Automotive Service Market Summary

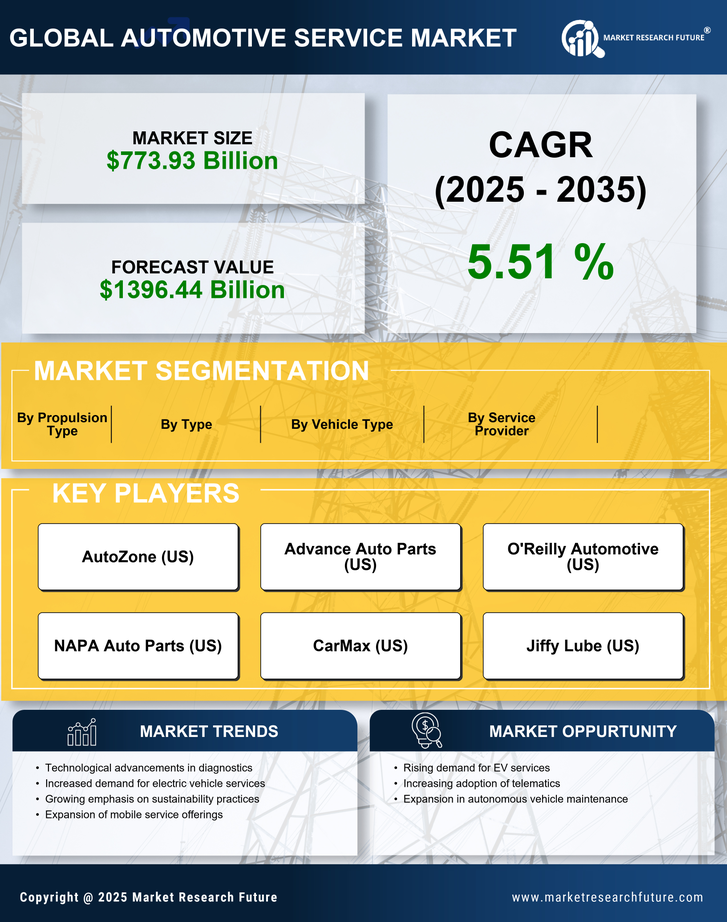

As per Market Research Future analysis, the Automotive Service Market was estimated at 773.93 USD Billion in 2024. The Automotive Service industry is projected to grow from 816.59 USD Billion in 2025 to 1396.44 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.5% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Automotive Service Market is experiencing a dynamic shift towards technological integration and sustainability.

- Technological integration is reshaping service offerings, enhancing efficiency and customer experience.

- The focus on sustainability is driving the adoption of eco-friendly practices within automotive services.

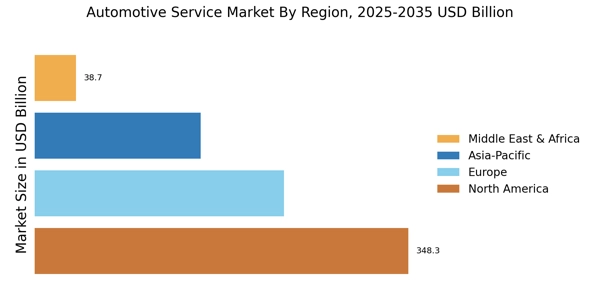

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in automotive services.

- Increasing vehicle ownership and rising consumer awareness of maintenance are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 773.93 (USD Billion) |

| 2035 Market Size | 1396.44 (USD Billion) |

| CAGR (2025 - 2035) | 5.51% |

Major Players

AutoZone (US), Advance Auto Parts (US), O'Reilly Automotive (US), NAPA Auto Parts (US), CarMax (US), Jiffy Lube (US), Firestone Complete Auto Care (US), Midas (US), Pep Boys (US), Goodyear (US)