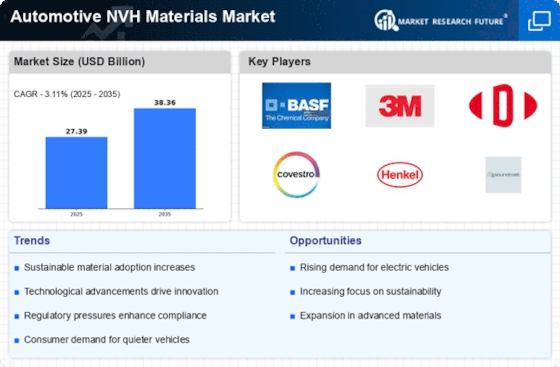

Top Industry Leaders in the Automotive NVH Materials Market

*Disclaimer: List of key companies in no particular order

The pursuit of a serene driving experience has spurred the thriving automotive NVH (noise, vibration, and harshness) materials market. Here, industry titans and agile innovators converge, competing to craft quieter, smoother rides. Let's embark on a comprehensive exploration, uncovering the strategies, trends, and factors steering this vibrant competition.

Strategic Approaches of Key Players:

Product Diversification: Leading entities like Sumitomo Riko and 3M are expanding beyond traditional acoustic foams and damping materials. They're introducing lightweight composites, sound-isolating membranes, and vibration-absorbing textiles, catering to diverse noise sources and varied vehicle types.

Technological Collaboration: Embracing collaboration fuels innovation. For instance, BASF has partnered with universities and startups to develop bio-sourced and recycled NVH materials, aligning with sustainability goals and potentially unlocking cost-effective solutions.

Regional Focus: Market dynamics vary geographically. Players like Johns Manville prioritize North America's fuel efficiency focus with lightweight materials, while Faurecia targets Europe's stringent noise regulations with advanced sound absorption technologies.

Vertical Integration: Gaining control over the supply chain is a growing trend. Saint-Gobain, for example, vertically integrates by expanding its production of glass and plastic substrates used in NVH materials, ensuring quality and potentially lowering costs.

Factors Influencing Market Share:

Material Performance: The efficacy of NVH materials rests on their ability to absorb noise and dampen vibrations. Players like Knauf Industries, with high-performance acoustic insulators, stand out, offering quieter cabins and smoother rides, gaining favor with automakers and consumers.

Cost Competitiveness: Performance is crucial, but cost remains pivotal. Companies like Trelleborg are developing cost-effective NVH solutions through optimized manufacturing processes and material selection, appealing to budget-conscious manufacturers.

Vehicle Design Optimization: Early integration of NVH materials in vehicle design is critical. Faurecia, for instance, offers design and engineering services to automakers, optimizing material placement and maximizing noise reduction, forging long-term partnerships.

Sustainability Focus: Environmental responsibility gains momentum. Manufacturers like Autoneum focus on recyclable and bio-based NVH materials, aligning with industry regulations and appealing to environmentally conscious consumers.

Emerging Trends:

Active Noise Cancellation: The integration of sensors and speakers into NVH materials is trending. These "smart" materials generate opposing sound waves, canceling unwanted noise, and elevating cabin comfort. Continental leads this technology.

Lightweighting and Electrification: In the drive for fuel-efficient and electric vehicles, NVH materials must be lighter and more efficient. Companies like T&I Group develop innovative lightweight composites and sound-absorbing foams specifically for EVs, reducing noise from electric motors and enhancing the driving experience.

Data-driven Optimization: Leveraging Big Data and AI to analyze and predict noise patterns within vehicles transforms the market. Players like Johnson Controls develop software tools optimizing NVH material placement and design based on specific vehicle models and driving conditions, maximizing effectiveness.

The Competitive Landscape:

The automotive NVH materials market is a dynamic and fiercely competitive space, driven by technological advancements, evolving consumer preferences, and an increasing focus on sustainability. Key players adapt strategies to meet these evolving needs, focusing on product diversification, technological collaboration, regional specialization, and vertical integration. Emerging trends like active noise cancellation, lightweighting, and data-driven optimization disrupt the landscape, presenting opportunities for innovative players to gain an edge. Ultimately, this market is poised for continued growth, and those providing cost-effective, high-performance, and sustainable solutions for a quieter, smoother ride will secure lasting competitive advantages.

Industry Developments and Recent Updates:

BASF SE (Germany):

-

October 26, 2023: Launched Infinergy®, a new lightweight and durable polyurethane foam for automotive applications, offering improved sound absorption and vibration damping.

The Dow Chemical Company (US):

-

December 15, 2023: Showcased VORANOL™ polyether polyols for lightweight and sound-absorbing automotive interior components at the K 2023 trade fair.

3M Company (US):

-

November 3, 2023: Introduced Thinsulate™ Acoustical Insulation 3M 40A, a thin and lightweight material for reducing engine and road noise in electric vehicles.

ElringKlinger AG (Germany):

-

December 5, 2023: Acquired Vibracoustic NVH, a Belgian manufacturer of acoustic and vibration control solutions, expanding its product portfolio.

Huntsman Corporation (US):

-

November 9, 2023: Launched ARALDITE® 2011-2 epoxy adhesive for bonding NVH materials in electric vehicles, offering fast curing and high thermal stability.

Top Companies in the Automotive NVH Materials Industry: BASF SE (Germany), The Dow Chemical Company (US), 3M Company (US), ElringKlinger AG (Germany), Huntsman Corporation (US), Sumitomo Riko Co. Ltd (Japan), Covestro AG (Germany), Celanese Corporation (US), Lanxess AG (Germany), Henkel AG & Co. KGaA (Germany), Wolverine Advanced Materials, LLC (US), Borgers AG (Germany), DuPont (US), Eastman Chemical Company (US), and others.