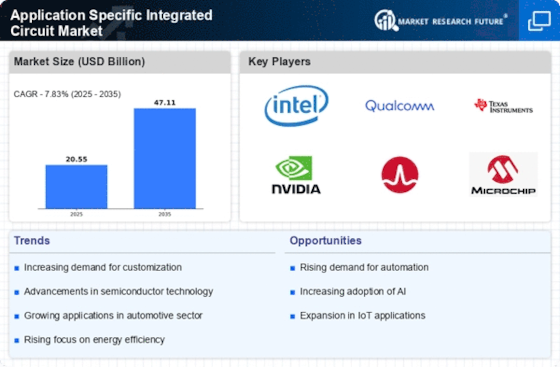

Increased Focus on Energy Efficiency

The Application Specific Integrated Circuit Market is witnessing a heightened focus on energy efficiency, driven by both regulatory pressures and consumer demand for sustainable solutions. As industries strive to reduce their carbon footprint, the need for circuits that optimize power consumption is becoming more pronounced. In 2025, energy-efficient solutions are expected to play a pivotal role in the Application Specific Integrated Circuit Market, with a projected growth rate of 7%. This trend reflects a broader commitment to sustainability across various sectors, including consumer electronics, automotive, and industrial applications. Manufacturers are increasingly investing in the development of application-specific integrated circuits that not only meet performance standards but also adhere to energy efficiency guidelines, thereby aligning with global sustainability goals.

Advancements in Automotive Technology

The Application Specific Integrated Circuit Market is significantly influenced by advancements in automotive technology, particularly with the rise of electric vehicles (EVs) and autonomous driving systems. As the automotive sector increasingly integrates sophisticated electronics for safety, navigation, and infotainment, the demand for application-specific integrated circuits is expected to grow. In 2025, the automotive segment is anticipated to represent a notable portion of the Application Specific Integrated Circuit Market, with a projected CAGR of 10%. This growth is fueled by the need for enhanced functionality and reliability in vehicles, as manufacturers adopt more complex systems that require tailored circuit solutions. The shift towards smart vehicles necessitates the development of specialized circuits that can handle the unique requirements of modern automotive applications.

Rising Demand for Consumer Electronics

The Application Specific Integrated Circuit Market is experiencing a surge in demand driven by the proliferation of consumer electronics. As devices such as smartphones, tablets, and wearables become increasingly sophisticated, the need for specialized circuits that enhance performance and efficiency is paramount. In 2025, the consumer electronics sector is projected to account for a substantial share of the Application Specific Integrated Circuit Market, with an estimated growth rate of 8% annually. This trend indicates a shift towards more integrated and efficient designs, as manufacturers seek to differentiate their products in a competitive landscape. The emphasis on high-performance computing and low power consumption further propels the demand for application-specific solutions, making this driver a critical factor in the market's expansion.

Growth of Internet of Things (IoT) Devices

The Application Specific Integrated Circuit Market is poised for growth due to the rapid expansion of Internet of Things (IoT) devices. As more devices become interconnected, the need for efficient and specialized circuits that can process data and communicate effectively is becoming increasingly critical. In 2025, the IoT segment is expected to contribute significantly to the Application Specific Integrated Circuit Market, with an estimated growth rate of 12%. This trend highlights the necessity for circuits that can operate in diverse environments while maintaining low power consumption. The proliferation of smart home devices, industrial automation, and wearable technology underscores the demand for application-specific solutions that cater to the unique requirements of IoT applications, thereby driving market growth.

Emerging Applications in Telecommunications

The Application Specific Integrated Circuit Market is being propelled by emerging applications in telecommunications, particularly with the rollout of 5G technology. The demand for high-speed data transmission and enhanced connectivity is driving the need for specialized circuits that can support these advanced networks. In 2025, the telecommunications sector is projected to account for a significant share of the Application Specific Integrated Circuit Market, with a growth rate of approximately 9%. This growth is indicative of the increasing complexity of communication systems, which require tailored solutions to meet the demands of higher bandwidth and lower latency. As telecommunications companies invest in infrastructure to support 5G, the need for application-specific integrated circuits that can facilitate these advancements becomes increasingly vital.