Increase in Vehicle Electrification

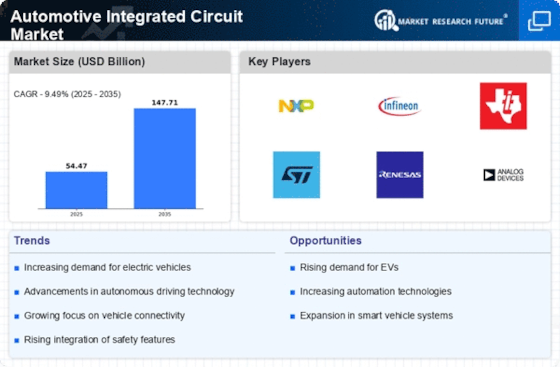

The automotive industry is witnessing a pronounced shift towards electrification, which is significantly influencing the Automotive Integrated Circuit Ics Market. As manufacturers increasingly adopt electric vehicle (EV) technologies, the demand for specialized integrated circuits is surging. These circuits are essential for managing battery systems, power distribution, and energy efficiency. In fact, the market for automotive ICs is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by the rising adoption of EVs. This transition not only enhances vehicle performance but also aligns with global sustainability goals, thereby creating a robust demand for advanced automotive ICs.

Growing Demand for Infotainment Systems

The rising consumer preference for advanced infotainment systems is significantly impacting the Automotive Integrated Circuit Ics Market. Modern vehicles are increasingly equipped with sophisticated multimedia systems that offer navigation, entertainment, and connectivity features. This trend necessitates the use of high-performance integrated circuits capable of handling complex audio-visual processing and user interface functionalities. The market for automotive ICs in infotainment applications is anticipated to grow at a CAGR of around 9%, driven by the demand for enhanced user experiences and seamless connectivity. As automakers strive to differentiate their offerings, the role of automotive ICs in delivering cutting-edge infotainment solutions becomes increasingly critical.

Regulatory Compliance and Emission Standards

Stringent regulatory compliance and emission standards are compelling automotive manufacturers to innovate, thereby influencing the Automotive Integrated Circuit Ics Market. Governments worldwide are implementing stricter regulations aimed at reducing vehicle emissions and enhancing fuel efficiency. This regulatory landscape necessitates the development of advanced automotive ICs that can optimize engine performance and reduce emissions. The market for automotive ICs designed to meet these standards is expected to witness a growth rate of approximately 8% annually. As manufacturers seek to comply with these regulations while maintaining performance, the demand for specialized integrated circuits that facilitate compliance becomes paramount.

Integration of Internet of Things (IoT) in Vehicles

The integration of Internet of Things (IoT) technologies into vehicles is a pivotal driver for the Automotive Integrated Circuit Ics Market. As vehicles become more connected, the demand for automotive ICs that facilitate communication between vehicles and external networks is escalating. These integrated circuits enable functionalities such as real-time traffic updates, remote diagnostics, and over-the-air software updates. The market for automotive ICs supporting IoT applications is projected to grow at a CAGR of approximately 15%, reflecting the increasing consumer preference for connected vehicle experiences. This trend not only enhances user convenience but also opens new avenues for data-driven services in the automotive sector.

Emergence of Advanced Driver Assistance Systems (ADAS)

The proliferation of Advanced Driver Assistance Systems (ADAS) is reshaping the Automotive Integrated Circuit Ics Market. These systems, which include features such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking, rely heavily on sophisticated integrated circuits for real-time data processing and sensor integration. The market for automotive ICs dedicated to ADAS applications is expected to expand significantly, with estimates suggesting a growth rate of around 12% annually. This growth is fueled by increasing consumer demand for safety features and regulatory pressures for enhanced vehicle safety standards, thereby driving the need for innovative automotive IC solutions.