North America : Market Leader in Automotive Filters

North America is poised to maintain its leadership in the automotive oil air filter market, holding a significant market share of 2000.0. The region's growth is driven by increasing vehicle production, stringent emission regulations, and a growing focus on vehicle maintenance. The demand for high-quality filters is further fueled by rising consumer awareness regarding vehicle performance and longevity. Regulatory catalysts, such as the Clean Air Act, continue to support the adoption of advanced filtration technologies.

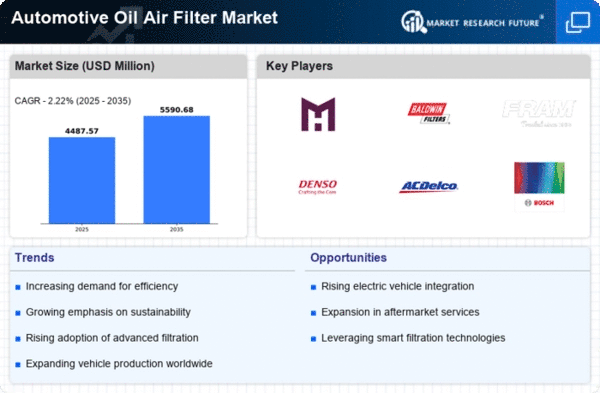

The competitive landscape in North America is robust, featuring key players like Baldwin Filters, Fram, and ACDelco. The U.S. stands out as the leading country, with a strong automotive manufacturing base and a high demand for replacement parts. Companies are investing in R&D to innovate and improve filter efficiency, ensuring compliance with environmental standards. This competitive environment fosters continuous improvement and market expansion, solidifying North America's position as a market leader.

Europe : Emerging Market with Growth Potential

Europe's automotive oil air filter market is experiencing significant growth, with a market size of 1200.0. The region benefits from stringent environmental regulations and a shift towards electric vehicles, which drives demand for advanced filtration solutions. The European Union's commitment to reducing emissions and promoting sustainable practices is a key regulatory catalyst, encouraging manufacturers to innovate and enhance product offerings. This regulatory framework is expected to propel market growth in the coming years.

Leading countries in this region include Germany, France, and the UK, where major players like Mann+Hummel and Mahle are headquartered. The competitive landscape is characterized by a mix of established companies and emerging players, all striving to meet the evolving demands of consumers. The presence of key players fosters innovation and ensures a diverse range of products, catering to various automotive needs, thus enhancing market dynamics.

Asia-Pacific : Rapid Growth in Automotive Sector

The Asia-Pacific region is witnessing rapid growth in the automotive oil air filter market, with a market size of 1500.0. This growth is primarily driven by increasing vehicle production, rising disposable incomes, and a growing middle class. Countries like China and India are leading this surge, supported by government initiatives aimed at enhancing automotive infrastructure and promoting cleaner technologies. Regulatory measures focused on emissions control are also contributing to the demand for high-quality filters in the region.

China stands out as the largest market, with significant investments in automotive manufacturing and a strong presence of key players like Denso and Sakura Filter. The competitive landscape is evolving, with both local and international companies vying for market share. The presence of established brands and the entry of new players are fostering innovation, ensuring that the market remains dynamic and responsive to consumer needs, thus driving further growth in the region.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa (MEA) region is gradually emerging in the automotive oil air filter market, with a market size of 690.11. The growth is driven by increasing vehicle ownership, urbanization, and a rising focus on vehicle maintenance. However, the market faces challenges such as economic fluctuations and varying regulatory standards across countries. Despite these hurdles, the demand for quality automotive filters is expected to rise as consumers become more aware of the importance of vehicle performance and longevity.

Leading countries in this region include South Africa and the UAE, where the automotive sector is expanding. The competitive landscape features both local and international players, with companies like Bosch and K&N Engineering making significant inroads. The presence of these key players is crucial for driving innovation and improving product offerings, ensuring that the market can meet the growing demand for automotive filters in the region.