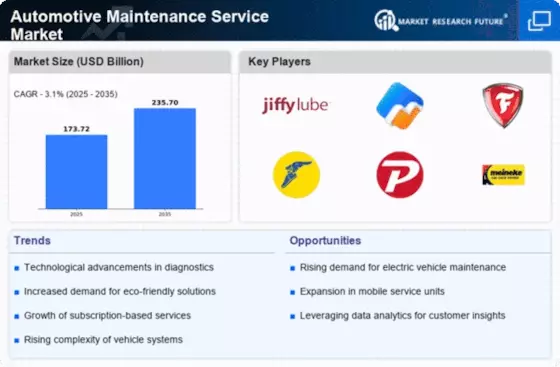

The Automotive Maintenance Service Market is characterized by a competitive landscape that is increasingly shaped by innovation, digital transformation, and strategic partnerships. Key players such as Jiffy Lube (US), Midas (US), and Firestone Complete Auto Care (US) are actively pursuing strategies that enhance their service offerings and operational efficiencies. Jiffy Lube (US), for instance, has focused on expanding its service portfolio to include advanced vehicle diagnostics, which positions it favorably in a market that demands more comprehensive maintenance solutions. Similarly, Midas (US) has been investing in technology-driven customer engagement platforms, which not only streamline service appointments but also enhance customer loyalty through personalized experiences. These strategic initiatives collectively contribute to a competitive environment that is increasingly reliant on technological advancements and customer-centric approaches.The business tactics employed by these companies reflect a moderately fragmented market structure, where local players coexist with larger chains. Companies are localizing their service offerings to cater to regional preferences, which is crucial in a market where consumer expectations vary significantly. Supply chain optimization has also emerged as a critical tactic, particularly in light of rising operational costs. The collective influence of these key players is shaping a market that is responsive to both consumer demands and operational efficiencies, thereby fostering a dynamic competitive landscape.

In November Jiffy Lube (US) announced the launch of its new mobile app, which integrates service scheduling with real-time vehicle health monitoring. This strategic move is significant as it not only enhances customer convenience but also positions Jiffy Lube (US) as a leader in digital service innovation. By leveraging technology to provide proactive maintenance alerts, the company aims to increase customer retention and drive service frequency, which could potentially lead to higher revenue streams.

In October Midas (US) unveiled a partnership with a leading telematics provider to offer integrated vehicle tracking and maintenance alerts. This collaboration is strategically important as it allows Midas (US) to tap into the growing trend of connected vehicles, thereby enhancing its service offerings. The integration of telematics data into their service model could lead to improved customer satisfaction and operational efficiencies, as it enables more accurate service recommendations based on real-time vehicle performance.

In September Firestone Complete Auto Care (US) expanded its footprint by acquiring a regional chain of auto service centers. This acquisition is indicative of Firestone's strategy to enhance its market presence and service capabilities. By integrating these centers into its existing network, Firestone aims to leverage economies of scale and improve service delivery, which could strengthen its competitive position in the market.

As of December the Automotive Maintenance Service Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence (AI) into service operations. Strategic alliances are increasingly shaping the competitive landscape, as companies seek to enhance their technological capabilities and service offerings. The shift from price-based competition to a focus on innovation and technology is evident, with companies prioritizing supply chain reliability and customer experience. Looking ahead, competitive differentiation is likely to evolve further, driven by advancements in technology and a growing emphasis on sustainable practices.