Increasing Focus on Sustainability

Sustainability has emerged as a critical driver in the Bagging Machine Market. With growing environmental concerns, manufacturers are increasingly seeking eco-friendly packaging solutions that minimize waste and reduce carbon footprints. The demand for biodegradable and recyclable materials is on the rise, prompting bagging machine manufacturers to innovate and adapt their technologies accordingly. In 2025, it is estimated that the market for sustainable bagging solutions will grow by approximately 8%, reflecting a shift towards environmentally responsible practices. This trend is particularly relevant in industries such as agriculture and retail, where sustainable packaging is becoming a key differentiator. Consequently, the Bagging Machine Market is likely to evolve, with a greater emphasis on developing machines that support sustainable practices while maintaining efficiency and performance.

Growth of the Food and Beverage Sector

The Bagging Machine Market is significantly influenced by the growth of the food and beverage sector. As consumer preferences shift towards convenience and ready-to-eat products, manufacturers are compelled to adopt efficient bagging solutions to meet rising demand. In 2025, the food and beverage industry is expected to account for over 40% of the total bagging machine market share. This trend is driven by the need for hygienic and efficient packaging methods that ensure product safety valve and extend shelf life. Additionally, the increasing focus on sustainable packaging solutions further propels the demand for advanced bagging machines that can accommodate eco-friendly materials. As a result, the Bagging Machine Market is likely to witness robust growth, fueled by the evolving dynamics of the food and beverage landscape.

Rising Demand for Efficient Packaging Solutions

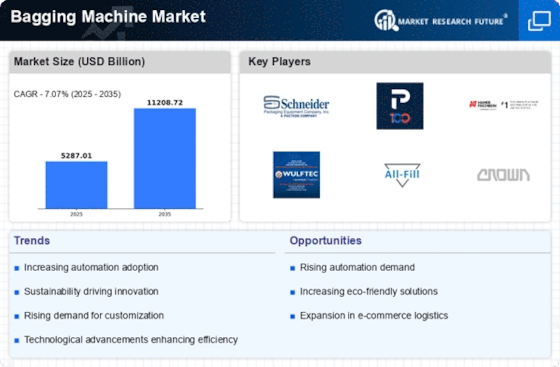

The Bagging Machine Market experiences a notable surge in demand for efficient packaging solutions across various sectors. As industries strive to enhance productivity and reduce operational costs, the adoption of advanced bagging machines becomes increasingly prevalent. In 2025, the market is projected to witness a growth rate of approximately 6.5%, driven by the need for automation in packaging processes. This trend is particularly evident in the food and beverage sector, where the requirement for quick and reliable packaging solutions is paramount. Furthermore, the rise of e-commerce has amplified the necessity for efficient bagging systems, as companies seek to streamline their supply chains and meet consumer expectations for timely deliveries. Consequently, the Bagging Machine Market is poised for substantial growth as businesses prioritize efficiency and speed in their packaging operations.

Technological Advancements in Bagging Machinery

Technological advancements play a pivotal role in shaping the Bagging Machine Market. Innovations such as smart technology integration and automation are revolutionizing the way bagging machines operate. The introduction of features like real-time monitoring, predictive maintenance, and enhanced user interfaces significantly improves operational efficiency. In 2025, it is anticipated that the market will see an increase in the adoption of these advanced technologies, with a projected market value reaching USD 1.2 billion. This growth is largely attributed to manufacturers' efforts to develop machines that not only meet but exceed industry standards. As companies increasingly invest in state-of-the-art bagging solutions, the Bagging Machine Market is likely to evolve, offering more sophisticated and efficient machinery that caters to diverse packaging needs.

Customization and Versatility in Bagging Solutions

Customization and versatility are increasingly recognized as vital components within the Bagging Machine Market. As businesses seek to differentiate their products, the demand for tailored bagging solutions that cater to specific requirements is on the rise. In 2025, it is projected that the market for customizable bagging machines will expand significantly, driven by the need for flexibility in packaging designs and sizes. This trend is particularly evident in sectors such as pharmaceuticals and consumer goods, where unique packaging can enhance brand identity and consumer appeal. Furthermore, the ability to adapt bagging machines for various materials and product types allows manufacturers to optimize their operations. As a result, the Bagging Machine Market is expected to witness a shift towards more versatile and customizable solutions that meet the diverse needs of modern businesses.