Regulatory Compliance

Regulatory compliance is a critical driver for the Automotive Glass Fiber Composite Market. Governments worldwide are implementing stringent regulations aimed at reducing vehicle emissions and enhancing safety standards. These regulations compel manufacturers to adopt advanced materials that meet compliance requirements. The Automotive Glass Fiber Composite Market is likely to benefit from these regulations, as composites offer superior performance characteristics that align with safety and environmental standards. In 2025, the market is expected to grow as companies invest in research and development to create compliant products, thereby ensuring their competitiveness in a regulated environment.

Sustainability Initiatives

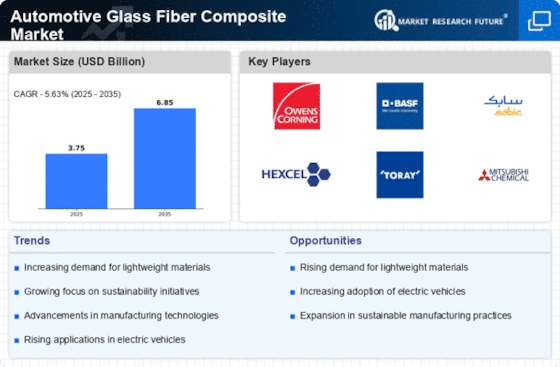

The Automotive Glass Fiber Composite Market is increasingly influenced by sustainability initiatives. Manufacturers are under pressure to reduce their carbon footprint and enhance recyclability. This shift is evident as companies adopt eco-friendly materials and processes. The demand for lightweight composites, which contribute to fuel efficiency, aligns with global environmental goals. In 2025, the market for sustainable automotive materials is projected to reach substantial figures, indicating a growing trend towards greener alternatives. This focus on sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers, thereby driving growth in the Automotive Glass Fiber Composite Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Automotive Glass Fiber Composite Market. Innovations in manufacturing processes, such as automated fiber placement and advanced resin systems, enhance the performance and durability of composites. These technologies enable the production of lighter and stronger materials, which are essential for modern vehicles. In 2025, the market is expected to witness a surge in the adoption of smart composites that integrate sensors for real-time monitoring. This evolution not only improves vehicle safety but also contributes to overall efficiency, thereby propelling the Automotive Glass Fiber Composite Market forward.

Cost Efficiency in Production

Cost efficiency in production is emerging as a significant driver for the Automotive Glass Fiber Composite Market. As manufacturers seek to optimize their production processes, the use of glass fiber composites offers a cost-effective solution. These materials not only reduce manufacturing costs but also lower overall vehicle production expenses. In 2025, the market is anticipated to expand as companies leverage advancements in production techniques to enhance cost efficiency. This trend is particularly relevant in the context of rising raw material prices, where the Automotive Glass Fiber Composite Market can provide a viable alternative that balances performance and cost.

Consumer Demand for Lightweight Vehicles

The Automotive Glass Fiber Composite Market is significantly driven by consumer demand for lightweight vehicles. As fuel efficiency becomes a priority for consumers, manufacturers are increasingly turning to glass fiber composites to reduce vehicle weight. This trend is supported by data indicating that lighter vehicles can improve fuel economy by up to 20%. In 2025, the market is projected to expand as automakers seek to meet stringent emissions regulations while satisfying consumer preferences. The shift towards electric vehicles further amplifies this demand, as lightweight materials are crucial for maximizing battery efficiency, thus enhancing the Automotive Glass Fiber Composite Market.