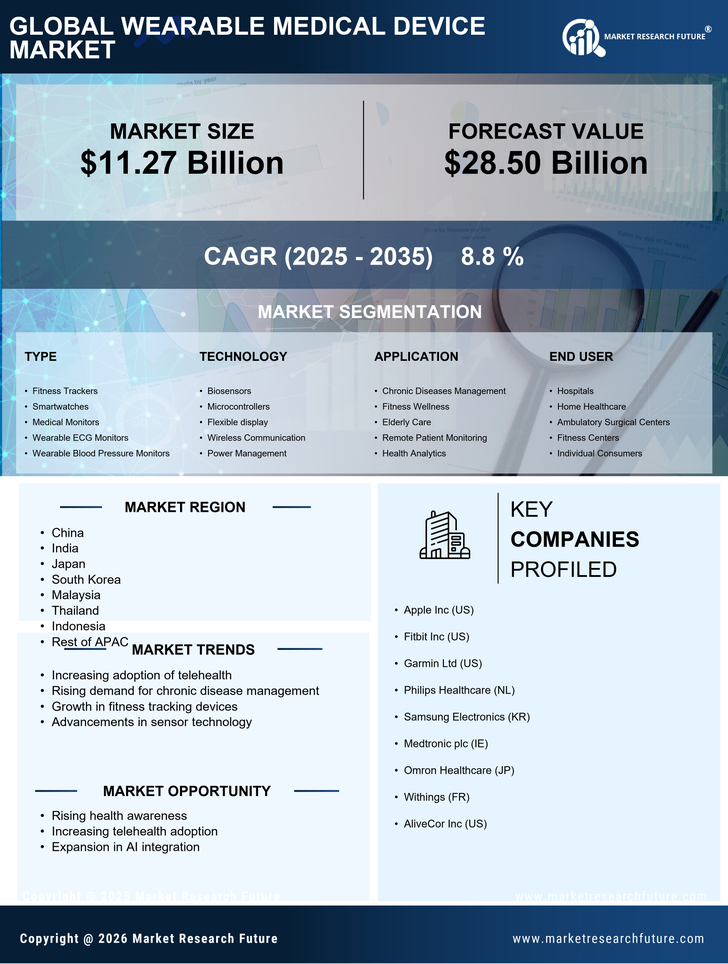

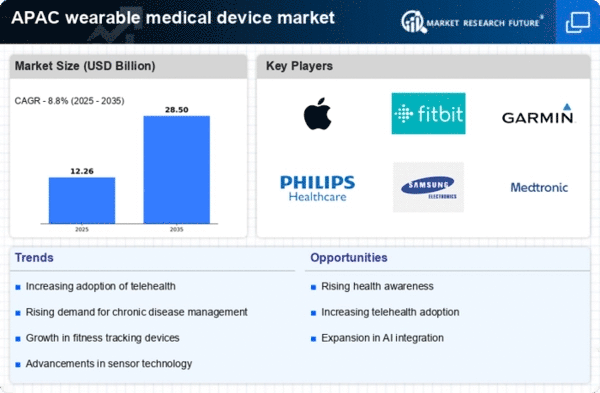

China : Rapid Growth and Innovation Hub

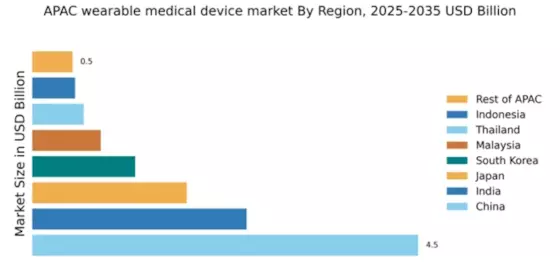

China holds a commanding 4.5% market share in the wearable medical-device sector, driven by a burgeoning healthcare demand and technological advancements. The government's push for digital health initiatives and favorable regulatory policies have catalyzed growth. Urbanization and increased health awareness among consumers are fueling demand, while investments in healthcare infrastructure enhance accessibility and distribution channels.

India : Growing Health Awareness and Adoption

India's wearable medical-device market accounts for 2.5% of the APAC share, reflecting a significant growth trajectory. Key drivers include rising disposable incomes, increasing chronic diseases, and a shift towards preventive healthcare. Government initiatives like Digital India promote health tech adoption, while urban centers see a surge in demand for innovative health solutions.

Japan : Innovation and Quality at Forefront

Japan's market share stands at 1.8%, characterized by a strong emphasis on quality and innovation in wearable medical devices. The aging population drives demand for health monitoring solutions, supported by government policies promoting advanced healthcare technologies. The integration of IoT in medical devices is a notable trend, enhancing user experience and data accuracy.

South Korea : Integration of Technology and Healthcare

South Korea captures 1.2% of the wearable medical-device market, with rapid adoption driven by tech-savvy consumers and robust healthcare infrastructure. Government support for health tech innovation and a focus on preventive care are key growth factors. The competitive landscape features major players like Samsung, which leads in smart health solutions, catering to urban populations.

Malaysia : Health Tech Adoption Accelerating

Malaysia's wearable medical-device market holds a 0.8% share, with growth fueled by increasing health awareness and government initiatives promoting digital health. Urban areas like Kuala Lumpur are key markets, where demand for fitness and health monitoring devices is rising. The competitive landscape includes both local and international players, enhancing product diversity.

Thailand : Rising Demand for Wearable Devices

Thailand's market share is 0.6%, driven by a growing interest in health and wellness among consumers. Government initiatives to promote health technology and improve healthcare access are pivotal. Urban centers like Bangkok are witnessing increased adoption of wearable medical devices, with a competitive landscape featuring both local and global brands.

Indonesia : Emerging Market with Growth Opportunities

Indonesia's wearable medical-device market accounts for 0.5% of the APAC share, with significant growth potential. Key drivers include a young population, increasing health awareness, and government support for health tech initiatives. Urban areas like Jakarta are central to market growth, with a competitive landscape that includes both local startups and established international players.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a 0.47% market share in wearable medical devices, characterized by diverse market dynamics. Growth is driven by varying levels of health awareness and technology adoption across countries. Government initiatives to enhance healthcare access and promote digital health are crucial, though infrastructure challenges persist in some areas.