Growing Electric Vehicle Market

The rise of electric vehicles (EVs) is significantly influencing the Automotive Carbon Thermoplastic Market. As the automotive landscape shifts towards electrification, manufacturers are increasingly seeking materials that can enhance the performance and efficiency of EVs. Carbon thermoplastics offer advantages such as reduced weight and improved thermal management, which are crucial for optimizing battery performance and extending vehicle range. The EV market is projected to grow substantially, with estimates suggesting that electric vehicles could account for a significant portion of total vehicle sales in the coming years. This trend is likely to drive the demand for carbon thermoplastics, positioning them as a key material in the Automotive Carbon Thermoplastic Market.

Advancements in Manufacturing Technologies

Technological innovations in manufacturing processes are playing a pivotal role in the Automotive Carbon Thermoplastic Market. The introduction of advanced techniques such as injection molding and 3D printing has enhanced the efficiency and precision of producing carbon thermoplastic components. These advancements not only reduce production costs but also enable the creation of complex geometries that were previously unattainable with traditional materials. As a result, manufacturers can produce lightweight, high-strength parts that meet the rigorous demands of the automotive industry. The market is projected to grow as these technologies become more widely adopted, potentially increasing the market share of carbon thermoplastics in automotive applications.

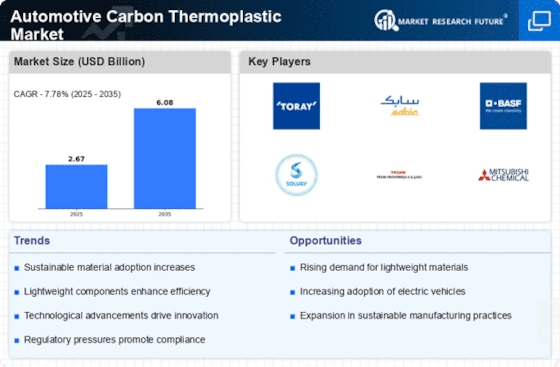

Increasing Demand for Lightweight Materials

The Automotive Carbon Thermoplastic Market is experiencing a surge in demand for lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. As manufacturers strive to meet stringent environmental regulations, the adoption of carbon thermoplastics is becoming more prevalent. These materials offer a significant weight reduction compared to traditional metals, which can lead to improved vehicle performance and lower fuel consumption. Recent studies indicate that vehicles utilizing lightweight materials can achieve up to a 10-15% increase in fuel efficiency. This trend is likely to continue as automakers seek innovative solutions to balance performance with sustainability, thereby propelling the growth of the Automotive Carbon Thermoplastic Market.

Regulatory Support for Sustainable Practices

The Automotive Carbon Thermoplastic Market is benefiting from increasing regulatory support aimed at promoting sustainable practices within the automotive sector. Governments are implementing stricter emissions standards and encouraging the use of eco-friendly materials. This regulatory landscape is fostering a shift towards carbon thermoplastics, which are not only lightweight but also recyclable. The potential for reduced environmental impact aligns with the objectives of many automotive manufacturers, who are under pressure to adopt sustainable practices. As regulations continue to evolve, the demand for carbon thermoplastics is expected to rise, further solidifying their position in the Automotive Carbon Thermoplastic Market.

Consumer Preference for High-Performance Vehicles

Consumer preferences are evolving towards high-performance vehicles, which is positively impacting the Automotive Carbon Thermoplastic Market. As buyers increasingly seek vehicles that offer superior performance, manufacturers are compelled to utilize advanced materials that can deliver enhanced strength and durability. Carbon thermoplastics are well-suited for this purpose, providing the necessary performance characteristics while also contributing to weight reduction. This shift in consumer demand is prompting automotive companies to invest in research and development to incorporate carbon thermoplastics into their designs. As a result, the market for these materials is expected to expand, reflecting the growing interest in high-performance automotive solutions within the Automotive Carbon Thermoplastic Market.