Labor Shortages and Skill Gaps

The Autonomous Construction Equipment Market is significantly influenced by ongoing labor shortages and skill gaps in the construction workforce. As the industry faces challenges in attracting skilled labor, the adoption of autonomous equipment becomes a viable solution to mitigate these issues. By utilizing autonomous machinery, construction firms can maintain productivity levels despite a reduced workforce. This trend is particularly evident in regions where the construction labor pool is shrinking, prompting companies to invest in technology that compensates for the lack of available skilled workers. The reliance on autonomous equipment is likely to increase as firms seek to address these labor challenges.

Increased Demand for Automation

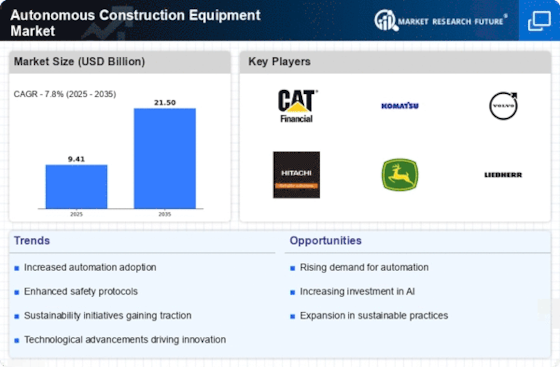

The Autonomous Construction Equipment Market is experiencing a surge in demand for automation across various construction sectors. This trend is driven by the need for enhanced efficiency and productivity on job sites. As construction projects become more complex, the integration of autonomous equipment allows for streamlined operations, reducing the time and labor costs associated with traditional methods. Reports indicate that the market for autonomous construction equipment is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is indicative of a broader shift towards automation, as companies seek to leverage technology to improve project outcomes and minimize human error.

Regulatory Support and Safety Standards

The Autonomous Construction Equipment Market is benefiting from an evolving regulatory landscape that increasingly supports the use of autonomous technologies. Governments and regulatory bodies are recognizing the potential of autonomous equipment to enhance safety and efficiency on construction sites. New safety standards and guidelines are being developed to facilitate the integration of these technologies, which may lead to greater acceptance and adoption within the industry. As regulations become more favorable, construction companies are likely to invest in autonomous solutions, further driving market growth. This regulatory support is crucial for fostering innovation and ensuring that safety remains a priority in the deployment of autonomous construction equipment.

Technological Innovations and Connectivity

The Autonomous Construction Equipment Market is propelled by rapid technological innovations, particularly in connectivity and data analytics. Advances in Internet of Things (IoT) technology enable autonomous equipment to communicate in real-time, enhancing operational efficiency and decision-making processes. The integration of artificial intelligence and machine learning algorithms allows for predictive maintenance and improved performance monitoring. As these technologies continue to evolve, they are expected to play a pivotal role in shaping the future of construction. The ability to collect and analyze data from autonomous equipment not only optimizes performance but also provides valuable insights for project management, thereby driving further adoption in the industry.

Sustainability and Environmental Considerations

The Autonomous Construction Equipment Market is increasingly aligned with sustainability and environmental considerations. As construction companies face pressure to reduce their carbon footprint, autonomous equipment offers a pathway to more sustainable practices. These machines are often designed to be more fuel-efficient and can optimize resource usage, leading to less waste and lower emissions. Furthermore, the ability to operate autonomously can reduce the need for multiple machines on-site, thereby minimizing environmental impact. As sustainability becomes a core focus for the construction industry, the demand for autonomous solutions that support eco-friendly practices is likely to rise, driving growth in the market.