Rising Demand for Fuel Efficiency

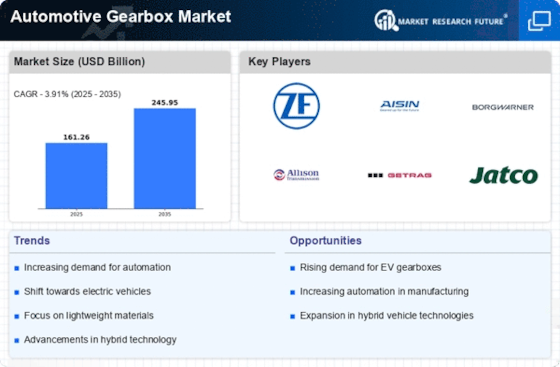

The Automotive Gearbox Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, manufacturers are compelled to innovate. The integration of advanced gearbox technologies, such as continuously variable transmissions (CVTs) and dual-clutch systems, is becoming prevalent. These technologies enhance fuel efficiency by optimizing engine performance and reducing energy loss. According to recent data, vehicles equipped with advanced gearboxes can achieve up to 20% better fuel economy compared to traditional systems. This trend is likely to drive investments in research and development within the Automotive Gearbox Market, as companies strive to meet consumer expectations and regulatory standards.

Increasing Focus on Safety Features

The Automotive Gearbox Market is increasingly shaped by a heightened focus on safety features in vehicles. As manufacturers strive to enhance vehicle safety, the integration of advanced gearbox technologies plays a crucial role. Features such as adaptive transmission systems and automatic emergency braking systems rely on sophisticated gear mechanisms to function effectively. The demand for vehicles equipped with these safety features is on the rise, driven by consumer preferences and regulatory requirements. Market analysis indicates that the automotive safety systems market is expected to grow significantly, which will likely influence gearbox design and functionality. Consequently, manufacturers in the Automotive Gearbox Market are expected to prioritize safety-oriented innovations to remain competitive.

Growth of Electric and Hybrid Vehicles

The Automotive Gearbox Market is witnessing a transformative shift with the increasing adoption of electric and hybrid vehicles. These vehicles require specialized gear systems to manage power delivery efficiently. The demand for electric drivetrains is prompting manufacturers to develop innovative gearbox solutions that cater to the unique requirements of electric motors. For instance, the use of single-speed transmissions in electric vehicles simplifies the drivetrain and enhances performance. Market data indicates that the electric vehicle segment is projected to grow at a compound annual growth rate (CAGR) of over 25% in the coming years. This growth is likely to create new opportunities for gearbox manufacturers to expand their product offerings within the Automotive Gearbox Market.

Regulatory Pressures for Emission Reductions

The Automotive Gearbox Market is under increasing pressure from regulatory bodies to reduce vehicle emissions. Stricter emission standards are prompting manufacturers to develop more efficient gearbox systems that can optimize engine performance while minimizing environmental impact. The transition towards lower emissions is driving the adoption of advanced gearbox technologies, such as hybrid systems that combine traditional and electric drivetrains. Data suggests that vehicles with optimized gearboxes can reduce CO2 emissions by up to 30%. This regulatory landscape is likely to compel manufacturers to invest in innovative gearbox solutions that align with environmental goals, thereby shaping the future of the Automotive Gearbox Market.

Technological Advancements in Gearbox Design

The Automotive Gearbox Market is significantly influenced by rapid technological advancements in gearbox design and manufacturing processes. Innovations such as 3D printing and advanced materials are enabling manufacturers to create lighter, more efficient gear systems. These advancements not only improve performance but also reduce production costs. Furthermore, the implementation of computer-aided design (CAD) and simulation tools allows for more precise engineering of gearboxes, enhancing reliability and durability. As a result, the market is likely to see an influx of next-generation gearboxes that meet the evolving demands of consumers and regulatory bodies. This trend suggests a competitive landscape where companies that invest in technology will likely gain a substantial advantage in the Automotive Gearbox Market.