Market Analysis

In-depth Analysis of Autonomous Construction Equipment Market Industry Landscape

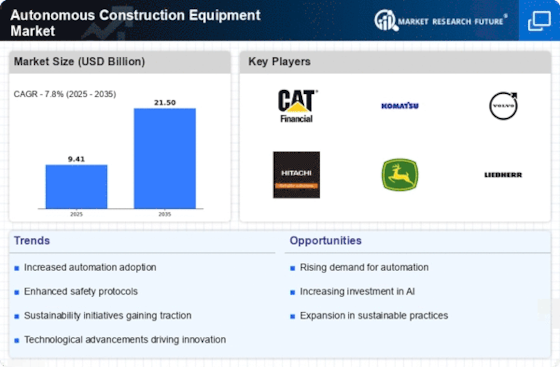

The market of Autonomous Construction Equipment (ACE) is witnessed to be through the transformation caused in the technology. Market dynamics within this area is influenced by the community of factors that characterize its forward motion. In this context, efficiency and productivity drive construction sector demand is one of the major factors. Autonomous construction equipment, together with leading technologies including AI, machine learning, and highly-advanced sensors,has turned a new page to cope with the challenges.

ACE market surge has found its footing in the goal of improved safety, reduced labor costs. Automation in construction is a promise of reducing danger to construction workers by contributing to the reduction of human operators who have to operate in dangerous environment. Such practices, apart from making a construction site safer to work on, also save the company a lot of money. The market trends show that a slow but temporal process of transition towards the autonomous approach in the construction industry leads to the better understanding of cost benefits for construction companies.

The next point is that regulations environment is a key factor which determines the course of market. The governments and governmental bodies of today, encouraged by the significant advantages of self-managed construction equipment, are developing the policies that support the technology. Incentives and laws which attract autonomous systems expansion and market nurture the market of ACE. With regulations aligning to accommodate autonomous systems, the market will eventually see a wider and rapid acceptance of these technology.

Cost efficiency is considered as an integral element of the market dynamics. Initially, investing in autonomous construction machine may prove expensive but it is proven that in the long run, the money that can be saved through the reduction in labor expenditure and the increase in operational efficiency is more significant. Due to the risk assessment of humongous initial capital costs vs. long-term benefits, construction companies ponder and the future follows the path of rapid growth.

Besides helping to shape industry relations, market dynamics are also affected by joint ventures and partnerships. Considering the fact that producers of equipment, construction firms as well as technology providers work together, there is a synergy which makes it possible for new products to develop quicker as well as more rapidly to be adopted. Such joint ventures are usually an occasion of the pooling and merging of different skill sets, resulting in the development of more complex and advanced autonomous systems. The bipolar nature of the stakeholders in the sector is building an environment that enhances innovation and quick evolutions.

Leave a Comment