for Clean Energy Technologies

Regulatory frameworks promoting clean energy technologies are fostering growth in the Lithium-ion Battery Electrolyte Solvent Market. Governments worldwide are implementing policies aimed at reducing carbon emissions and encouraging the adoption of renewable energy sources. These regulations often include incentives for electric vehicle production and renewable energy storage solutions, which in turn drive the demand for lithium-ion batteries. In 2025, it is expected that more stringent regulations will be enacted, further supporting the transition to cleaner energy technologies. This regulatory environment creates a favorable landscape for the Lithium-ion Battery Electrolyte Solvent Market, as manufacturers align their products with compliance standards and sustainability goals.