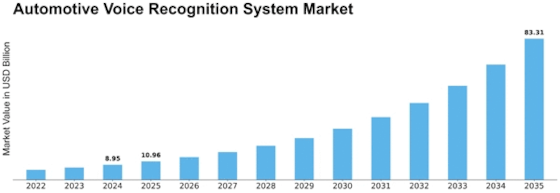

Automotive Voice Recognition System Size

Automotive Voice Recognition System Market Growth Projections and Opportunities

The voice recognition system market is moved by the growing requirement for easy to use, without hands advancements all through different areas. The rising commonness of voice-enacted gadgets like shrewd speakers, cell phones, and others adds to this flood popular, consequently laying out voice acknowledgment frameworks as a convincing answer for work with communication among clients and organizations.

Calculations for AI and regular language handling are propelling the accuracy and adequacy of voice acknowledgment frameworks. The extension of the voice recognition system market is moved by the market's consistent advancement, which draws in organizations to integrate voice-empowered highlights into their items and administrations and results in improved abilities.

Market development is impelled by the fuse of voice acknowledgment frameworks into businesses like money, retail, medical services, and auto. Car applications use these frameworks to streamline documentation cycles and improve functional viability. Additionally, the rising pervasiveness of voice-actuated controls for in-vehicle diversion and route in the auto business is driving interest for voice recognition system market.

The voice recognition system market is significantly influenced by government drives and guidelines, given the worldwide accentuation that states put on computerized change and availability. Upgraded interests in innovative work have resulted as an outcome, encouraging the movement of voice acknowledgment frameworks as per administrative orders and cultural requests.

A critical member in the market shapes the serious scene by making progress toward development and an upper hand. Associations increase their product offerings through the execution of vital acquisitions, joint efforts, and organizations. Rivalry is strengthened by the development of firms that have some expertise in specialty voice acknowledgment innovation.

The voice recognition system market is going through a change because of the worldwide business climate, which is expanding the requirement for multilingual frameworks equipped for fathoming and giving reactions in different dialects and accents. These circumstances direct that suppliers of voice recognition system market ought to put resources into language-explicit models and local transformations, as they are given the two difficulties and valuable open doors.

The voice recognition system market is being pushed by security contemplations, as encryption strategies and powerful conventions are arising as basic components to guarantee the secrecy of client information and verification.

Organizations are constrained to adjust to the voice recognition system market's mechanical, administrative, and market-driven elements; it is additionally influenced by industry combination, government drives, cutthroat techniques, semantic contemplations, and security concerns.

Leave a Comment