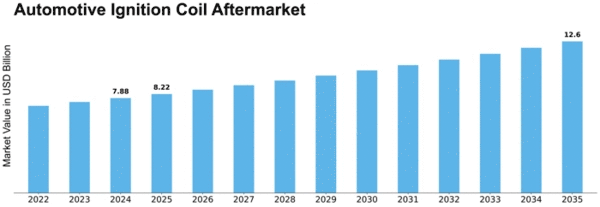

Automotive Ignition Coil Aftermarket Size

Automotive Ignition Coil Aftermarket Market Growth Projections and Opportunities

The automotive ignition coil, also commonly known as the automotive spark coil, plays a pivotal role in the functioning of the automotive ignition system. Located within the engine compartment of vehicles, its primary function is to convert the low voltage supplied by the battery into the required voltage to generate an electric spark within the spark plug. This spark is essential for igniting the air-fuel mixture within the vehicle's internal combustion (IC) engine. The global use of automotive ignition coils is widespread, being a critical component in internal combustion vehicles across the world.

As of now, the global automotive ignition coil aftermarket is poised for significant growth, with an estimated Compound Annual Growth Rate (CAGR) of 5.50% anticipated during the forecast period from 2018 to 2023. Analyzing the market distribution in 2017, Asia-Pacific led the way with a substantial market share of 37.27%, followed by Europe at 29.96% and North America at 24.36%.

The segmentation of the global automotive ignition coil aftermarket is based on product type, application, and region. Regarding product types, the pencil ignition coil segment dominated in 2017, holding the largest market share at 32.71% and a valuation of USD 1,230.3 million. Projections indicate that this segment will continue to exhibit strong growth with a CAGR of 7.72% during the forecast period. In terms of market volume, the pencil ignition coil segment recorded 36,879.67 thousand units in 2017, with an expected CAGR of 7.03% during the forecast period.

Further analysis based on vehicle type reveals that the passenger car segment accounted for the most significant market share in 2017 at 68.18%, with a valuation of USD 2,674.9 million. Projections suggest a steady growth trajectory with a CAGR of 5.18% during the forecast period. In terms of market volume, passenger cars recorded 76,346.01 thousand units sold in 2017, and a CAGR of 4.18% is expected during the forecast period.

The robust growth in the automotive ignition coil aftermarket is underpinned by various factors, including the continual expansion of the automotive industry, technological advancements, and the increasing number of vehicles on the road. As the demand for internal combustion vehicles persists globally, the automotive ignition coil remains a critical component for ensuring efficient engine ignition.

Asia-Pacific's dominance in the market can be attributed to the rapid growth of the automotive sector in countries like China and India. These regions exhibit increased vehicle production, leading to a higher demand for automotive ignition coils. Europe and North America, while slightly trailing Asia-Pacific, still contribute significantly to the market, driven by a well-established automotive industry and a large existing fleet of vehicles.

Leave a Comment