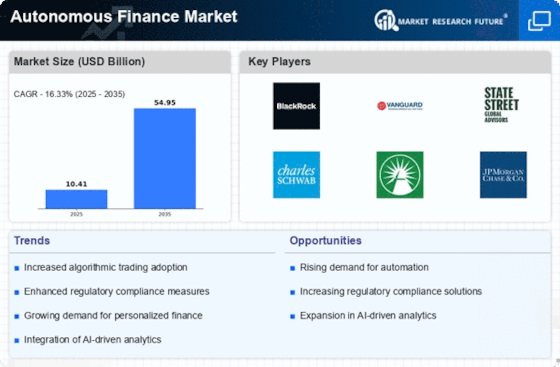

Increased Demand for Automation

The Autonomous Finance Market is experiencing a surge in demand for automation solutions. As financial institutions seek to enhance operational efficiency, the adoption of automated systems is becoming prevalent. According to recent data, the automation of financial processes can reduce operational costs by up to 30%. This trend is driven by the need for faster transaction processing and improved accuracy in financial reporting. Furthermore, the integration of machine learning algorithms allows for real-time data analysis, which is crucial for decision-making. As a result, financial organizations are increasingly investing in automated solutions, thereby propelling the growth of the Autonomous Finance Market.

Rise of Digital Payment Solutions

The proliferation of digital payment solutions is a key factor influencing the Autonomous Finance Market. As consumers increasingly prefer cashless transactions, financial institutions are compelled to innovate their payment systems. Data indicates that digital payment transactions are projected to surpass traditional payment methods significantly in the coming years. This shift is driven by the convenience and speed offered by digital solutions, which enhance customer experiences. Moreover, the integration of autonomous finance technologies into payment systems allows for seamless transactions and improved security measures. Consequently, the Autonomous Finance Market is likely to expand as more entities adopt digital payment innovations.

Regulatory Developments and Compliance

The evolving regulatory landscape is a critical driver of the Autonomous Finance Market. Governments and regulatory bodies are increasingly focusing on establishing frameworks that govern the use of autonomous financial technologies. Compliance with these regulations is essential for financial institutions to operate effectively. Recent initiatives have aimed at enhancing consumer protection and ensuring the integrity of financial markets. As regulations become more defined, organizations are investing in compliance technologies to navigate these complexities. This trend not only fosters trust among consumers but also stimulates growth within the Autonomous Finance Market as firms seek to align with regulatory expectations.

Advancements in Artificial Intelligence

The Autonomous Finance Market is significantly influenced by advancements in artificial intelligence (AI). AI technologies, such as natural language processing and predictive analytics, are transforming how financial services are delivered. These innovations enable institutions to offer personalized financial advice and enhance customer experiences. Recent studies indicate that AI can improve customer satisfaction rates by over 20%. Additionally, AI-driven risk assessment tools are becoming essential for identifying potential fraud and managing financial risks. As financial entities continue to leverage AI capabilities, the Autonomous Finance Market is poised for substantial growth, reflecting the increasing reliance on intelligent systems.

Growing Interest in Decentralized Finance

The rise of decentralized finance (DeFi) is reshaping the Autonomous Finance Market. DeFi platforms, which operate without traditional intermediaries, are gaining traction among consumers seeking greater control over their financial assets. Data suggests that the total value locked in DeFi protocols has reached unprecedented levels, indicating a shift in consumer preferences. This trend is further fueled by the desire for transparency and lower transaction fees associated with DeFi solutions. As more users engage with decentralized platforms, traditional financial institutions are compelled to adapt, thereby driving innovation within the Autonomous Finance Market.