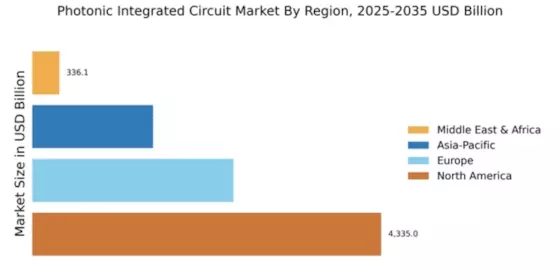

North America : Innovation and Leadership Hub

North America continues to lead the Photonic Integrated Circuit market, holding a significant share of 4335.0M in 2025. The region's growth is driven by robust investments in R&D, a strong presence of tech giants, and increasing demand for high-speed data transmission. Regulatory support for advanced technologies further catalyzes market expansion, making it a focal point for innovation in photonics. The competitive landscape is characterized by major players such as Intel Corporation, Cisco Systems, and IBM Corporation, which are at the forefront of technological advancements. The U.S. remains a key player, supported by a favorable business environment and a skilled workforce. This concentration of expertise and resources positions North America as a powerhouse in The Photonic Integrated Circuit.

Europe : Emerging Market with Potential

Europe's Photonic Integrated Circuit market is projected to reach 2500.0M by 2025, driven by increasing demand for telecommunications and data center applications. The region benefits from strong governmental support and initiatives aimed at fostering innovation in photonics. Regulatory frameworks are evolving to encourage investment in sustainable technologies, which is expected to further boost market growth. Leading countries like Germany, France, and the UK are pivotal in this landscape, hosting key players such as Nokia Corporation and Mitsubishi Electric Corporation. The competitive environment is marked by collaborations between academia and industry, enhancing research capabilities. This synergy is crucial for advancing photonic technologies and maintaining Europe's competitive edge in the global market.

Asia-Pacific : Rapid Growth and Adoption

The Asia-Pacific region is witnessing rapid growth in the Photonic Integrated Circuit market, projected to reach 1500.0M by 2025. This growth is fueled by increasing investments in telecommunications infrastructure and the rising demand for high-speed internet. Countries like Japan and China are leading the charge, supported by government initiatives aimed at enhancing technological capabilities and fostering innovation in photonics. The competitive landscape features key players such as Broadcom Inc. and Finisar Corporation, which are expanding their operations in the region. The presence of a large consumer base and a growing number of startups in photonics technology further contribute to the region's dynamic market environment. This combination of factors positions Asia-Pacific as a significant player in The Photonic Integrated Circuit.

Middle East and Africa : Emerging Market with Opportunities

The Middle East and Africa region is gradually emerging in the Photonic Integrated Circuit market, with a projected size of 336.07M by 2025. The growth is driven by increasing investments in telecommunications and the need for advanced data transmission technologies. Governments are recognizing the potential of photonics and are implementing policies to support research and development in this field, which is expected to catalyze market growth. Countries like South Africa and the UAE are at the forefront of this development, with a growing number of initiatives aimed at enhancing technological capabilities. The competitive landscape is still developing, but the presence of international players is beginning to shape the market. This evolving environment presents significant opportunities for growth and innovation in the region.