Rising Demand for Fuel Efficiency

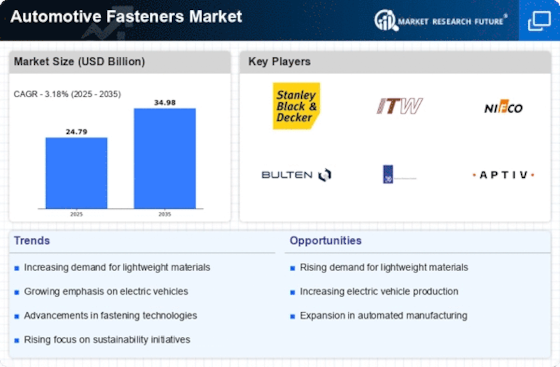

The Automotive Fasteners Market is experiencing a notable surge in demand driven by the increasing emphasis on fuel efficiency. As automotive manufacturers strive to meet stringent regulatory standards and consumer expectations, the need for lightweight materials has become paramount. Fasteners play a crucial role in reducing vehicle weight, thereby enhancing fuel economy. According to recent data, vehicles that utilize advanced fasteners can achieve up to a 10% reduction in weight, translating to significant fuel savings over time. This trend is likely to continue as manufacturers innovate and adopt new materials and designs, further propelling the Automotive Fasteners Market.

Increasing Vehicle Production Rates

The Automotive Fasteners Market is benefiting from the increasing production rates of vehicles across various segments. As consumer demand for automobiles rises, manufacturers are ramping up production to meet this need. Data suggests that global vehicle production is projected to reach over 100 million units annually in the near future. This surge in production directly correlates with a heightened demand for fasteners, which are essential components in vehicle assembly. Consequently, the Automotive Fasteners Market is expected to expand as manufacturers seek reliable and efficient fastening solutions to support their production goals.

Growth in Electric Vehicle Production

The Automotive Fasteners Market is poised for growth due to the rapid expansion of electric vehicle (EV) production. As automakers pivot towards electric mobility, the demand for specialized fasteners that cater to the unique requirements of EVs is increasing. These vehicles often require advanced fastening solutions to accommodate high-voltage systems and lightweight structures. Market data indicates that the EV segment is expected to grow at a compound annual growth rate of over 20% in the coming years. This shift not only enhances the Automotive Fasteners Market but also encourages innovation in fastening technologies tailored for electric vehicles.

Focus on Safety and Durability Standards

The Automotive Fasteners Market is significantly influenced by the growing focus on safety and durability standards in vehicle manufacturing. Regulatory bodies are increasingly enforcing stringent safety regulations, compelling manufacturers to utilize high-quality fasteners that ensure structural integrity and reliability. Fasteners are critical in maintaining the safety of various automotive components, and their failure can lead to severe consequences. As a result, manufacturers are investing in advanced fastening technologies that meet or exceed these safety standards. This trend is likely to drive growth in the Automotive Fasteners Market, as companies prioritize quality and compliance in their production processes.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the Automotive Fasteners Market. Innovations such as automation, 3D printing, and advanced materials are reshaping how fasteners are produced and utilized. For instance, the adoption of automated assembly lines has improved production efficiency and reduced costs, allowing manufacturers to meet the growing demand for high-quality fasteners. Furthermore, the integration of smart technologies in fasteners, such as sensors for monitoring structural integrity, is becoming more prevalent. This evolution in manufacturing is likely to enhance the competitiveness of the Automotive Fasteners Market, as companies strive to offer cutting-edge solutions.