North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Automotive Transmission Oil Filter market, holding a significant market share of 800.0. The region's growth is driven by increasing vehicle production, stringent emission regulations, and a rising focus on vehicle maintenance. The demand for high-quality oil filters is further propelled by the growing trend of electric vehicles, which require advanced filtration solutions to enhance performance and longevity.

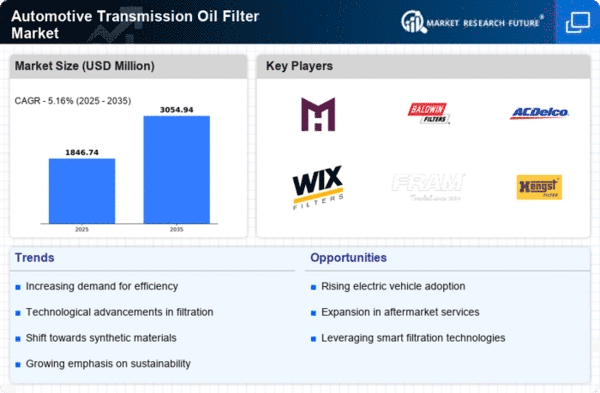

The competitive landscape in North America is robust, featuring key players such as ACDelco, Baldwin Filters, and WIX Filters. These companies are investing heavily in R&D to innovate and improve product offerings. The U.S. remains the largest market, supported by a strong automotive industry and consumer preference for premium products. The presence of established manufacturers ensures a steady supply of advanced oil filters, catering to both OEM and aftermarket segments.

Europe : Emerging Market with Regulations

Europe's Automotive Transmission Oil Filter market is projected to grow significantly, with a market size of 500.0. The region's growth is fueled by stringent environmental regulations and a shift towards sustainable automotive solutions. The European Union's focus on reducing emissions and enhancing fuel efficiency is driving demand for high-performance oil filters, which are essential for meeting these regulatory standards.

Leading countries in this market include Germany, France, and the UK, where major players like Mann+Hummel and Mahle are headquartered. The competitive landscape is characterized by innovation and collaboration among manufacturers to develop advanced filtration technologies. The presence of a well-established automotive sector in Europe ensures a steady demand for quality oil filters, catering to both new and existing vehicles.

Asia-Pacific : Rapid Growth in Emerging Markets

Asia-Pacific is witnessing rapid growth in the Automotive Transmission Oil Filter market, with a market size of 350.0. The region's expansion is driven by increasing vehicle ownership, urbanization, and rising disposable incomes. Additionally, government initiatives to promote automotive manufacturing and improve infrastructure are further boosting demand for oil filters, as more vehicles on the road require maintenance and replacement parts.

Key countries in this region include China, Japan, and India, where major players like Sakura Filter and K&N Engineering are actively competing. The competitive landscape is evolving, with local manufacturers emerging alongside established global brands. The growing focus on quality and performance in automotive components is leading to increased investments in R&D and innovation in filtration technologies.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the Automotive Transmission Oil Filter market, with a market size of 106.12. The growth is primarily driven by increasing vehicle sales, urbanization, and a growing awareness of vehicle maintenance. Additionally, the region's strategic location as a trade hub is facilitating the import of advanced automotive components, including oil filters, to meet rising demand.

Countries like South Africa and the UAE are leading the market, with a mix of local and international players vying for market share. The competitive landscape is characterized by a focus on affordability and quality, as consumers seek reliable products for their vehicles. The presence of key players is essential for driving innovation and ensuring a steady supply of automotive filters in this developing market.