Growing Focus on Electric Vehicles

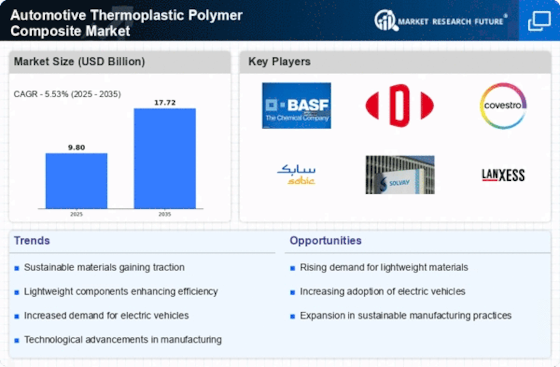

The shift towards electric vehicles (EVs) is significantly influencing the Automotive Thermoplastic Polymer Composite Market. As automakers transition to EV production, there is an increasing need for lightweight and durable materials that can enhance battery efficiency and overall vehicle performance. Thermoplastic polymer composites are particularly well-suited for EV applications due to their excellent thermal and electrical properties. Recent market analyses suggest that the EV segment is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth presents a substantial opportunity for the Automotive Thermoplastic Polymer Composite Market, as manufacturers seek to incorporate advanced materials that align with the evolving demands of the electric vehicle landscape.

Advancements in Manufacturing Technologies

Technological innovations in manufacturing processes are playing a pivotal role in shaping the Automotive Thermoplastic Polymer Composite Market. The introduction of advanced techniques such as injection molding and 3D printing has revolutionized the production of thermoplastic composites, enabling manufacturers to achieve higher precision and efficiency. These advancements not only reduce production costs but also enhance the scalability of composite materials, making them more accessible to automotive manufacturers. Furthermore, the integration of automation and robotics in manufacturing processes is expected to streamline operations, thereby increasing output and reducing lead times. As a result, the Automotive Thermoplastic Polymer Composite Market is likely to benefit from these technological advancements, which facilitate the rapid development and deployment of innovative composite solutions in the automotive sector.

Increasing Demand for Lightweight Materials

The Automotive Thermoplastic Polymer Composite Market is experiencing a notable surge in demand for lightweight materials. This trend is primarily driven by the automotive sector's ongoing efforts to enhance fuel efficiency and reduce emissions. As manufacturers strive to meet stringent environmental regulations, the adoption of thermoplastic polymer composites has become increasingly attractive. These materials offer a favorable strength-to-weight ratio, which is essential for improving vehicle performance. Recent data indicates that the use of lightweight materials can lead to a reduction in vehicle weight by up to 30%, thereby significantly enhancing fuel economy. Consequently, the growing emphasis on sustainability and efficiency is likely to propel the Automotive Thermoplastic Polymer Composite Market forward, as automakers seek innovative solutions to meet consumer expectations and regulatory requirements.

Rising Consumer Awareness of Sustainability

Consumer awareness regarding sustainability is becoming a driving force in the Automotive Thermoplastic Polymer Composite Market. As individuals increasingly prioritize eco-friendly products, automotive manufacturers are compelled to adopt sustainable practices in their production processes. Thermoplastic polymer composites, which can be recycled and have a lower environmental impact compared to traditional materials, are gaining traction among consumers and manufacturers alike. This shift in consumer preferences is prompting automakers to invest in sustainable materials, thereby expanding the market for thermoplastic composites. Data indicates that a significant percentage of consumers are willing to pay a premium for vehicles made with sustainable materials, suggesting that the Automotive Thermoplastic Polymer Composite Market could see substantial growth as manufacturers respond to this demand.

Regulatory Pressures for Emission Reductions

Regulatory frameworks aimed at reducing vehicle emissions are exerting considerable influence on the Automotive Thermoplastic Polymer Composite Market. Governments worldwide are implementing stringent regulations to curb greenhouse gas emissions, compelling automotive manufacturers to seek innovative solutions. Thermoplastic polymer composites offer a viable pathway to meet these regulatory requirements, as their lightweight nature contributes to lower fuel consumption and reduced emissions. Recent legislative measures indicate that many regions are setting ambitious targets for emission reductions, which could drive the adoption of composite materials in vehicle design. Consequently, the Automotive Thermoplastic Polymer Composite Market is likely to expand as manufacturers align their strategies with regulatory expectations, fostering a shift towards more sustainable automotive solutions.