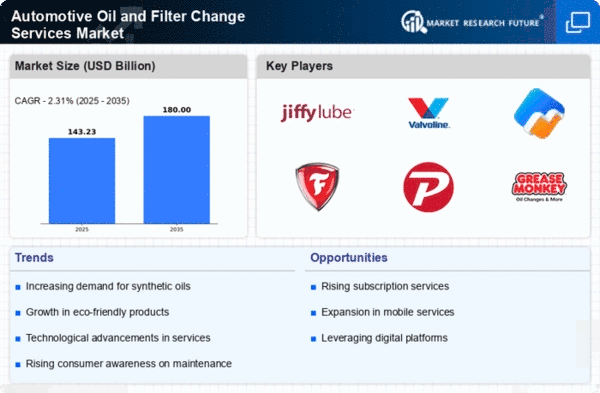

The Automotive Oil and Filter Change Services Market is characterized by a competitive landscape that is both dynamic and multifaceted. Key growth drivers include increasing vehicle ownership, heightened consumer awareness regarding vehicle maintenance, and a growing emphasis on sustainability. Major players such as Jiffy Lube (US), Valvoline (US), and Midas (US) are strategically positioned to leverage these trends. Jiffy Lube (US) focuses on rapid service delivery and customer convenience, while Valvoline (US) emphasizes product innovation and brand loyalty. Midas (US) adopts a comprehensive service approach, integrating oil changes with other automotive services, thereby enhancing customer retention. Collectively, these strategies contribute to a competitive environment that is increasingly defined by service quality and customer experience.In terms of business tactics, companies are localizing their service offerings to better meet regional demands and optimizing their supply chains to enhance efficiency. The market structure appears moderately fragmented, with a mix of national chains and local service providers. This fragmentation allows for diverse service offerings, yet the influence of key players remains substantial, as they set benchmarks for service quality and operational standards.

In November Jiffy Lube (US) announced the launch of a new mobile app designed to streamline appointment scheduling and enhance customer engagement. This strategic move is likely to improve customer satisfaction and retention by providing a more convenient service experience. The app's features, which include reminders for oil changes and promotions, may also drive repeat business, positioning Jiffy Lube (US) favorably against competitors.

In October Valvoline (US) expanded its partnership with a leading automotive parts supplier to enhance its product offerings. This collaboration is expected to bolster Valvoline's service capabilities, allowing for a wider range of high-quality oil and filter products. Such strategic alliances may not only improve operational efficiency but also strengthen Valvoline's market position by ensuring access to cutting-edge automotive technologies.

In September Midas (US) launched a sustainability initiative aimed at reducing waste generated during oil change services. This initiative includes recycling used oil and filters, which aligns with growing consumer preferences for environmentally responsible practices. By adopting such measures, Midas (US) is likely to enhance its brand image and appeal to eco-conscious consumers, thereby differentiating itself in a competitive market.

As of December current trends in the Automotive Oil and Filter Change Services Market indicate a strong shift towards digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and innovate more effectively. Looking ahead, competitive differentiation is expected to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift may redefine customer expectations and service delivery standards in the industry.