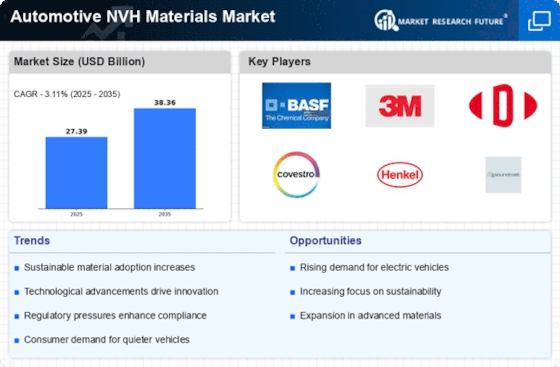

Significant competitive dynamics characterize the Automotive NVH Materials Market as players strive to innovate and enhance their offerings in noise, vibration, and harshness materials. This Automotive NVH Materials market encompasses a range of products designed to improve vehicle acoustics, increase comfort, and meet stringent regulatory standards regarding noise levels.

As the automotive industry continues to evolve with advancements in electric vehicles and stricter emissions regulations, the focus on NVH materials has gained prominence among manufacturers. Competitive strategies are shaped by factors such as technological advancements, customer preferences, material performance, and the growing trend toward sustainability and eco-friendly solutions. Overall, the landscape is marked by a blend of established companies and emerging players, all vying for Automotive NVH Materials market share in a sector increasingly focused on quality and performance.

Hemlite has established a notable presence in the automotive noise, vibration & harshness (NVH) materials market through its commitment to developing high-performance solutions that cater to the evolving needs of the industry. The company's strengths lie in its extensive research and development capabilities, which enable it to introduce innovative materials that effectively combat noise and vibrations while ensuring durability.

Hemlite is recognized for its focus on ensuring customer satisfaction by providing tailored solutions that align with the unique requirements of various automotive manufacturers. The brand's reputation for quality and reliability, along with its strong service support, enhances its competitive position in the Automotive NVH Materials market. Additionally, Hemlite's alignment with modern sustainability trends, including the use of eco-friendly materials and processes, further bolsters its appeal among environmentally conscious consumers and manufacturers.

Henkel is a prominent player in the automotive noise, vibration & harshness (NVH) materials market, leveraging its vast expertise in adhesive technologies and material sciences to deliver high-value solutions for noise and vibration damping. The company's robust portfolio is complemented by its strong focus on innovation, enabling Henkel to address the specific challenges faced by the automotive sector in terms of sound insulation and vibration control. With a commitment to research and development, Henkel remains at the forefront of pioneering new NVH materials that not only enhance vehicle performance but also contribute to passenger comfort.

The company's global footprint and strategic partnerships with automotive manufacturers bolster its Automotive NVH Materials market presence, allowing it to cater to a diverse range of clients effectively. Henkel's dedication to sustainability is also reflected in its offerings, making it a competitive force in a Automotive NVH Materials market that increasingly values environmentally responsible practices.

In September 2025, Supreme Group launched its Circuline range of sustainable automotive components, featuring recycled and eco-friendly materials. The product line aims to reduce automotive plastic waste while maintaining OEM-grade performance. This initiative highlights growing sustainability efforts in the components industry.

In April 2025, a major investment was announced to establish a new manufacturing facility for automotive polyurethane components in China, boosting production capacity for global OEM customers. The expansion supports rising demand for high-performance materials in modern vehicles.