Automotive Oem Size

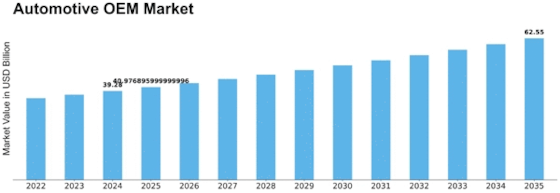

Automotive OEM Market Growth Projections and Opportunities

An extensive variety of market factors affect the auto OEM market, which is a complex and consistently evolving industry. Purchaser premium, influenced by monetary circumstances, mechanical headway, and creating tendencies, is a key variable pushing the market. Monetary determinants, including anyway not limited to additional money levels, GDP improvement, and business rates, apply basic effect over the purchasing power of clients and their inclination to place assets into new vehicles.

In like manner, mechanical movements essentially influence the auto OEM market. The motorization of transportation structures, the augmentation of electric vehicles (EVs), and the improvement of organization game plans have commonly altered the business. New auto OEMs face a promise to create and organize these headways into their vehicles to stay aware of force and satisfy the changing solicitations of purchasers. Likewise, the arrangement and creation patterns of vehicle extraordinary stuff producers are impacted by the managerial environment, which encompasses surges rules and prosperity rules. As a result, these producers are limited to following consistent and manageable procedures.

Also, the components of overall stock chains on a very basic level influence the auto OEM market. The expense and openness of vehicle parts are impacted by international occasions, exchange strategies, and the accessibility of unrefined components. Taking into account the auto business' overall reach, OEMs are resolved to investigate these intricacies to protect a streamlined and reasonable creation organization.

Another significant component is the powers of market rivalry. OEMs' uncommon contention is the primary purpose behind cost suitability, quality improvement, and advancement. Market pioneers continually endeavour to acquire a benefit over their opponents by recognizing their items through plan, highlights, or brand notoriety. This resistance fosters a constant motivation for progress and peculiarity across the entire business.

Normal examinations even influence the auto OEM market. As the emphasis on legitimacy and carbon impression decline creates, exceptional stuff makers (OEMs) are resolved to design and manufacture vehicles that are either totally electric or more eco-accommodating. Natural concerns influence the preferences of administrative and consumer groups, which in turn constrains original equipment manufacturers (OEMs) from adopting eco-friendly innovations.

Market changes are additionally impacted by shifts in socioeconomics and purchaser ways of life. Popular car models are influenced by the preferences of various segment groups, such as millennials and Generation Xers. The market's synthesis and consumers' desired highlights in a vehicle are likewise impacted by moving ways of life, for example, a developing accentuation on shared versatility and urbanization patterns.

The OEM market for vehicles is likewise impacted by recurrent monetary examples. Demand changes in the business a significant part of the time result from monetary cycles, which influence OEMs' advantage and creation levels. Buyers could concede the acquirement of new vehicles during seasons of monetary slump, which subsequently achieves diminished solicitation and creation.

The market is defenceless to global events and overall trade relations due to its overall nature. Political feebleness, assessments, and trade discussions might conceivably irritated supply chains, impact costs, and make wide weakness. OEMs are focused on emphatically notice worldwide enhancements to change their strategies and straightforwardness potential risks. The auto OEM market is an erratic natural framework affected by different interconnected parts. The business is subject to constant change in light of countless factors, including section shifts, money related cycles, creative movements, authoritative requirements, challenge, and regular considerations. These parts aggregately add to the reliably changing scene of the area. These market factors actually need to be managed by automotive OEMs in order for them to assert their competitiveness, meet the needs of customers, and raise sustainable expansion in this challenging and ever-changing industry.

Leave a Comment