Growing Emphasis on Product Protection

The Automotive Poly Bagging Machine Market is witnessing a growing emphasis on product protection. As automotive components become more sophisticated and sensitive, the need for effective packaging solutions that safeguard these products during transit is critical. Poly bagging machines provide a protective barrier against dust, moisture, and physical damage, ensuring that components arrive at their destination in optimal condition. This focus on product integrity is particularly relevant in the context of increasing global competition, where manufacturers cannot afford to compromise on quality. Data suggests that the market for automotive components is expected to reach USD 1 trillion by 2026, indicating a robust demand for packaging solutions that enhance product protection.

Increasing Regulatory Standards for Packaging

The Automotive Poly Bagging Machine Market is also influenced by increasing regulatory standards for packaging. Governments and regulatory bodies are implementing stricter guidelines to ensure that packaging materials are safe, sustainable, and environmentally friendly. This trend is prompting manufacturers to invest in poly bagging machines that comply with these regulations. The shift towards eco-friendly packaging solutions is not only a response to regulatory pressures but also aligns with consumer preferences for sustainable products. As a result, manufacturers are likely to seek poly bagging machines that utilize recyclable materials and minimize environmental impact. This evolving landscape suggests that compliance with regulatory standards will be a key driver for growth in the automotive poly bagging machine market.

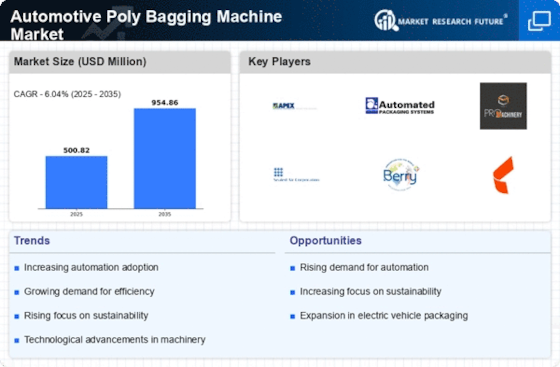

Rising Demand for Efficient Packaging Solutions

The Automotive Poly Bagging Machine Market is experiencing a notable increase in demand for efficient packaging solutions. As automotive manufacturers strive to enhance their operational efficiency, the need for reliable and effective packaging systems becomes paramount. This trend is driven by the necessity to protect automotive components during transportation and storage, thereby reducing damage and waste. According to recent data, the automotive sector is projected to grow at a compound annual growth rate of approximately 4% over the next few years, which may further fuel the demand for advanced poly bagging machines. These machines not only streamline the packaging process but also contribute to cost savings, making them an attractive investment for manufacturers aiming to optimize their supply chain.

Technological Innovations in Packaging Machinery

Technological innovations are playing a pivotal role in shaping the Automotive Poly Bagging Machine Market. The introduction of advanced features such as smart sensors, automation, and real-time monitoring systems is revolutionizing the packaging process. These innovations not only enhance the efficiency of poly bagging machines but also improve the accuracy and consistency of packaging. As manufacturers increasingly adopt Industry 4.0 principles, the integration of smart technologies into packaging machinery is likely to become a standard practice. This shift may lead to a more streamlined production process, reducing waste and improving overall productivity. The market for smart packaging solutions is projected to grow significantly, indicating a strong future for technologically advanced poly bagging machines.

Focus on Cost Reduction and Operational Efficiency

In the Automotive Poly Bagging Machine Market, the emphasis on cost reduction and operational efficiency is increasingly evident. Manufacturers are continuously seeking ways to minimize production costs while maximizing output. The integration of poly bagging machines into the packaging process can significantly reduce labor costs and time, as these machines automate the bagging process. Furthermore, the ability to package multiple components simultaneously enhances productivity. Market analysis indicates that companies adopting automated packaging solutions can achieve up to a 30% reduction in operational costs. This trend suggests that the demand for poly bagging machines will likely continue to rise as manufacturers prioritize efficiency and cost-effectiveness in their operations.