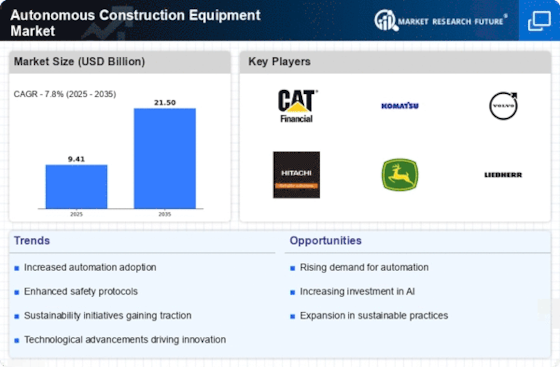

Top Industry Leaders in the Autonomous Construction Equipment Market

The construction industry, long known for its reliance on manual labor and heavy machinery, is experiencing a seismic shift. Autonomous construction equipment (ACE) is on the rise, promising increased efficiency, improved safety, and a revolution in how we build. But within this nascent market, the battle for dominance is already in full swing, with established players, technology giants, and nimble startups vying for market share.

The construction industry, long known for its reliance on manual labor and heavy machinery, is experiencing a seismic shift. Autonomous construction equipment (ACE) is on the rise, promising increased efficiency, improved safety, and a revolution in how we build. But within this nascent market, the battle for dominance is already in full swing, with established players, technology giants, and nimble startups vying for market share.

Strategies Shaping the Autonomous Construction Landscape:

-

Partnerships and Acquisitions: Recognizing the need for diverse expertise, established construction companies like Caterpillar and Volvo are partnering with tech giants like Nvidia and Google to develop and integrate autonomous technologies into their equipment. Acquisitions, like Volvo's recent purchase of autonomous hauler developer Robex, are also accelerating market presence. -

Vertical Specialization: Companies are focusing on specific applications, from autonomous excavators for earthmoving by Komatsu to aerial drones for surveying by DJI. This targeted approach caters to unique industry needs and builds brand recognition within specific niches. -

Software and Data Dominance: Recognizing the importance of software and data in controlling these intelligent machines, companies like Trimble and Bentley Systems are investing heavily in developing proprietary software platforms and cloud-based data analytics solutions. This creates a sticky ecosystem, locking customers into their technology stack. -

Pilot Programs and Demonstrations: To showcase the benefits of ACE and build trust among skeptical stakeholders, companies are actively engaging in pilot programs and demonstrations on real-world construction sites. This hands-on experience helps overcome adoption hurdles and generates valuable data for further development.

Factors Influencing Market Share:

-

Technological Innovation: Companies at the forefront of developing advanced sensors, AI algorithms, and machine learning capabilities will possess a significant advantage. The ability to navigate complex environments and make real-time decisions will be crucial. -

Safety and Efficiency: ACE promises to reduce workplace accidents and enhance operational efficiency, leading to cost savings and shorter project timelines. Companies that can demonstrably improve these metrics will stand out. -

Regulations and Legal Framework: The legal landscape surrounding ACE is still evolving, with uncertainties regarding liability and insurance coverage. Companies that actively engage in shaping regulations and building trust with governments and insurers will be better positioned. -

Affordability and ROI: Despite the long-term benefits, the upfront cost of ACE remains a barrier for many smaller construction companies. Offering flexible financing options and demonstrating a clear return on investment will be crucial for wider adoption.

Key Players

- Volvo Construction Equipment

- Caterpillar Inc.

- Komatsu Ltd.

- Built Robotics Inc.

- Hitachi Construction Machinery Co. Ltd.

- Case Construction Equipment

- Cyngn

- Royal Truck & Equipment

Recent Developments

June 2023: Caterpillar Inc.'s new Cat 995 Wheel Loader climbed to 19% greater. It will also provide an extra 8% efficiency increase and reduce hourly fuel use by up to 13%.

May 2023: Hitachi Construction Machinery made a financial investment in aptpod, Inc. and established a business relationship. In the future, Hitachi Construction Machinery will co-create real-time "digital twins"1 for construction sites utilizing Autopod's high-speed loT platform. It will also design systems for the digital twins' autonomous and remote control operation.

March 2023: Komatsu purchased Dynamic Perception, a business that creates 3D perception software for self-driving cars. Komatsu's Autonomous Construction Equipment will operate more safely and effectively as a result of the acquisition.