Market Trends

Key Emerging Trends in the Automotive Ignition Coil Aftermarket Market

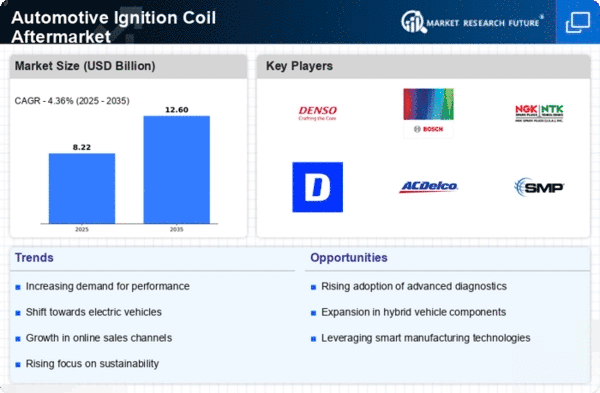

In the dynamic landscape of the automotive ignition coil aftermarket, a multitude of intermediary business models is evolving, with the digital model emerging as the most prominent and widely embraced by manufacturers worldwide. Notably, established retailers like Autozone, Advance Auto Parts, and O'Reilly Auto Parts are spearheading the distribution of automotive ignition coils through digital platforms in the aftermarket. Concurrently, major players such as Denso Corporation, Delphi Technologies, SMP, NGK Spark Plug, and Robert Bosch are proactively investing in partnerships and collaborations with online retailers and digital-focused auto part companies, ensuring a seamless online platform to meet the demand for automotive ignition coils.

In this digital era, even new entrants and smaller players are leveraging digitally-driven business models as a gateway to enter the global automotive ignition coil aftermarket. These strategies not only streamline the distribution process but also enhance accessibility for consumers. As the industry undergoes a transformation, intermediaries are strategically expanding their value chain footprint, gaining direct access to both business clients and end consumers, along with valuable data insights.

Experts in the aftermarket predict a notable focus on expanding partnerships between intermediaries and workshop chains. This collaboration aims to automate workflow and parts logistics, ensuring a more efficient and streamlined supply chain. Additionally, collaborations between suppliers and intermediaries are on the rise, with a shared goal of providing high-quality ignition coils directly to end customers in the aftermarket. This collaborative approach is contributing to the overall efficiency and effectiveness of the aftermarket ecosystem.

A significant trend observed is the diversification of manufacturers' product offerings across both online and offline platforms. This expansion strategy is poised to have a substantial impact on the demand for automotive ignition coils in the aftermarket during the forecast period. The convenience of online platforms coupled with the established presence of traditional offline channels ensures a comprehensive reach for manufacturers, catering to a diverse range of end-users.

The rise of digital intermediaries in the global automotive ignition coil aftermarket presents an array of opportunities for manufacturers. It opens avenues for expanding product portfolios and offering a diverse range of automotive ignition coils to end-users during the forecast period. As manufacturers embrace digital platforms and e-commerce strategies, the aftermarket benefits from increased accessibility, streamlined logistics, and a more efficient supply chain.

Leave a Comment