Regulatory Compliance

Stringent regulatory frameworks governing offshore operations are significantly influencing the Global auv rov for offshore irm Market Industry. Governments worldwide are implementing regulations to ensure safety and environmental protection in offshore activities. Compliance with these regulations necessitates regular inspections and maintenance, which AUVs and ROVs are well-equipped to handle. For instance, the International Maritime Organization has established guidelines that mandate the use of advanced technologies for monitoring underwater infrastructure. This regulatory push is likely to enhance the adoption of AUVs and ROVs, thereby contributing to a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035.

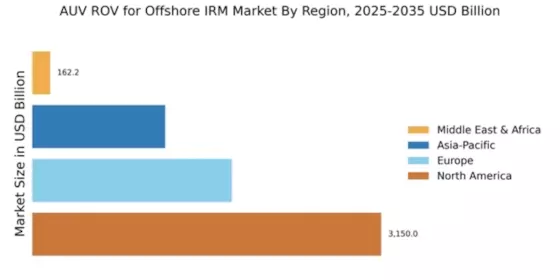

Market Growth Projections

The Global Auv Rov For Offshore Irm Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 6312.2 USD Billion in 2024 and an anticipated increase to 13150.4 USD Billion by 2035, the industry is poised for significant expansion. The compound annual growth rate (CAGR) of 6.9% from 2025 to 2035 reflects the increasing adoption of AUVs and ROVs across various sectors. This growth trajectory indicates a robust demand for advanced underwater technologies, driven by the need for efficient and effective offshore inspection, maintenance, and repair solutions.

Technological Advancements

The Global Auv Rov For Offshore Irm Market Industry is experiencing rapid technological advancements that enhance operational efficiency and safety. Innovations in autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) are enabling more precise inspections and data collection. For instance, the integration of artificial intelligence and machine learning algorithms allows for real-time data analysis, improving decision-making processes. As a result, companies are increasingly adopting these technologies, contributing to a projected market value of 6312.2 USD Billion in 2024. This trend suggests a growing reliance on advanced technologies to meet the demands of offshore infrastructure management.

Increasing Offshore Activities

The Global Auv Rov For Offshore Irm Market Industry is driven by the increasing number of offshore activities, particularly in oil and gas exploration and renewable energy sectors. As countries seek to harness marine resources, the demand for AUVs and ROVs for inspection, maintenance, and repair (IRM) services is on the rise. For example, offshore wind farms require regular monitoring and maintenance, which AUVs and ROVs can efficiently provide. This surge in offshore projects is expected to propel the market to a valuation of 13150.4 USD Billion by 2035, indicating a robust growth trajectory fueled by expanding offshore operations.

Growing Demand for Data Analytics

The Global Auv Rov For Offshore Irm Market Industry is witnessing a growing demand for data analytics in offshore operations. Companies are increasingly recognizing the value of data collected by AUVs and ROVs for optimizing maintenance schedules and improving operational efficiency. Advanced data analytics tools enable organizations to interpret vast amounts of underwater data, leading to informed decision-making. For example, predictive analytics can forecast potential equipment failures, allowing for proactive maintenance. This trend underscores the importance of integrating data analytics into offshore IRM strategies, further driving the market's growth as organizations seek to leverage data for competitive advantage.

Environmental Sustainability Initiatives

The Global Auv Rov For Offshore Irm Market Industry is also influenced by the increasing emphasis on environmental sustainability. As global awareness of environmental issues rises, companies are adopting sustainable practices in their offshore operations. AUVs and ROVs play a crucial role in monitoring environmental impacts and ensuring compliance with sustainability standards. For instance, these vehicles can assess the health of marine ecosystems and detect pollution levels, contributing to more responsible offshore practices. This shift towards sustainability is likely to enhance the demand for AUVs and ROVs, aligning with global efforts to minimize ecological footprints in offshore activities.