North America : Market Leader in Services

North America holds a commanding position in the Automotive Maintenance Service Market, with a market size of $70.0 billion in 2025. The region's growth is driven by increasing vehicle ownership, a rising focus on vehicle longevity, and stringent regulations promoting regular maintenance. The demand for quick service and convenience is also a significant factor, as consumers seek reliable and efficient service options.

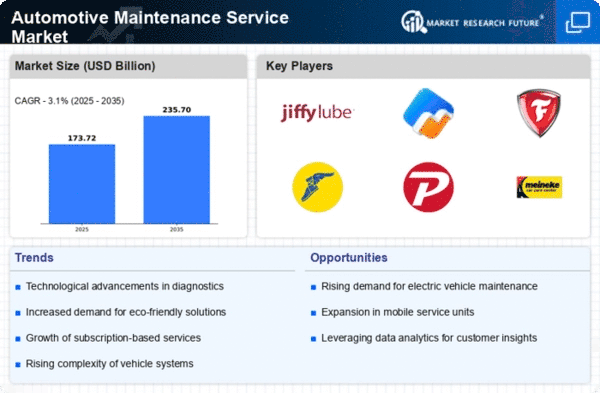

The competitive landscape is robust, featuring key players such as Jiffy Lube, Midas, and Firestone Complete Auto Care. The U.S. is the leading country, accounting for the majority of the market share. The presence of established brands and a well-developed service infrastructure further enhance market dynamics, ensuring that North America remains at the forefront of automotive maintenance services.

Europe : Emerging Market with Growth Potential

Europe's Automotive Maintenance Service Market is valued at $45.0 billion in 2025, driven by a growing emphasis on sustainability and eco-friendly practices. Regulatory frameworks, such as the EU's Green Deal, are catalyzing demand for maintenance services that align with environmental standards. The increasing complexity of vehicles, particularly electric and hybrid models, also necessitates specialized maintenance, contributing to market growth.

Leading countries include Germany, France, and the UK, where established service networks and a high density of vehicles create a competitive environment. Key players like Goodyear Auto Service and Pep Boys are expanding their offerings to meet evolving consumer needs. The market is characterized by innovation and adaptation to new technologies, ensuring a dynamic landscape for automotive services.

Asia-Pacific : Rapidly Growing Automotive Hub

The Asia-Pacific region is witnessing a rapid expansion in the Automotive Maintenance Service Market, projected at $40.0 billion in 2025. Factors such as increasing disposable income, urbanization, and a growing middle class are driving demand for vehicle ownership and, consequently, maintenance services. Additionally, government initiatives promoting vehicle safety and emissions standards are further propelling market growth.

Countries like China, Japan, and India are at the forefront of this growth, with a burgeoning number of vehicles on the road. The competitive landscape features both local and international players, with companies like Meineke Car Care Centers and AAMCO Transmissions establishing a strong presence. The region's diverse market dynamics and consumer preferences create opportunities for innovative service offerings and partnerships.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region, with a market size of $13.5 billion in 2025, is emerging as a significant player in the Automotive Maintenance Service Market. The growth is fueled by increasing vehicle ownership, urbanization, and a rising demand for quality maintenance services. Regulatory initiatives aimed at improving vehicle safety and environmental standards are also contributing to market expansion.

Leading countries in this region include South Africa and the UAE, where a growing number of service centers are catering to the rising demand. The competitive landscape is evolving, with both local and international players vying for market share. The presence of key players and the increasing focus on customer service and quality are shaping the future of automotive maintenance in this region.