Market Trends

Key Emerging Trends in the Automotive NVH Materials Market

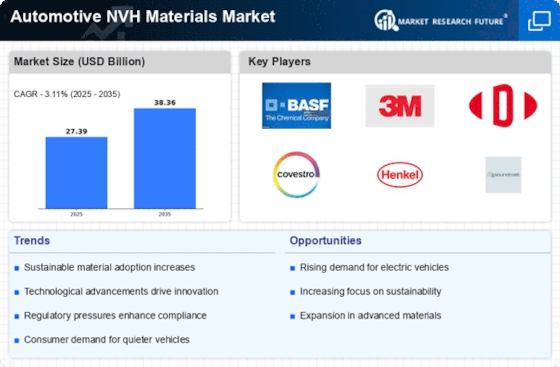

According to MRFR research, the global automotive NVH market will grow by around 6.58% to USD 20.73 billion by 2030. NVH is an item's development noise, vibrations, and harshness. All noticeable vibrations that affect driving comfort are included.Companies use key positioning methods to differentiate themselves and provide vehicle comfort and performance solutions in the Automotive NVH Materials Market. These methods include mechanical advancement, material separation, market division, partnerships, performance and manageability emphasis, and expanded uses.

Mechanical development underpins Automotive NVH Materials Market positioning. Companies innovate to provide high-quality materials that reduce noise, hose vibrations, and vehicle comfort. New composite materials, protection, and sound-engulfing advances drive progress. By demonstrating cutting-edge material technology, companies present themselves as leaders in NVH arrangements that improve driving.

Separating materials is key to positioning techniques. Companies create compounds for specific vehicle NVH issues. Different definitions reduce outside sound, motor vibrations, or lodge protection, positioning companies as suppliers of specialized NVH solutions.

Market segmentation is crucial to positioning tactics in this market. Organizations target traveler, business, electric, and luxury automobiles. Adjusting NVH materials to meet section standards and performance expectations positions companies as automotive suppliers.

Organizations and coordinated efforts shape Automotive NVH Materials Market positioning methods. Collaboration with automakers, material suppliers, and research foundations provides assets, expertise, and market knowledge. Vital unions can boost NVH arrangements and market positioning by providing broad vehicle materials.

Procedure placement must emphasize execution and maintainability. Organizations prioritize NVH-improving and supportability-aligned items. Promoting eco-friendly materials, recyclability, and energy efficiency resonates with environmentally conscious consumers and supports global sustainability efforts.

Enhancing applications is crucial for positioning systems. Companies will provide NVH materials for flooring, roofs, doors, motor compartments, and wheel wells. Giving a scope of use specific materials makes companies versatile suppliers for varying vehicle part NVH requirements.

Locating methods require customer support and training. Offering guidance, specialist aid, and advice on choosing, launching, and simplifying NVH products presents companies as dedicated partners in customer success and satisfaction.

In this sector, flexibility and growth are crucial to positioning. Companies that develop their materials, adapt to changing vehicle designs, and offer new NVH solutions are industry leaders that can meet car makers' evolving demands.

Leave a Comment