Growing Demand for Financial Inclusion

The Banking Wearable Market is also being propelled by a growing demand for financial inclusion. As more individuals in underserved regions seek access to banking services, wearables offer a convenient solution. These devices can facilitate transactions, provide account information, and enable users to manage their finances without the need for traditional banking infrastructure. Recent statistics suggest that nearly 1.7 billion adults remain unbanked, highlighting a significant opportunity for wearable technology to bridge this gap. By offering affordable and accessible banking solutions, the Banking Wearable Market could play a pivotal role in promoting financial literacy and inclusion, thereby expanding its consumer base.

Shift Towards Contactless Transactions

The Banking Wearable Market is witnessing a notable shift towards contactless transactions. As consumers increasingly prefer seamless payment experiences, wearables equipped with NFC technology are becoming essential tools for everyday transactions. Data indicates that contactless payments are expected to account for over 30% of total payment transactions by 2025. This trend is particularly appealing to younger demographics who prioritize convenience and speed. Consequently, the Banking Wearable Market is likely to benefit from this shift, as financial institutions and technology providers collaborate to enhance the functionality of wearables, making them integral to modern payment ecosystems.

Increased Focus on Personal Finance Management

The Banking Wearable Market is benefiting from an increased focus on personal finance management. Consumers are becoming more proactive in managing their finances, seeking tools that provide real-time insights and budgeting capabilities. Wearable devices that integrate financial management applications can help users track spending, set savings goals, and receive alerts for unusual transactions. Recent surveys indicate that over 60% of consumers express interest in using wearables for financial management purposes. This growing interest presents a significant opportunity for the Banking Wearable Market to develop innovative solutions that cater to the evolving needs of consumers, ultimately enhancing user engagement and satisfaction.

Technological Advancements in Wearable Devices

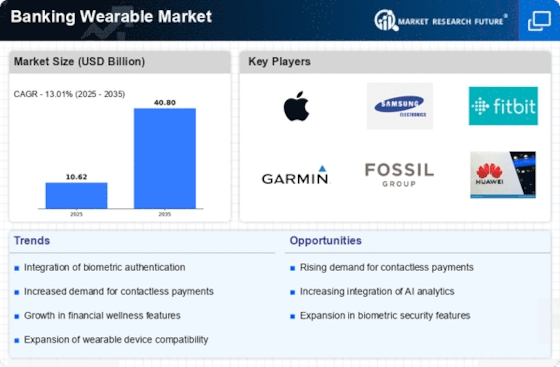

The Banking Wearable Market is experiencing a surge due to rapid technological advancements in wearable devices. Innovations in sensors, battery life, and connectivity are enhancing the functionality of wearables, making them more appealing to consumers. For instance, the integration of biometric authentication features, such as fingerprint and facial recognition, is increasing security and user trust. According to recent data, the wearable technology market is projected to reach a valuation of over 100 billion dollars by 2026, indicating a robust growth trajectory. This growth is likely to drive the adoption of wearables in banking, as consumers seek more secure and efficient ways to manage their finances. As technology continues to evolve, the Banking Wearable Market may see further enhancements that could redefine user experiences.

Rising Health Consciousness and Financial Wellness

The Banking Wearable Market is also influenced by rising health consciousness among consumers. As individuals increasingly prioritize their health and well-being, there is a growing recognition of the link between financial wellness and overall health. Wearable devices that offer health monitoring features, such as heart rate tracking and stress management, can also provide insights into financial habits. For instance, some wearables are now integrating financial wellness programs that encourage users to save for health-related expenses. This convergence of health and finance may create new opportunities for the Banking Wearable Market, as consumers seek holistic solutions that address both their financial and health needs.