Automotive Voice Recognition System Market Trends

Automotive Voice Recognition System Market Research Report Information By Technology (Embedded, and Hybrid) By Application (AI, and Non-AI), By Vehicle Type (Passenger Vehicle, and Commercial Vehicle), And By Region (North America, Europe, Asia-Pacific, And Middle East & Africa) - Forecast Till 2035

Market Summary

The Global Automotive Voice Recognition System Market is projected to grow significantly from 9.02 USD Billion in 2024 to 45.3 USD Billion by 2035.

Key Market Trends & Highlights

Automotive Voice Recognition System Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 15.81% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 45.3 USD Billion, indicating robust growth potential.

- In 2024, the market is valued at 9.02 USD Billion, reflecting the increasing integration of voice recognition technologies in vehicles.

- Growing adoption of automotive voice recognition systems due to enhanced user convenience is a major market driver.

Market Size & Forecast

| 2024 Market Size | 9.02 (USD Billion) |

| 2035 Market Size | 45.3 (USD Billion) |

| CAGR (2025-2035) | 15.81% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Nuance, Microsoft, Alphabet, Harman, Apple, BMW, Daimler, Ford, IBM Corporation

Market Trends

Growing Technological Advancements to Augment the Market for Voice Recognition System

Several technological advancements are supporting the Automotive Voice Recognition System market growth opportunities. The evolution of VR integrated into assistant systems is also providing growth opportunities for the market. The integration of VR into the assistant system significantly increases productivity and safety in working spaces. Popular voice assistants such as Alexa and Google assistant have tremendous demand. Also, voice recognition with these popular voice assistants can enhance the safety and operations of the systems.

The customer can take advantage of voice shopping through this technological advancement. Voice shopping will be safe due to the identification of the purchaser’s voice. The conversational commerce report suggests around 51% of customers are already utilizing the voice assistant for shopping. Further, the incorporation of voice recognition with the assistant will provide significant growth possibilities for the market. This growth opportunity will prove advantageous for the market. The demand for these products and the Automotive Voice Recognition System market expansion rate will be exceptional during the forecast period.

However, the growing cyber-attacks on various sectors is another factor driving the growth of the VR system market revenue.

The ongoing integration of advanced voice recognition technologies in vehicles is poised to enhance user experience and safety, reflecting a broader trend towards automation and connectivity in the automotive sector.

U.S. Department of Transportation

Automotive Voice Recognition System Market Market Drivers

Market Growth Projections

The Global Automotive Voice Recognition System Market Industry is poised for substantial growth, with projections indicating a market value of 9.02 USD Billion in 2024 and an anticipated increase to 45.3 USD Billion by 2035. This growth represents a remarkable CAGR of 15.81% from 2025 to 2035, highlighting the increasing integration of voice recognition technologies in vehicles. The upward trend is driven by factors such as technological advancements, consumer demand for connectivity, and regulatory support for safety features. As the automotive industry evolves, voice recognition systems are likely to become a standard feature in modern vehicles.

Technological Advancements

The Global Automotive Voice Recognition System Market Industry is experiencing rapid technological advancements, particularly in natural language processing and machine learning. These innovations enhance the accuracy and responsiveness of voice recognition systems, making them more user-friendly and efficient. For instance, the integration of AI-driven algorithms allows for better understanding of diverse accents and dialects, which is crucial in a global market. As a result, the market is projected to reach 9.02 USD Billion in 2024, reflecting the growing demand for sophisticated voice interfaces in vehicles.

Growing Adoption of Electric Vehicles

The growing adoption of electric vehicles (EVs) is another significant driver for the Global Automotive Voice Recognition System Market Industry. As the automotive landscape shifts towards electrification, manufacturers are increasingly integrating advanced voice recognition systems into EVs to enhance user interaction and control. These systems not only improve the driving experience but also align with the eco-friendly ethos of electric vehicles. The market's expansion is further supported by the projected CAGR of 15.81% from 2025 to 2035, reflecting the increasing integration of innovative technologies in the evolving automotive sector.

Regulatory Support for Safety Features

Regulatory bodies are increasingly emphasizing the importance of safety features in vehicles, which positively impacts the Global Automotive Voice Recognition System Market Industry. Governments worldwide are implementing regulations that encourage the adoption of technologies that minimize driver distraction. Voice recognition systems play a pivotal role in this context, allowing drivers to control navigation, communication, and entertainment systems without taking their hands off the wheel. This regulatory support is likely to propel market growth, as manufacturers strive to comply with safety standards while enhancing user convenience.

Increased Consumer Demand for Connectivity

There is a notable increase in consumer demand for connectivity features in vehicles, which significantly drives the Global Automotive Voice Recognition System Market Industry. Modern consumers expect seamless integration of their smartphones and other devices with their vehicles, leading to a heightened interest in voice recognition systems that facilitate hands-free operation. This trend is evident as automakers incorporate advanced voice recognition technologies into their infotainment systems, enhancing user experience. The market is anticipated to grow substantially, reaching 45.3 USD Billion by 2035, indicating a robust shift towards connected automotive solutions.

Rising Demand for Enhanced User Experience

The demand for enhanced user experience in vehicles is a critical factor driving the Global Automotive Voice Recognition System Market Industry. Consumers are increasingly seeking intuitive interfaces that allow for effortless interaction with vehicle systems. Voice recognition technology meets this demand by providing a hands-free, user-friendly alternative to traditional controls. Automakers are investing in research and development to refine these systems, ensuring they are responsive and capable of understanding complex commands. This focus on user experience is expected to contribute to the market's growth trajectory, as more consumers prioritize advanced technology in their vehicle choices.

Market Segment Insights

Automotive Voice Recognition System Type Insights

On the basis of technologies, the Automotive Voice Recognition System market has been further divided into AI and non-AI technologies. The Non-AI segment accounted for a dominant share of the market in 2022. The segment is estimated to hold the leading position growing at a steady CAGR during the forecast period. On the other hand, the AI technology segment is anticipated to record the fastest growth rate during the forecast period. The demand for Artificial intelligence-based technology is increasing as the system automatically recognizes the patterns of speech precisely.

The rising developments in machine learning and natural language processing are expected to boost the growth of the Artificial intelligence-based technology segment. A rising number of Artificial intelligence-based digital assistants, such as Alexa and Cortana, are expected to drive the demand for voice and speech recognition solutions over the forecast period.

Automotive Voice Recognition System Technology Insights

The Automotive Voice Recognition System market segmentation, based on technology, includes embedded, and hybrid. The hybrid segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is due to the cost-effectiveness and ease of use make single-factor VR systems. The key drivers of the segment include the convenience of voice recognition, demand from the automotive industry, and growing security concerns. Also, the technological advancements in the product category and new product launches are also supporting the market growth. Hence, rising applications of hybrid technology positively impact the market growth.

Figure 1: Automotive Voice Recognition System Market, by Technology, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Automotive Voice Recognition System Market Research Report - Global Forecast to 2030

Regional Insights

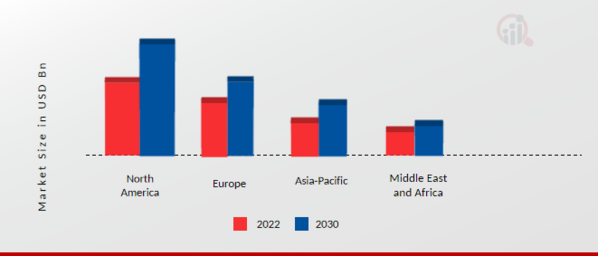

The Automotive Voice Recognition System market has been further split into North America, Europe, Asia-Pacific, the Middle East, and Africa based on geography. The largest portion of revenue in 2022 was generated in North America. The region is anticipated to continue to grow at a constant CAGR and hold the leading market position during the forecast period.

The market in the North American area is anticipated to be driven by the increasing use of voice-enabled applications in smartphones and voice & speech recognition in mobile banking, consumer electronics, and IoT devices. Further, the major countries studied are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Automotive Voice Recognition System Market Share By Region 2022 (Usd Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Automotive Voice Recognition System market accounts for the second-largest market share due to the growing trend of linked devices in automotive and home automation, to see greater applications in the consumer electronics and retail industries. Further, the Germany Automotive Voice Recognition System market held the largest market share, and the UK speech recognition system market was the fastest growing market in the European region

The Asia-Pacific Automotive Voice Recognition System Market is expected to grow at a CAGR of 28.9% from 2023 to 2030. The expansion of the APAC regional market is also anticipated to be aided by the increasing adoption of voice-enabled devices in the automotive and healthcare sectors. Moreover, China speech recognition system market held the largest market share, and the India speech recognition system market was the fastest growing market in the Asia-Pacific region

China, which has the biggest population in the world, is anticipated to embrace voice recognition technologies at a rapid rate. Voice recognition software will be even more necessary in 2021, when CNNIC estimated that 903.63 million mobile users would use payment services on their smartphones. The amount of voice-based searches has expanded as a result of the region's expanding retail and e-commerce sectors. Businesses like Alibaba, Baidu, Google, and Amazon saw a surge in sales of their individual voice-activated smart gadgets.

For instance, the most recent Ascential Digital Commerce report predicted that Southeast Asia's eCommerce sales will rise by 18% to USD 38.2 billion in 2022. Hence, Asia-Pacific is anticipated to register the highest growth rate over the forecast period from 2022–2030.

Key Players and Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the speech recognition system market grow even more. The Automotive Voice Recognition System Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the speech recognition system industry must offer cost-effective solutions to expand and survive in an increasingly competitive and rising automotive voice recognition system market environment.

One of the primary business strategies adopted by manufacturers in the speech recognition system industry to benefit clients and expand the voice recognition system Automotive Voice Recognition System market sector is to manufacture locally to reduce operating costs. In recent years, speech recognition system has provided solutions with some of the most significant benefits. In order to acquire a competitive advantage, market vendors are concentrating on growing their consumer base. As a result, important players are undertaking a number of strategic activities, including collaborations and mergers.

The entry of new market players will change the speech recognition system market outlook. The market players are establishing new strategies, market expansion measures and acquisitions in the forecast period. Also, there are high possibilities for product launches and technological advancements.

For instance, Microsoft and Nuance Communications introduced Nuance Dragon Ambient experience (DAX) in September 2020. This Ambient Clinical Intelligence (ACI) solution is now integrated into Microsoft Teams and enables large-scale virtual consultations with the goal of improving physician wellness and patient health outcomes.

Key Companies in the Automotive Voice Recognition System Market market include

Industry Developments

In March 2023, Google AI released an update for its Universal Speech Model – USM – in support of the 1000 Languages Initiative. The concept of a universal speech model involves using machine learning algorithms to comprehend spoken languages from different ethnicities as well as regions worldwide. USM is a family of advanced speech models with two billion parameters trained on data consisting of twelve million hours’ worth of audio samples across three hundred languages containing twenty-eight billion sentences, according to Google.

ASR, under these conditions, could perform better than other such systems in another language like Mandarin or English besides less-resourced ones, including Assamese, Amharic, Cebuano, or Azerbaijani, as per Google’s claims.

In April 2022, Verint introduced its latest solution, Virtual Assistant IVA, to the public, which is a low-code conversational AI. It can instantly transform existing conversation data into automated self-service experiences. This chatbot is ready for use as it is required. Businesses may need it to deflect calls and support clients. Verint IVA scales business capabilities with unlimited intelligence for voice and digital across the enterprise

In September 2021, Microsoft and Nuance Communications announced the integration of Nuance Dragon Ambient Experience (DAX), an ambient clinical intelligence (ACI) solution made by the company, into Microsoft Teams, aiming not only at increasing physician satisfaction but also at promoting better health outcomes for patients.

Future Outlook

Automotive Voice Recognition System Market Future Outlook

The Automotive Voice Recognition System Market is projected to grow at a 15.81% CAGR from 2024 to 2035, driven by advancements in AI, increasing consumer demand for safety, and enhanced user experience.

New opportunities lie in:

- Develop AI-driven voice recognition systems for enhanced multilingual support.

- Integrate voice recognition with advanced driver-assistance systems for improved safety.

- Create customizable voice interfaces for automotive manufacturers to enhance brand identity.

By 2035, the market is expected to achieve substantial growth, solidifying its role in automotive innovation.

Market Segmentation

Automotive Voice Recognition System Regional Outlook

- US

- Canada

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Middle East

- Africa

Automotive Voice Recognition System Technology Outlook

- Embedded

- Hybrid

Automotive Voice Recognition System Application Outlook

- AI

- Non-AI

Automotive Voice Recognition System Vehicle Type Outlook

- Passenger Vehicle

- Commercial Vehicle

Report Scope

| Attribute/Metric | Details |

| Market Size 2022 | USD 5.97 billion |

| Market Size 2023 | USD 7.31 billion |

| Market Size 2030 | USD 16.44 billion |

| Compound Annual Growth Rate (CAGR) | 22.48% (2024-2030) |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Historical Data | 2020 & 2022 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Technology, Application, Vehicle Type and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Middle East and Africa |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Nuance (US), Microsoft (US), Alphabet (US), Harman (US), Apple (US), BMW (Germany), Daimler (Germany), and Ford (US) |

| Key Market Opportunities | Evolution of VR systems to integrated assistant systems |

| Key Market Dynamics | Increasing demand for safety features in automobiles Stringent government norms Rapidly rising safety awareness |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the voice recognition system market?

The voice recognition systems market was USD 4.87 billion in 2022.

How Big is the U.S voice recognition systems market?

The voice recognition systems market in the U.S. was USD 1.62 in 2022

What is the growth rate of the voice recognition systems market?

The voice recognition systems market is anticipated to develop favourably with a CAGR of 22.48%.

Who are the key players in the voice recognition system market?

The key players of the market are Ford, Nuance, Daimler, Alphabet, BMW, Harman and Apple.

-

|-

-

Table of Contents

-

Executive Summary

-

Market Attractiveness Analysis

-

Global Automotive Voice Recognition System Market, by Technology

-

Global Automotive Voice Recognition System Market, by Vehicle Type

-

Global Automotive Voice Recognition System Market, by Application

-

Global Automotive Voice Recognition System Market, by Region

-

Market Introduction

-

Definition

-

Scope of the Study

-

Market Structure

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

Market Dynamics

-

Introduction

-

Drivers

-

Increasing demand for safety and convenience features in vehicles

-

Growing popularity of self-driving cars and ADAS technologies

-

Driver 3

-

Drivers Impact Analysis

-

Restraints

-

High cost of voice recognition systems

-

Restraints Impact Analysis

-

Opportunities

-

Increasing demand for voice recognition systems in emerging markets

-

Opportunity 2

-

Challenge

-

Challenge 1

-

Impact of COVID-19

-

Impact on Automotive Voice Recognition System market

-

Impact on YoY Growth

-

Market Factor Analysis

-

Value Chain Analysis/Supply Chain Analysis

-

Porter’s Five Forces Model

-

Bargaining Power of Suppliers

-

Bargaining Power of Buyers

-

Threat of New Entrants

-

Threat of Substitutes

-

Intensity of Rivalry

-

Market SWOT analysis

-

Market PESTEL analysis

-

Global Automotive Voice Recognition System Market Size Estimation & Forecast, by Technology

-

Embedded

-

Hybrid

-

Global Automotive Voice Recognition System Market Size Estimation & Forecast, by Vehicle Type

-

Passenger Vehicle

-

Commercial Vehicle

-

Global Automotive Voice Recognition System Market Size Estimation & Forecast, by APPLICATION

-

AI

-

Non AI

-

Global Automotive Voice Recognition System Market Size Estimation & Forecast, by Region

-

North America

-

Market Estimates & Forecast, by Region, 2022-2030

-

Market Estimates & Forecast, by Technology, 2022-2030

-

Market Estimates & Forecast, by Vehicle Type, 2022-2030

-

Market Estimates & Forecast, by Application, 2022-2030

-

US

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East & Africa

-

South America

-

Competitive Landscape

-

Key Players Market Share Analysis, 2022 (%)

-

Competitive Benchmarking

-

Key Developments & Growth Strategies

-

New Product Development/Product Innovation

-

Mergers & Acquisitions

-

Contracts & Agreements

-

Expansions & Investments

-

Company Profiles

-

LumenVox

-

Company Overview

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Microsoft

-

Alphabet

-

Amazon

-

Nuance Communications

-

Apple

-

Daimler

-

BMW

-

Ford Motor

-

Sensory

-

VoiceBox

-

Sound Hound

-

Harman

-

iNAGO

-

Company 15

-

Other Players

-

LIST OF TABLES

-

TABLE 1 LIST OF ASSUMPTIONS 31

-

TABLE 2 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY TECHNOLOGY, 2022–2030 (USD MILLION) 46

-

TABLE 3 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 49

-

TABLE 4 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY APPLICATION, 2022–2030 (USD MILLION) 51

-

TABLE 5 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY REGION, 2022–2030 (USD MILLION) 53

-

TABLE 6 NORTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 55

-

TABLE 7 NORTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 57

-

TABLE 8 NORTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 59

-

TABLE 9 NORTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 61

-

TABLE 10 US: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 63

-

TABLE 11 US: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 65

-

TABLE 12 US: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 67

-

TABLE 13 CANADA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 69

-

TABLE 14 CANADA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 71

-

TABLE 15 CANADA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 73

-

TABLE 16 MEXICO: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 75

-

TABLE 17 MEXICO: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 77

-

TABLE 18 MEXICO: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 79

-

TABLE 19 EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 81

-

TABLE 20 EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 83

-

TABLE 21 EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 85

-

TABLE 22 EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 87

-

TABLE 23 UK: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 89

-

TABLE 24 UK: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 91

-

TABLE 25 UK: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 93

-

TABLE 26 GERMANY: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 95

-

TABLE 27 GERMANY: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 97

-

TABLE 28 GERMANY: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 99

-

TABLE 29 FRANCE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 101

-

TABLE 30 FRANCE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 103

-

TABLE 31 FRANCE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 105

-

TABLE 32 ITALY: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 107

-

TABLE 33 ITALY: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 109

-

TABLE 34 ITALY: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 111

-

TABLE 35 SPAIN: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 113

-

TABLE 36 SPAIN: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 115

-

TABLE 37 SPAIN: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 117

-

TABLE 38 REST OF EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 119

-

TABLE 39 REST OF EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 121

-

TABLE 40 REST OF EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 123

-

TABLE 41 ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 125

-

TABLE 42 ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 127

-

TABLE 43 ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 129

-

TABLE 44 ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 131

-

TABLE 45 CHINA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 133

-

TABLE 46 CHINA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 135

-

TABLE 47 CHINA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 137

-

TABLE 48 INDIA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 139

-

TABLE 49 INDIA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 141

-

TABLE 50 INDIA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 143

-

TABLE 51 JAPAN: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 145

-

TABLE 52 JAPAN: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 147

-

TABLE 53 JAPAN: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 149

-

TABLE 54 SOUTH KOREA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 151

-

TABLE 55 SOUTH KOREA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 153

-

TABLE 56 SOUTH KOREA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 155

-

TABLE 57 REST OF ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 157

-

TABLE 58 REST OF ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 159

-

TABLE 59 REST OF ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 161

-

TABLE 60 MIDDLE EAST & AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 163

-

TABLE 61 MIDDLE EAST & AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 165

-

TABLE 62 MIDDLE EAST & AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 167

-

TABLE 63 MIDDLE EAST & AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 169

-

TABLE 64 UAE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 171

-

TABLE 65 UAE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 173

-

TABLE 66 UAE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 175

-

TABLE 67 SAUDI ARABIA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 177

-

TABLE 68 SAUDI ARABIA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 179

-

TABLE 69 SAUDI ARABIA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 181

-

TABLE 70 SOUTH AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 183

-

TABLE 71 SOUTH AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 185

-

TABLE 72 SOUTH AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 187

-

TABLE 73 REST OF MEA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 189

-

TABLE 74 REST OF MEA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 191

-

TABLE 75 REST OF MEA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 193

-

TABLE 76 SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 195

-

TABLE 77 SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 197

-

TABLE 78 SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 199

-

TABLE 79 SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 201

-

TABLE 80 BRAZIL: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 203

-

TABLE 81 BRAZIL: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 205

-

TABLE 82 BRAZIL: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 207

-

TABLE 83 ARGENTINA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 209

-

TABLE 84 ARGENTINA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 211

-

TABLE 85 ARGENTINA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 213

-

TABLE 86 REST OF SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION) 215

-

TABLE 87 REST OF SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 217

-

TABLE 88 REST OF SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION) 219

-

TABLE 89 KEY DEVELOPMENTS: CONTRACTS & AGREEMENTS 221

-

TABLE 90 KEY DEVELOPMENTS: PARTNERSHIPS & COLLABORATIONS 223

-

TABLE 91 KEY DEVELOPMENTS: PRODUCT DEVELOPMENTS/LAUNCHES 225

-

TABLE 92 LUMENVOX: PRODUCTS OFFERED 227

-

TABLE 93 LUMENVOX: KEY DEVELOPMENTS 229

-

TABLE 94 MICROSOFT: PRODUCTS OFFERED 231

-

TABLE 95 MICROSOFT: KEY DEVELOPMENTS 233

-

TABLE 96 ALPHABET: PRODUCTS OFFERED 235

-

TABLE 97 ALPHABET: KEY DEVELOPMENTS 237

-

TABLE 98 AMAZON: PRODUCTS OFFERED 239

-

TABLE 99 AMAZON: KEY DEVELOPMENTS 241

-

TABLE 100 NUANCE COMMUNICATIONS: PRODUCTS OFFERED 243

-

TABLE 101 NUANCE COMMUNICATIONS: KEY DEVELOPMENTS 245

-

TABLE 102 APPLE: PRODUCTS OFFERED 247

-

TABLE 103 APPLE: KEY DEVELOPMENTS 249

-

TABLE 104 DAIMLER: PRODUCTS OFFERED 251

-

TABLE 105 DAIMLER: KEY DEVELOPMENTS 253

-

TABLE 106 BMW: PRODUCTS OFFERED 255

-

TABLE 107 BMW: KEY DEVELOPMENTS 257

-

TABLE 108 FORD MOTOR: PRODUCTS OFFERED 259

-

TABLE 109 FORD MOTOR: KEY DEVELOPMENTS 261

-

TABLE 110 SENSORY: PRODUCTS OFFERED 263

-

TABLE 111 SENSORY: KEY DEVELOPMENTS 265

-

TABLE 112 VOICEBOX: PRODUCTS OFFERED 267

-

TABLE 113 VOICEBOX: KEY DEVELOPMENTS 269

-

TABLE 114 SOUND HOUND: PRODUCTS OFFERED 271

-

TABLE 115 SOUND HOUND: KEY DEVELOPMENTS 273

-

TABLE 116 HARMAN: PRODUCTS OFFERED 275

-

TABLE 117 HARMAN: KEY DEVELOPMENTS 277

-

TABLE 118 INAGO: PRODUCTS OFFERED 279

-

TABLE 119 INAGO: KEY DEVELOPMENTS 281

-

TABLE 120 COMPANY 15: PRODUCTS OFFERED 283

-

TABLE 121 COMPANY 15: KEY DEVELOPMENTS 285

-

LIST OF FIGURES

-

FIGURE 1 MARKET SYNOPSIS 20

-

FIGURE 2 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY TECHNOLOGY, 2022–2030 (USD MILLION) 21

-

FIGURE 3 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET ANALYSIS, BY VEHICLE TYPE 22

-

FIGURE 4 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET ANALYSIS, BY APPLICATION 23

-

FIGURE 5 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET: STRUCTURE 25

-

FIGURE 6 RESEARCH PROCESS 26

-

FIGURE 7 TOP-DOWN & Bottom-up ApproachES 27

-

FIGURE 8 MARKET DYNAMICS OVERVIEW 28

-

FIGURE 9 DRIVER IMPACT ANALYSIS: GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET 29

-

FIGURE 10 RESTRAINT IMPACT ANALYSIS: GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET 30

-

FIGURE 11 PORTER’S FIVE FORCES ANALYSIS: GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM 31

-

FIGURE 12 SUPPLY CHAIN ANALYSIS: GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM 32

-

FIGURE 13 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY TECHNOLOGY, 2022 (% SHARE) 33

-

FIGURE 14 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY TECHNOLOGY, 2022–2030 (USD MILLION) 34

-

FIGURE 15 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY VEHICLE TYPE, 2022 (% SHARE) 35

-

FIGURE 16 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 36

-

FIGURE 17 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY APPLICATION, 2022 (% SHARE) 37

-

FIGURE 18 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY APPLICATION, 2022–2030 (USD MILLION) 38

-

FIGURE 19 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY REGION, 2022 TO 2030 (USD MILLION) 41

-

FIGURE 20 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM, BY REGION, 2022 (% SHARE) 42

-

FIGURE 21 NORTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 43

-

FIGURE 22 EUROPE: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 44

-

FIGURE 23 ASIA-PACIFIC: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 45

-

FIGURE 24 MIDDLE EAST & AFRICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 46

-

FIGURE 25 SOUTH AMERICA: AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 47

-

FIGURE 26 BENCHMARKING OF MAJOR COMPETITORS 48

-

FIGURE 27 GLOBAL AUTOMOTIVE VOICE RECOGNITION SYSTEM MARKET SHARE ANALYSIS, 2022 49

-

FIGURE 28 LUMENVOX: FINANCIAL OVERVIEW SNAPSHOT 50

-

FIGURE 29 LUMENVOX: SWOT ANALYSIS 51

-

FIGURE 30 MICROSOFT: FINANCIAL OVERVIEW SNAPSHOT 52

-

FIGURE 31 MICROSOFT: SWOT ANALYSIS 53

-

FIGURE 32 ALPHABET: FINANCIAL OVERVIEW SNAPSHOT 54

-

FIGURE 33 ALPHABET: SWOT ANALYSIS 55

-

FIGURE 34 AMAZON: FINANCIAL OVERVIEW SNAPSHOT 56

-

FIGURE 35 AMAZON: SWOT ANALYSIS 57

-

FIGURE 36 NUANCE COMMUNICATIONS: FINANCIAL OVERVIEW SNAPSHOT 58

-

FIGURE 37 NUANCE COMMUNICATIONS: SWOT ANALYSIS 59

-

FIGURE 38 APPLE: FINANCIAL OVERVIEW SNAPSHOT 60

-

FIGURE 39 APPLE: SWOT ANALYSIS 61

-

FIGURE 40 DAIMLER: FINANCIAL OVERVIEW SNAPSHOT 62

-

FIGURE 41 DAIMLER: SWOT ANALYSIS 63

-

FIGURE 42 BMW: FINANCIAL OVERVIEW SNAPSHOT 64

-

FIGURE 43 BMW: SWOT ANALYSIS 65

-

FIGURE 44 FORD MOTOR: FINANCIAL OVERVIEW SNAPSHOT 66

-

FIGURE 45 FORD MOTOR: SWOT ANALYSIS 67

-

FIGURE 46 SENSORY: FINANCIAL OVERVIEW SNAPSHOT 68

-

FIGURE 47 SENSORY: SWOT ANALYSIS 69

-

FIGURE 48 VOICEBOX: FINANCIAL OVERVIEW SNAPSHOT 70

-

FIGURE 49 VOICEBOX: SWOT ANALYSIS 71

-

FIGURE 50 SOUND HOUND: FINANCIAL OVERVIEW SNAPSHOT 72

-

FIGURE 51 SOUND HOUND: SWOT ANALYSIS 73

-

FIGURE 52 HARMAN: FINANCIAL OVERVIEW SNAPSHOT 74

-

FIGURE 53 HARMAN: SWOT ANALYSIS 75

-

FIGURE 54 INAGO: FINANCIAL OVERVIEW SNAPSHOT 76

-

FIGURE 55 INAGO: SWOT ANALYSIS 77

-

FIGURE 56 COMPANY 15: FINANCIAL OVERVIEW SNAPSHOT 78

-

FIGURE 57 COMPANY 15: SWOT ANALYSIS 79

Automotive Voice Recognition System Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment