Research Methodology on Bariatric Surgery Devices Market

Introduction

This research report focuses on a comprehensive research methodology to investigate the Bariatric Surgery Devices Market. Bariatric surgery, also known as weight loss surgery, is a procedure that helps patients with obesity to lose weight by making changes to their digestive system to reduce the amount of food intake, control appetite and even change the absorption of nutrients into the body.

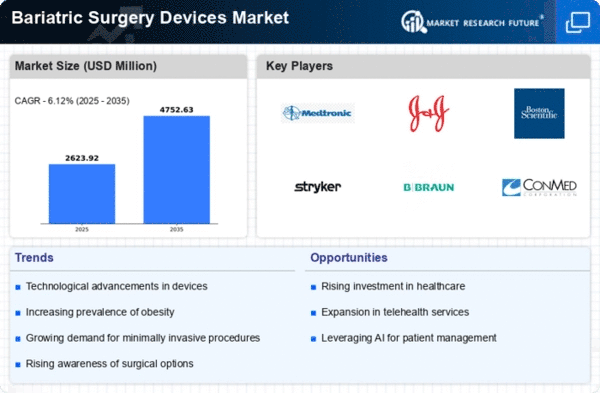

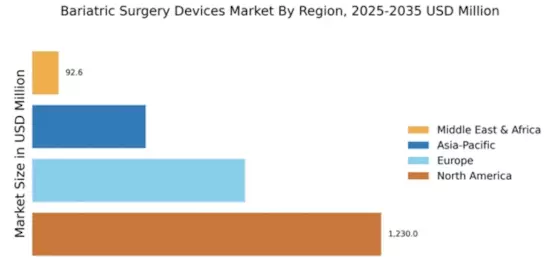

This market for Bariatric Surgery Devices is expected to grow significantly in the upcoming future due to the increasing incidence of obesity and its prevalence in society. The report provided by Market Research Future (MRFR) provides detailed information about the market and its various segments. The research reported by MRFR is used as the basis of this research methodology.

Research Question

To analyze and forecast the Bariatric Surgery Devices Market, what are the key factors that need to be taken into consideration?

Research Objectives

The main objective of this research is to analyze and forecast the Bariatric Surgery Devices Market and its various segments. This research aims to provide an in-depth understanding of the market in terms of market size, drivers, barriers, opportunities, and revenue forecasts.

Research Design

The research design that is used to investigate the Bariatric Surgery Devices Market is the exploratory research design. The exploratory research design allows for a deep analysis of the market, its various segments and the various factors that influence it. This research design also allows for the collection of data from secondary sources as well as primary sources. This includes interviews with key industry players and stakeholders and quantitative data analysis.

Data Sources

The data for this research is obtained from both primary and secondary sources. Primary sources include interviews with key industry players such as manufacturers, suppliers, vendors, and distributors. This allows for an understanding of the market dynamics and insights into the various factors that influence the market. Secondary sources include databases such as the Center for Disease Control and Prevention (CDC) and World Health Organization (WHO), publications by leading research organizations, project reports by industry bodies, and articles published in related journals.

Sampling

The research uses a combination of purposive and convenience sampling methods to acquire data from primary sources. The purposive sampling method is used to select the key stakeholders that will provide key insights into the dynamics of the Bariatric Surgery Devices Market. The convenience sampling method is used to select the respondents to partake in the interviews.

Data Collection Tools

The main tool that is used to collect data is the interview. The interviews are conducted via video-conferencing and telephone interviews to ensure the safety and security of the respondents. Interview questions are used to solicit insights from the respondents, and the interviews are recorded and transcribed for further analysis.

Data Analysis

The data collected from the interviews are analyzed using both qualitative and quantitative analysis techniques. Qualitative analysis involves the use of tools such as open coding and content analysis to identify patterns and themes in the data. The quantitative analysis involves the use of descriptive and inferential statistical tools.

Conclusion

This research methodology is created to analyze and forecast the Bariatric Surgery Devices Market. The methodology aims to provide an in-depth understanding of the market and its various segments in terms of market size, drivers, barriers, and opportunities. The exploratory research design is used to collect data from both primary and secondary sources. The data is analyzed using qualitative and quantitative analysis techniques.